Printable Loan Agreement Form for the State of Florida

Guide to Writing Florida Loan Agreement

Filling out the Florida Loan Agreement form is a straightforward process. Follow these steps carefully to ensure all necessary information is provided accurately.

- Obtain the Form: Download or print the Florida Loan Agreement form from a reliable source.

- Read the Instructions: Familiarize yourself with the form's sections and requirements before filling it out.

- Fill in Borrower Information: Provide the full name, address, and contact details of the borrower.

- Fill in Lender Information: Enter the full name, address, and contact details of the lender.

- Loan Amount: Clearly state the total amount of the loan being agreed upon.

- Interest Rate: Specify the interest rate applicable to the loan, if any.

- Loan Term: Indicate the duration of the loan, including start and end dates.

- Payment Schedule: Outline how and when payments will be made (e.g., monthly, quarterly).

- Signatures: Ensure both the borrower and lender sign the form. Include the date of signing.

- Review: Double-check all entered information for accuracy before submitting the form.

Once you have completed the form, make copies for both parties and keep them for your records. This ensures everyone has access to the agreement details in the future.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida, specifically under Florida Statutes Chapter 687. |

| Parties Involved | The form requires the full names and addresses of both the lender and the borrower to ensure clarity. |

| Loan Amount | The specific amount being borrowed must be clearly stated in the agreement to avoid confusion. |

| Interest Rate | The agreement should specify the interest rate applicable to the loan, whether it is fixed or variable. |

| Repayment Terms | Details about repayment schedules, including due dates and payment methods, are essential components of the form. |

| Default Conditions | The form outlines what constitutes a default and the potential consequences for the borrower. |

| Signatures | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be valid. |

FAQ

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Florida. It details the amount borrowed, interest rates, repayment schedule, and any collateral involved. This document helps protect both parties by clearly defining their rights and responsibilities.

Who should use a Florida Loan Agreement form?

Anyone who is lending or borrowing money in Florida should consider using a Loan Agreement form. This includes individuals, businesses, or organizations. Whether it's a personal loan between friends or a business loan, having a written agreement can prevent misunderstandings and disputes later on.

What key elements should be included in the agreement?

A comprehensive Florida Loan Agreement should include the following elements:

- The names and contact information of the lender and borrower.

- The total amount of the loan.

- The interest rate and how it will be calculated.

- The repayment schedule, including due dates.

- Any collateral that secures the loan.

- Consequences of defaulting on the loan.

- Any applicable fees or charges.

Is it necessary to have the agreement notarized?

While it is not legally required to notarize a Florida Loan Agreement, doing so can add an extra layer of security. A notary public verifies the identities of the parties involved and ensures that they are signing the document willingly. This can be helpful if disputes arise later.

Can the terms of the loan be modified after the agreement is signed?

Yes, the terms of the loan can be modified after the agreement is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the new terms to avoid confusion in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include:

- Negotiating a new repayment plan.

- Charging late fees as specified in the agreement.

- Taking legal action to recover the owed amount.

- Seizing any collateral if applicable.

It is important for both parties to understand the consequences of defaulting before entering into the agreement.

Are there any state-specific laws that affect the Loan Agreement?

Yes, Florida has specific laws that govern loan agreements, including regulations on interest rates and consumer protections. It is essential to be aware of these laws to ensure that the agreement complies with state requirements. Consulting with a legal professional can provide clarity on these matters.

Can I use a template for a Florida Loan Agreement?

Using a template for a Florida Loan Agreement can be a good starting point. However, it is crucial to customize the template to fit the specific terms of your loan. Ensure that all necessary elements are included and that the agreement complies with Florida law. Seeking legal advice is always a wise choice when drafting any legal document.

Consider Popular Loan Agreement Forms for Specific States

Promissory Note Texas - Offers a clear indication of how disputes will be resolved.

In addition to its critical role in ensuring security and thorough investigations, the CID Name Check Request form can be complemented by utilizing tools like the Blank Check Template, which provides a structured format for efficiently gathering and organizing the necessary personal information required for accurate background checks.

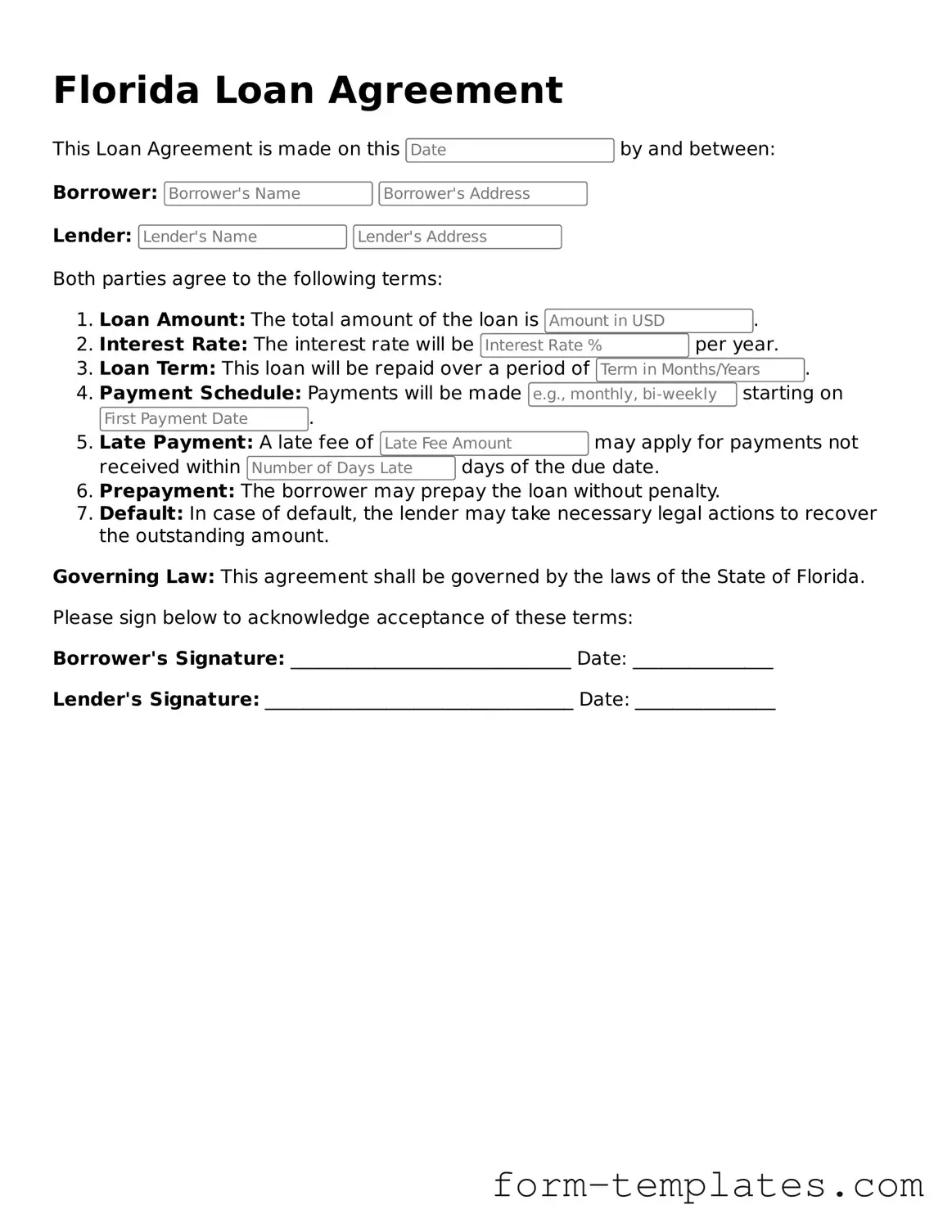

Florida Loan Agreement Example

Florida Loan Agreement

This Loan Agreement is made on this by and between:

Borrower:

Lender:

Both parties agree to the following terms:

- Loan Amount: The total amount of the loan is .

- Interest Rate: The interest rate will be per year.

- Loan Term: This loan will be repaid over a period of .

- Payment Schedule: Payments will be made starting on .

- Late Payment: A late fee of may apply for payments not received within days of the due date.

- Prepayment: The borrower may prepay the loan without penalty.

- Default: In case of default, the lender may take necessary legal actions to recover the outstanding amount.

Governing Law: This agreement shall be governed by the laws of the State of Florida.

Please sign below to acknowledge acceptance of these terms:

Borrower's Signature: ______________________________ Date: _______________

Lender's Signature: _________________________________ Date: _______________