Fill Out a Valid Fl Dr 312 Template

Guide to Writing Fl Dr 312

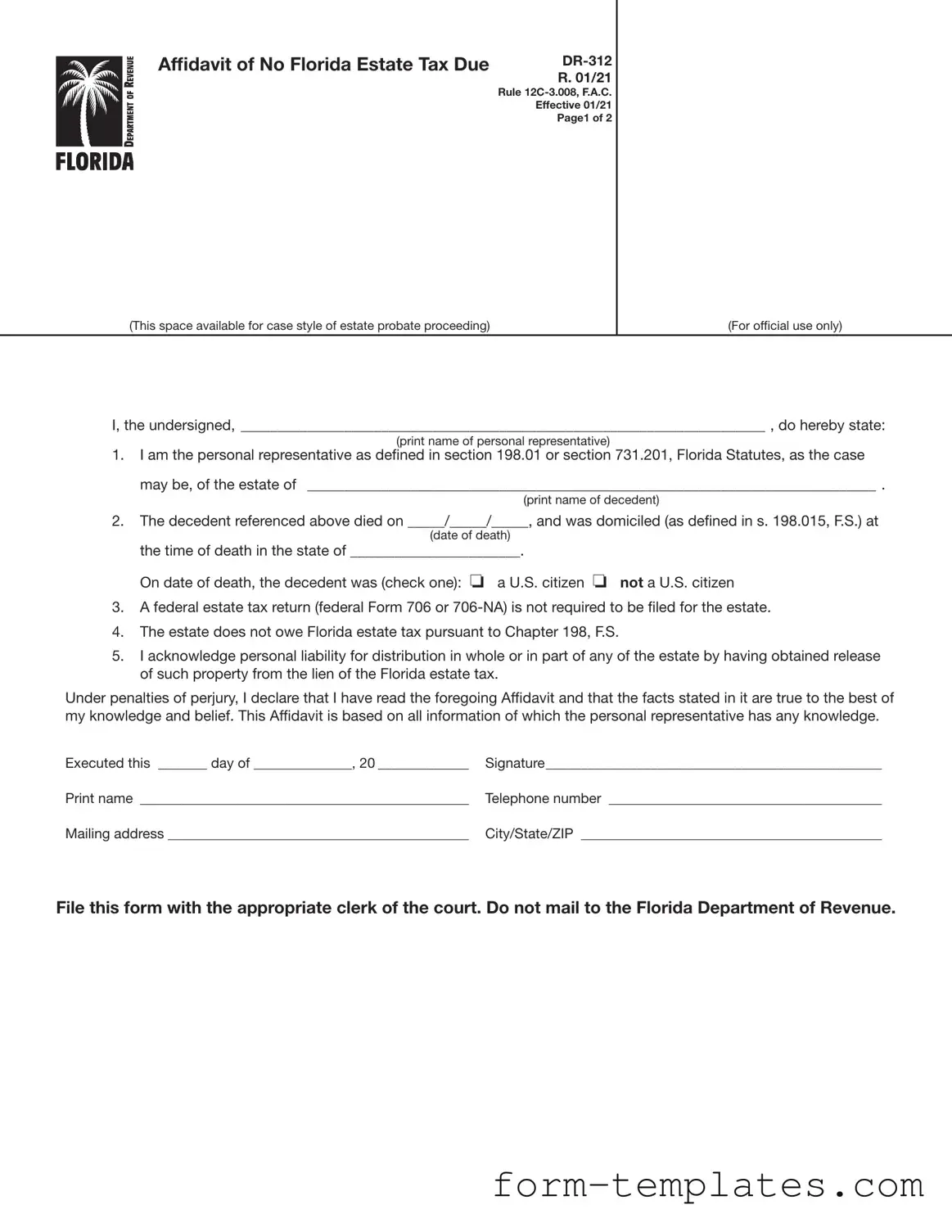

Completing the Fl Dr 312 form is an essential step for personal representatives of estates that are not subject to Florida estate tax. After filling out this form, you will need to file it with the appropriate clerk of the court in the county where the decedent owned property. Ensure that all information is accurate before submission.

- Begin by printing your name in the designated space for the personal representative.

- Next, provide the name of the decedent in the specified area.

- Enter the date of death in the format of month/day/year.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to specify whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return (Form 706 or 706-NA) is not required for the estate.

- State that the estate does not owe any Florida estate tax as per Chapter 198, F.S.

- Acknowledge your personal liability for any distribution of the estate by signing the affidavit.

- Fill in the date of execution in the designated space.

- Sign the form where indicated and print your name below your signature.

- Provide your telephone number, mailing address, and city/state/ZIP code in the appropriate sections.

- Ensure that you do not mark or write in the 3-inch by 3-inch space at the top right corner of the form.

Once completed, submit the form to the clerk of the circuit court. Remember, do not send it to the Florida Department of Revenue. Keep a copy for your records.

Document Breakdown

| Fact Name | Fact Details |

|---|---|

| Form Title | The official title of the form is "Affidavit of No Florida Estate Tax Due DR-312." |

| Governing Law | This form is governed by Chapter 198 of the Florida Statutes and Rule 12C-3.008 of the Florida Administrative Code. |

| Purpose | The form is used to declare that no Florida estate tax is due for the decedent's estate. |

| Eligibility | It is applicable when no federal estate tax return (Form 706 or 706-NA) is required to be filed. |

| Filing Requirements | The completed form must be filed with the clerk of the circuit court in the county where the decedent owned property. |

| Personal Liability | The personal representative acknowledges liability for any distribution of estate property after obtaining a release from the Florida estate tax lien. |

| Non-Taxable Certificates | After filing the DR-312, the Florida Department of Revenue will no longer issue Nontaxable Certificates for that estate. |

| Signature Requirement | The personal representative must sign the affidavit, affirming the truth of its contents under penalties of perjury. |

| Contact Information | For questions or assistance, individuals can contact the Florida Department of Revenue's Taxpayer Services at 850-488-6800. |

FAQ

What is the purpose of the FL DR 312 form?

The FL DR 312 form, also known as the Affidavit of No Florida Estate Tax Due, is used to declare that an estate does not owe any Florida estate tax. This form is necessary when a federal estate tax return is not required to be filed. By completing this form, the personal representative confirms that the estate is not subject to Florida estate tax under Chapter 198 of the Florida Statutes.

Who can file the FL DR 312 form?

The form can be filed by the personal representative of the estate. This includes anyone who is in actual or constructive possession of the decedent's property. If you are responsible for managing the estate and meet the definition of a personal representative as outlined in Florida law, you are eligible to complete and submit this form.

Where should the FL DR 312 form be filed?

You must file the FL DR 312 form with the clerk of the circuit court in the county where the decedent owned property. It is important not to send this form to the Florida Department of Revenue. Ensure that the form is recorded properly in the public records of the appropriate county or counties.

When should the FL DR 312 form be used?

The FL DR 312 form should be used when an estate is not subject to Florida estate tax and a federal estate tax return (Form 706 or 706-NA) is not required. If the estate meets these criteria, the form serves as evidence of nonliability for Florida estate tax and helps remove any estate tax lien imposed by the Department of Revenue. However, if a federal estate tax return is required, this form cannot be used.

Fill out Other Forms

Fake Bill Template - This form serves as a guide for your utility-related questions and concerns.

The Payroll Check form is essential for businesses to accurately reflect the wages paid to employees, serving both record-keeping and compliance purposes. For a streamlined approach to creating these checks, consider using a Fillable Blank Check that can simplify your payroll process and ensure all necessary details are included.

Yugioh Deck List Form - Specify the type of event being played, whether local, regional, or a larger tournament.

Fl Dr 312 Example

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter