Printable Promissory Note Form for the State of Florida

Guide to Writing Florida Promissory Note

After you have gathered all necessary information, you are ready to fill out the Florida Promissory Note form. This document is essential for establishing the terms of a loan agreement. Ensure that you have all relevant details at hand before proceeding.

- Begin by entering the date at the top of the form. This should reflect the date you are completing the document.

- Next, fill in the name and address of the borrower. This identifies who is responsible for repaying the loan.

- Provide the lender's name and address. This is the individual or entity providing the loan.

- Specify the principal amount of the loan in numerical and written form. This ensures clarity regarding the total amount borrowed.

- Indicate the interest rate, if applicable. This can be a fixed or variable rate, so be clear about which type you are using.

- State the repayment terms, including the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. This sets expectations for both parties.

- Sign and date the document at the bottom. The borrower must sign, and the lender may also choose to sign.

- Finally, make copies of the completed form for both the borrower and the lender for their records.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a certain time. |

| Governing Law | Florida Statutes, Chapter 673 governs negotiable instruments, including promissory notes. |

| Parties Involved | The borrower (maker) promises to pay the lender (payee) the agreed-upon amount. |

| Interest Rates | Interest rates can be fixed or variable, and must comply with Florida usury laws. |

| Payment Terms | Payment terms should be clearly outlined, including due dates and payment methods. |

| Default Provisions | The note should specify what constitutes default and the remedies available to the lender. |

| Transferability | Promissory notes are generally transferable, allowing the lender to sell or assign the note to another party. |

| Enforceability | For a promissory note to be enforceable, it must meet certain legal requirements, including clarity and intent to create a binding obligation. |

FAQ

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate and whether it is fixed or variable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Information about collateral, if applicable.

- Signatures of both parties, along with the date of signing.

What is a Florida Promissory Note?

A Florida Promissory Note is a written agreement in which one party promises to pay a specified sum of money to another party at a designated time or on demand. This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

Who can use a Florida Promissory Note?

Any individual or entity can use a Florida Promissory Note. This includes individuals lending money to friends or family, businesses providing loans to customers, or financial institutions offering credit. The note serves as a formal record of the debt and the obligations of both parties.

What are the key components of a Florida Promissory Note?

A typical Florida Promissory Note includes the following components:

Is a Florida Promissory Note legally binding?

Yes, a Florida Promissory Note is legally binding as long as it meets certain requirements. These include the presence of clear terms, mutual agreement, and the intention to create a legal obligation. It is advisable for both parties to keep a copy of the signed document for their records.

Do I need a lawyer to create a Florida Promissory Note?

No, it is not mandatory to have a lawyer create a Florida Promissory Note. However, consulting with a legal professional can provide additional assurance that the document meets all legal requirements and adequately protects the interests of both parties.

What happens if the borrower fails to repay the loan?

If the borrower defaults on the loan, the lender has several options. They may pursue collection efforts, which could include contacting the borrower directly or hiring a collection agency. If necessary, the lender can also file a lawsuit to recover the owed amount, depending on the terms outlined in the Promissory Note.

Can a Florida Promissory Note be modified?

Yes, a Florida Promissory Note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and legal enforceability.

Is notarization required for a Florida Promissory Note?

No, notarization is not required for a Florida Promissory Note to be valid. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future.

How long is a Florida Promissory Note valid?

The validity of a Florida Promissory Note typically depends on the statute of limitations for written contracts, which is generally five years in Florida. After this period, the lender may lose the ability to enforce the note through legal action. It is advisable to keep track of repayment schedules and maintain communication to avoid issues related to the expiration of the note.

Where can I obtain a Florida Promissory Note form?

A Florida Promissory Note form can be obtained from various sources, including online legal document preparation services, office supply stores, or legal professionals. It is essential to ensure that the form complies with Florida laws and includes all necessary terms specific to the loan agreement.

Consider Popular Promissory Note Forms for Specific States

Promissory Note Form California - A Promissory Note can be tailored to include specific clauses, such as penalties for late payments.

For those seeking clarity in medical decisions, the Arizona Living Will form serves as a crucial document that allows individuals to specify their treatment preferences in case of incapacitation. By understanding its importance, you can take the necessary steps to safeguard your healthcare choices with the Arizona Living Will form guidelines available here.

Promissory Note Texas - The note may specify the governing law, determining which state laws apply to the agreement.

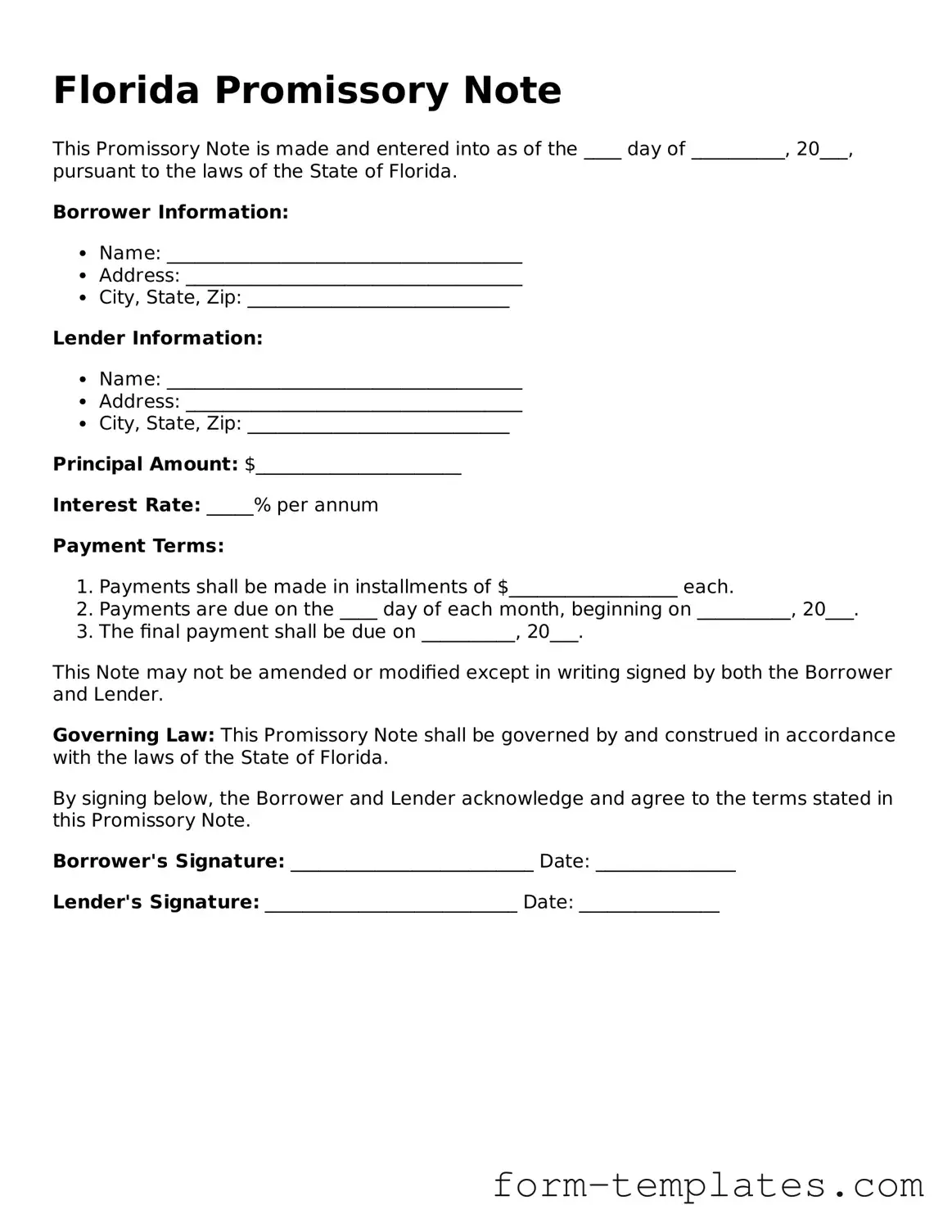

Florida Promissory Note Example

Florida Promissory Note

This Promissory Note is made and entered into as of the ____ day of __________, 20___, pursuant to the laws of the State of Florida.

Borrower Information:

- Name: ______________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

Lender Information:

- Name: ______________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

Principal Amount: $______________________

Interest Rate: _____% per annum

Payment Terms:

- Payments shall be made in installments of $__________________ each.

- Payments are due on the ____ day of each month, beginning on __________, 20___.

- The final payment shall be due on __________, 20___.

This Note may not be amended or modified except in writing signed by both the Borrower and Lender.

Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of the State of Florida.

By signing below, the Borrower and Lender acknowledge and agree to the terms stated in this Promissory Note.

Borrower's Signature: __________________________ Date: _______________

Lender's Signature: ___________________________ Date: _______________