Printable Transfer-on-Death Deed Form for the State of Florida

Guide to Writing Florida Transfer-on-Death Deed

After completing the Florida Transfer-on-Death Deed form, the next step is to ensure it is properly executed and recorded. This will help ensure that the transfer of property occurs as intended upon the owner's passing. Follow these steps carefully to fill out the form accurately.

- Obtain the Florida Transfer-on-Death Deed form. You can find it online or through local legal offices.

- Begin by filling in the name of the property owner (the Grantor) at the top of the form.

- Next, provide the address of the property that is being transferred.

- Identify the beneficiary by writing their full name in the designated section. This is the person who will receive the property.

- Include the beneficiary's address to ensure proper identification.

- In the next section, indicate if there are any additional beneficiaries and provide their details as needed.

- Sign the form in the presence of a notary public to validate the document.

- Ensure that the notary public signs and stamps the form, confirming the authenticity of your signature.

- Finally, file the completed form with the county clerk’s office in the county where the property is located.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, specifically Chapter 732.901. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed, provided they are of sound mind and at least 18 years old. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property, and they can also specify alternate beneficiaries. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, as long as the owner follows the proper legal procedures. |

| Filing Requirements | The deed must be signed by the property owner and recorded with the county clerk's office in the county where the property is located. |

FAQ

-

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TODD) allows property owners in Florida to transfer their real estate to a designated beneficiary upon their death. This deed bypasses probate, making the transfer process simpler and more efficient for the heirs.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Florida can use a Transfer-on-Death Deed. However, it is important to ensure that the property is not subject to any liens or other encumbrances that could complicate the transfer.

-

How do I create a Transfer-on-Death Deed?

To create a TODD, you must complete the appropriate form, which includes details about the property and the beneficiary. The deed must then be signed in front of a notary public and recorded with the county clerk's office where the property is located.

-

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, you can change or revoke a TODD at any time during your lifetime. To do this, you must complete a new deed that either names a different beneficiary or explicitly revokes the previous deed. This new deed must also be signed, notarized, and recorded.

-

What happens if the beneficiary dies before me?

If the designated beneficiary dies before you, the TODD becomes ineffective. You may need to create a new deed to designate a different beneficiary or address the situation in your estate planning documents.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. However, the beneficiary may be responsible for property taxes and potential capital gains taxes when they sell the property after your death. It is advisable to consult a tax professional for specific guidance.

-

Can I use a Transfer-on-Death Deed for all types of property?

Transfer-on-Death Deeds are specifically designed for real estate. They cannot be used for personal property, bank accounts, or other assets. For those assets, different estate planning tools should be considered.

-

Is a Transfer-on-Death Deed the same as a will?

No, a TODD is not the same as a will. A will distributes assets after death and goes through probate, while a TODD transfers property directly to a beneficiary without the need for probate. This distinction can significantly affect the efficiency of the estate distribution process.

-

What should I consider before using a Transfer-on-Death Deed?

Before using a TODD, consider the following:

- Your overall estate plan and how the deed fits into it.

- The potential needs of your beneficiaries and any possible disputes.

- Consulting with an estate planning attorney to ensure that this option aligns with your goals.

-

Where can I find the Transfer-on-Death Deed form?

The Transfer-on-Death Deed form can be obtained from the Florida Department of State’s website or through your local county clerk’s office. It is crucial to use the most current version of the form to ensure compliance with state laws.

Consider Popular Transfer-on-Death Deed Forms for Specific States

Texas Lady Bird Deed Form - Every state has its own rules regarding how to execute and enforce a Transfer-on-Death Deed.

In today's world, having the right resources can make a significant difference for those seeking reintegration into society; one such resource is the Work Release Form, which allows individuals to work while serving their time, facilitating a smoother transition back into everyday life.

What Is a Transfer on Death - Provisions can be included to handle scenarios where a beneficiary predeceases the owner.

Florida Transfer-on-Death Deed Example

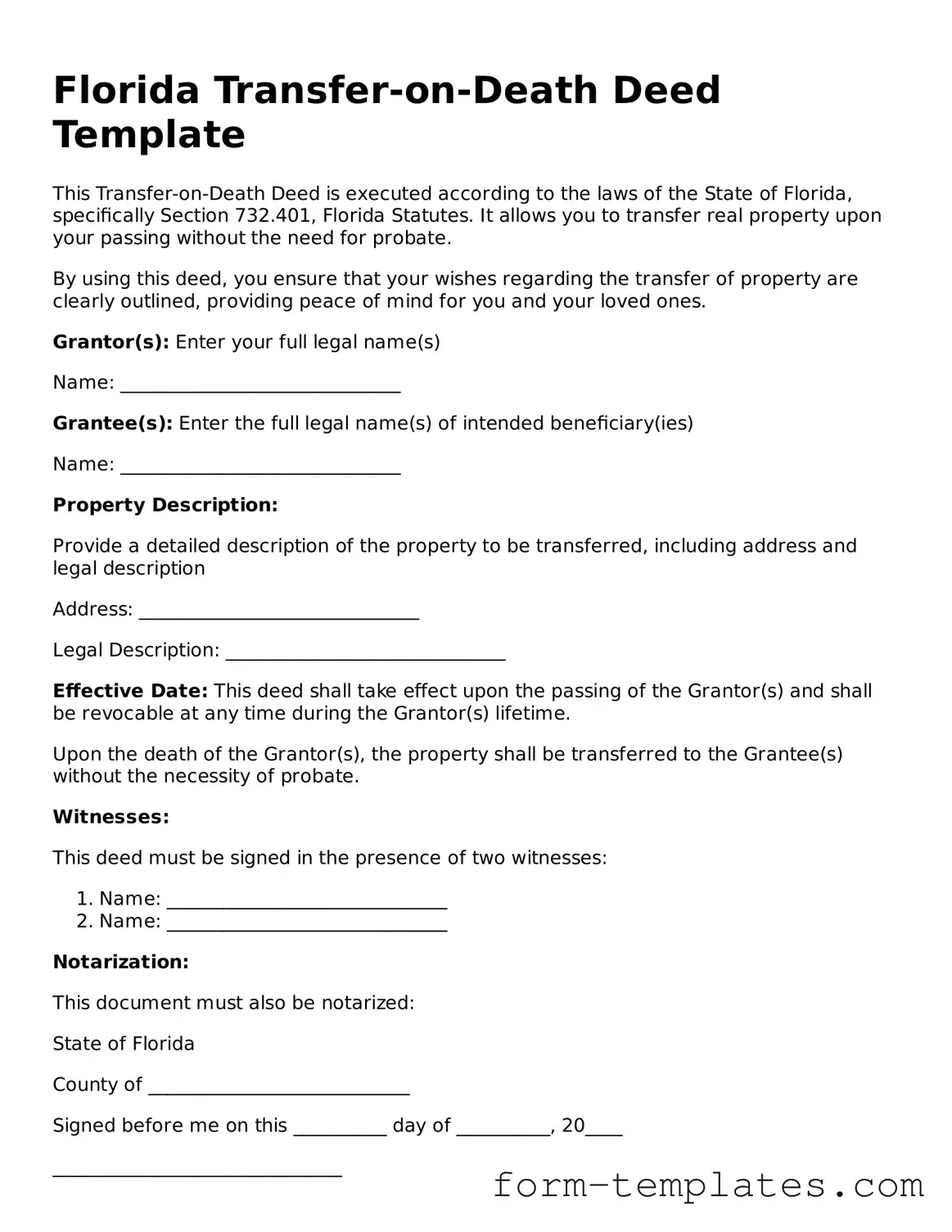

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed according to the laws of the State of Florida, specifically Section 732.401, Florida Statutes. It allows you to transfer real property upon your passing without the need for probate.

By using this deed, you ensure that your wishes regarding the transfer of property are clearly outlined, providing peace of mind for you and your loved ones.

Grantor(s): Enter your full legal name(s)

Name: ______________________________

Grantee(s): Enter the full legal name(s) of intended beneficiary(ies)

Name: ______________________________

Property Description:

Provide a detailed description of the property to be transferred, including address and legal description

Address: ______________________________

Legal Description: ______________________________

Effective Date: This deed shall take effect upon the passing of the Grantor(s) and shall be revocable at any time during the Grantor(s) lifetime.

Upon the death of the Grantor(s), the property shall be transferred to the Grantee(s) without the necessity of probate.

Witnesses:

This deed must be signed in the presence of two witnesses:

- Name: ______________________________

- Name: ______________________________

Notarization:

This document must also be notarized:

State of Florida

County of ____________________________

Signed before me on this __________ day of __________, 20____

_______________________________

Notary Public Signature

_______________________________

Print Name of Notary Public

Notes:

- This deed must be recorded with the county clerk to be effective.

- Please consider consulting a legal professional to ensure your intentions are properly executed.