Printable Deed in Lieu of Foreclosure Form for the State of Florida

Guide to Writing Florida Deed in Lieu of Foreclosure

After completing the Florida Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties. This typically includes the lender and potentially the county clerk's office. Ensure that all necessary signatures are obtained and that copies are kept for personal records.

- Obtain the Florida Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Provide the name and address of the borrower (the individual or entity giving the deed).

- List the lender's name and address in the designated section.

- Describe the property being transferred, including the address and legal description.

- Indicate whether there are any outstanding liens or mortgages on the property.

- Sign the form in the appropriate section, ensuring that the signature matches the name provided.

- Have the signature notarized to validate the document.

- Make copies of the completed form for personal records.

- Submit the original form to the lender and, if required, file it with the county clerk's office.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Purpose | This process allows homeowners to relinquish their property to the lender, potentially minimizing the negative impact of foreclosure on their credit score. |

| Governing Law | The Deed in Lieu of Foreclosure in Florida is governed by the Florida Statutes, specifically under Title XL, Chapter 697. |

| Eligibility | Homeowners must be facing financial hardship and unable to continue making mortgage payments to qualify for this option. |

| Process | The borrower must negotiate with the lender to agree on the terms of the deed transfer, often involving a written agreement and the completion of specific forms. |

| Impact on Credit | While a Deed in Lieu may still affect credit ratings, it is generally viewed more favorably than a foreclosure, making it easier for borrowers to recover in the future. |

FAQ

What is a Deed in Lieu of Foreclosure?

A deed in lieu of foreclosure is a legal process in which a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish ownership of the property in exchange for the cancellation of the mortgage debt.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a deed in lieu of foreclosure typically depends on several factors, including:

- The homeowner must be facing financial hardship that makes it difficult to continue mortgage payments.

- The property must be free of other liens or encumbrances, or the lender must be willing to accept the property with those liens.

- The homeowner must be willing to vacate the property upon completion of the transfer.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to opting for a deed in lieu of foreclosure, including:

- Less impact on credit score compared to a foreclosure.

- Potential for a smoother transition out of the property.

- Possibility of negotiating a cash incentive from the lender.

What are the drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also some potential downsides, such as:

- The homeowner may still face tax consequences if the forgiven debt exceeds the property’s value.

- Not all lenders accept deeds in lieu, which may limit options.

- The homeowner must vacate the property, which can be emotionally challenging.

How does the process work?

The process generally involves the following steps:

- The homeowner contacts the lender to discuss the option of a deed in lieu of foreclosure.

- The lender reviews the homeowner’s financial situation and the property’s condition.

- If approved, the parties will draft and sign the deed in lieu of foreclosure document.

- The homeowner transfers the property title to the lender.

Will I still owe money after the deed is completed?

In many cases, the deed in lieu of foreclosure cancels the mortgage debt. However, if there are other liens or if the lender does not agree to forgive the remaining balance, the homeowner may still owe money. It is essential to clarify this with the lender before proceeding.

Can I negotiate the terms of the Deed in Lieu of Foreclosure?

Yes, homeowners can negotiate the terms with the lender. This may include discussions about any potential cash incentives, the timeline for vacating the property, and whether the lender will forgive any remaining debt.

What happens to my credit score?

A deed in lieu of foreclosure typically has a less severe impact on a homeowner's credit score compared to a foreclosure. However, it will still be reported to credit bureaus and can affect future borrowing opportunities.

How long does the process take?

The timeline for completing a deed in lieu of foreclosure can vary. It generally takes a few weeks to a few months, depending on the lender’s processes and the complexity of the homeowner's situation. Prompt communication between the homeowner and lender can help expedite the process.

Are there alternatives to a Deed in Lieu of Foreclosure?

Yes, several alternatives exist, including:

- Loan modification, which changes the terms of the existing mortgage.

- Short sale, where the property is sold for less than the mortgage balance with lender approval.

- Bankruptcy, which may provide relief from debt obligations.

Homeowners should explore all options and consult with a financial advisor or legal expert to determine the best course of action for their specific situation.

Consider Popular Deed in Lieu of Foreclosure Forms for Specific States

California Voluntary Foreclosure Deed - A solution that allows for a clean break from an unmanageable mortgage.

The California Vehicle Purchase Agreement is a crucial document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form ensures that both parties are aware of their rights and obligations, providing a clear framework for the transaction. Understanding this agreement is essential for a smooth and legally compliant vehicle purchase in California. For more information, visit https://californiadocsonline.com/vehicle-purchase-agreement-form.

Foreclosure Vs Deed in Lieu - Ultimately, a Deed in Lieu of Foreclosure provides a mechanism for closure during financial turmoil.

Will I Owe Money After a Deed in Lieu of Foreclosure - This option avoids the public nature of foreclosure and can protect the homeowner's dignity.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It establishes clear terms for transferring property ownership to the lender.

Florida Deed in Lieu of Foreclosure Example

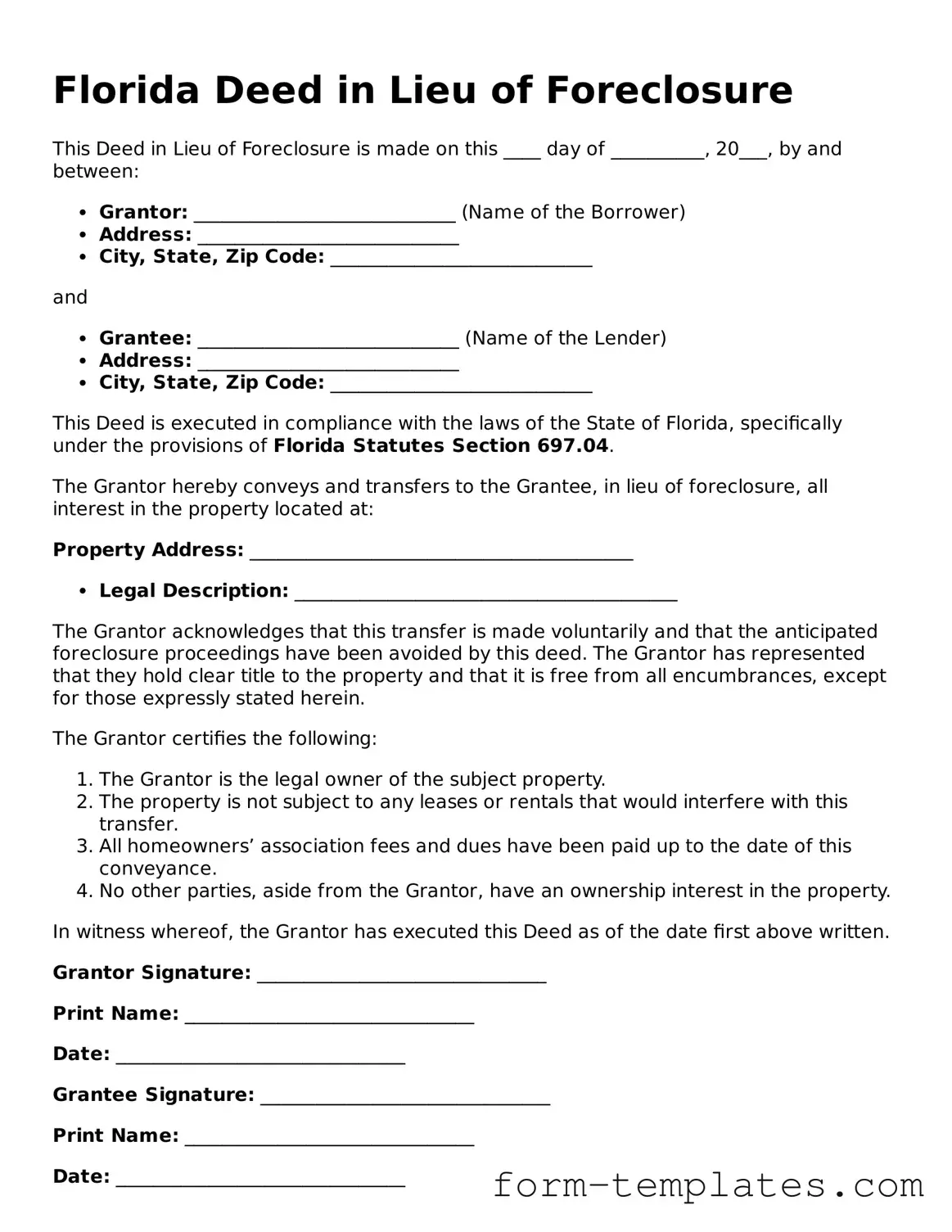

Florida Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made on this ____ day of __________, 20___, by and between:

- Grantor: ____________________________ (Name of the Borrower)

- Address: ____________________________

- City, State, Zip Code: ____________________________

and

- Grantee: ____________________________ (Name of the Lender)

- Address: ____________________________

- City, State, Zip Code: ____________________________

This Deed is executed in compliance with the laws of the State of Florida, specifically under the provisions of Florida Statutes Section 697.04.

The Grantor hereby conveys and transfers to the Grantee, in lieu of foreclosure, all interest in the property located at:

Property Address: _________________________________________- Legal Description: _________________________________________

The Grantor acknowledges that this transfer is made voluntarily and that the anticipated foreclosure proceedings have been avoided by this deed. The Grantor has represented that they hold clear title to the property and that it is free from all encumbrances, except for those expressly stated herein.

The Grantor certifies the following:

- The Grantor is the legal owner of the subject property.

- The property is not subject to any leases or rentals that would interfere with this transfer.

- All homeowners’ association fees and dues have been paid up to the date of this conveyance.

- No other parties, aside from the Grantor, have an ownership interest in the property.

In witness whereof, the Grantor has executed this Deed as of the date first above written.

Grantor Signature: _______________________________

Print Name: _______________________________

Date: _______________________________

Grantee Signature: _______________________________

Print Name: _______________________________

Date: _______________________________

State of Florida

County of ______________________

On this ____ day of __________, 20___, before me, a Notary Public, personally appeared ____________________________, who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to this instrument, and acknowledged that they executed it.

Notary Public Signature: _______________________________

Print Name: _______________________________

My Commission Expires: _______________________________