Printable Affidavit of Gift Form for the State of Florida

Guide to Writing Florida Affidavit of Gift

After obtaining the Florida Affidavit of Gift form, it is essential to complete it accurately to ensure proper documentation of the gift. This form will need to be submitted to the appropriate authorities or retained for personal records. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide your full name in the designated space.

- Fill in your address, including city, state, and zip code.

- Next, enter the recipient's full name.

- Include the recipient's address in the appropriate fields.

- State the nature of the gift clearly, describing what is being given.

- Indicate the value of the gift as accurately as possible.

- Sign the form where indicated to validate the affidavit.

- Have a witness sign the form, if required, to attest to the gift.

Once the form is completed, review it for accuracy. Ensure all necessary signatures are present. After that, you can proceed to submit or retain the form as needed.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to document the transfer of property or assets as a gift from one individual to another. |

| Governing Law | This form is governed by Florida Statutes, specifically Chapter 709, which outlines the laws regarding gifts and property transfers. |

| Signature Requirement | The form must be signed by the donor (the person giving the gift) in the presence of a notary public to be legally binding. |

| Property Types | The affidavit can be used for various types of property, including real estate, vehicles, and personal belongings. |

| Tax Implications | Gifts may have tax implications for both the donor and the recipient, and it is advisable to consult a tax professional regarding potential gift tax responsibilities. |

FAQ

What is a Florida Affidavit of Gift?

The Florida Affidavit of Gift is a legal document used to transfer ownership of property or assets as a gift. This form is typically used when someone wishes to give a gift of real estate, vehicles, or other valuable items without expecting anything in return. The affidavit serves as proof of the gift and may be required for tax purposes or to establish clear ownership.

Who needs to complete the Affidavit of Gift?

Anyone who is giving or receiving a gift of property in Florida may need to complete this form. It is particularly important for:

- Individuals transferring ownership of real estate.

- People gifting vehicles or boats.

- Those giving valuable personal property, such as jewelry or collectibles.

Both the donor (the person giving the gift) and the recipient (the person receiving the gift) should sign the affidavit to ensure clarity and legality in the transfer.

What information is required on the Affidavit of Gift?

The Affidavit of Gift must include several key pieces of information:

- The names and addresses of both the donor and the recipient.

- A detailed description of the property being gifted.

- The date of the gift.

- Any conditions or restrictions related to the gift, if applicable.

Providing accurate and complete information is crucial to avoid any potential disputes or issues in the future.

Is the Affidavit of Gift required for tax purposes?

While the Affidavit of Gift itself may not be required for all tax filings, it can play a significant role in documenting the transfer of assets. In the United States, gifts above a certain value may trigger gift tax implications. The IRS allows individuals to gift a specific amount each year without incurring taxes. It is advisable to consult a tax professional to understand the potential tax consequences associated with gifting property and to determine if filing the affidavit is necessary.

Consider Popular Affidavit of Gift Forms for Specific States

Texas Vehicle Bill of Sale - A well-prepared affidavit can deter potential claims against the gift in the future.

The Employee Availability form is essential for employers to understand the preferred working hours and availability of their employees, facilitating effective shift scheduling. To simplify this process and ensure that all staffing needs are met, you can access the necessary document by using the following link: Employee Availability Form.

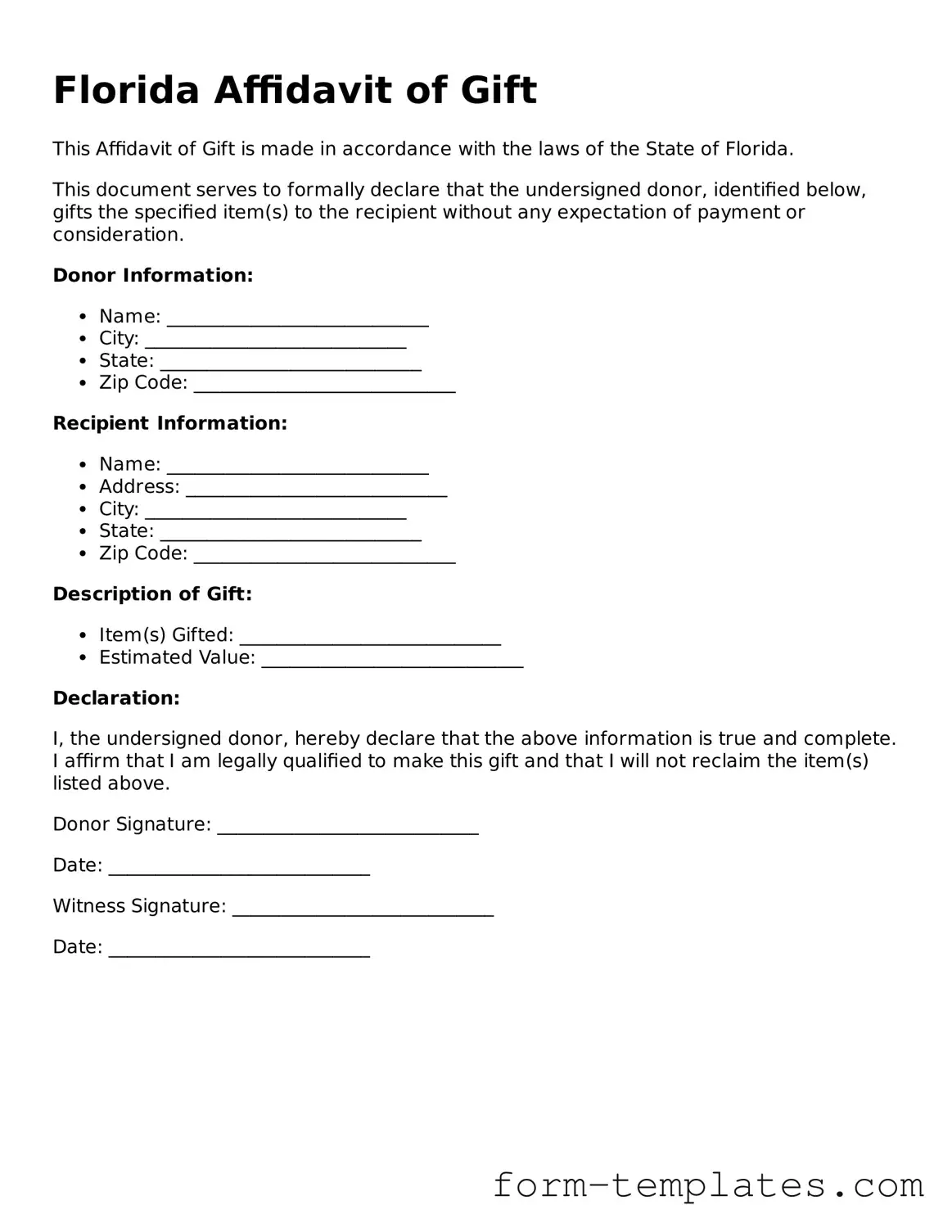

Florida Affidavit of Gift Example

Florida Affidavit of Gift

This Affidavit of Gift is made in accordance with the laws of the State of Florida.

This document serves to formally declare that the undersigned donor, identified below, gifts the specified item(s) to the recipient without any expectation of payment or consideration.

Donor Information:

- Name: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Recipient Information:

- Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Description of Gift:

- Item(s) Gifted: ____________________________

- Estimated Value: ____________________________

Declaration:

I, the undersigned donor, hereby declare that the above information is true and complete. I affirm that I am legally qualified to make this gift and that I will not reclaim the item(s) listed above.

Donor Signature: ____________________________

Date: ____________________________

Witness Signature: ____________________________

Date: ____________________________