Fill Out a Valid Employment Application Pdf Template

Guide to Writing Employment Application Pdf

Filling out the Employment Application PDF form is an important step in your job search process. It allows you to present your qualifications and experiences to potential employers. Follow these steps to ensure that you complete the form accurately and efficiently.

- Download the Employment Application PDF form from the specified source.

- Open the PDF using a compatible viewer or editor that allows you to fill out forms.

- Begin by entering your personal information at the top of the form. This typically includes your name, address, phone number, and email.

- Next, provide your employment history. List your previous jobs, including the company name, your job title, dates of employment, and a brief description of your responsibilities.

- After that, fill in your education background. Include the names of the institutions you attended, the degrees earned, and any relevant certifications.

- Continue to the skills section. Highlight any specific skills or qualifications that relate to the position you are applying for.

- If applicable, complete the references section. Provide the names and contact information of individuals who can vouch for your professional abilities.

- Review all the information you have entered to ensure accuracy and completeness.

- Save the completed form on your device, ensuring it retains the filled information.

- Submit the form as instructed, either by email or through an online application portal.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Employment Application PDF form is used by employers to collect information from job applicants. |

| Information Required | Typically includes personal details, work history, education, and references. |

| Legal Compliance | Employers must comply with federal and state laws, such as the Fair Labor Standards Act (FLSA) and Equal Employment Opportunity (EEO) laws. |

| State-Specific Forms | Some states may require additional information or specific formats based on local employment laws. |

| Signature Requirement | Applicants usually need to sign the form to certify that the information provided is accurate and complete. |

FAQ

What is the Employment Application PDF form?

The Employment Application PDF form is a standardized document used by employers to collect information from job applicants. This form typically includes sections for personal details, work history, education, skills, and references. It serves as a tool for employers to evaluate candidates and streamline the hiring process.

How do I fill out the Employment Application PDF form?

To fill out the Employment Application PDF form, follow these steps:

- Download the PDF form from the employer's website or request it directly from the hiring manager.

- Open the form using a PDF reader that allows for editing.

- Complete each section with accurate and relevant information. Ensure that you provide details about your work history, educational background, and skills.

- Review the form for any errors or omissions.

- Save the completed form and follow the employer's instructions for submission, which may include emailing or printing the document.

What information do I need to provide on the form?

When filling out the Employment Application PDF form, you will typically need to provide:

- Your full name and contact information.

- A detailed work history, including previous employers, job titles, and dates of employment.

- Your educational background, including schools attended and degrees earned.

- A list of relevant skills and qualifications.

- References who can vouch for your work ethic and experience.

Can I submit the Employment Application PDF form electronically?

Yes, many employers allow electronic submissions of the Employment Application PDF form. After completing the form, you can save it as a PDF file and email it to the designated contact. Always check the employer's submission guidelines to ensure compliance with their preferred method.

What should I do if I make a mistake on the form?

If you make a mistake while filling out the Employment Application PDF form, do not panic. Depending on the nature of the error, you have a couple of options:

- If the mistake is minor, you can correct it directly on the form using a PDF editor.

- If the error is significant, it may be best to start over with a new form to ensure clarity and professionalism.

Always double-check your information before submitting to minimize errors.

Is there a deadline for submitting the Employment Application PDF form?

Deadlines for submitting the Employment Application PDF form vary by employer and job posting. It is essential to check the specific job listing for any stated deadlines. If no deadline is provided, it is advisable to submit your application as soon as possible to increase your chances of being considered for the position.

Fill out Other Forms

What Is Form 940 - Form 940 data contributes to national statistics on employment and job losses.

The FedEx Bill of Lading is a crucial document that outlines the details of your shipment. It serves as a receipt for the goods transported and establishes the terms of the transport contract between the shipper and the carrier. To make your shipping process smoother, you can access the necessary template by visiting Top Document Templates and filling out the form.

Puppy Health Guarantee Template - The buyer is responsible for all veterinary costs associated with the puppy.

Cg2010 Endorsement Definition - Careful reading of the terms is encouraged as it alters the original policy.

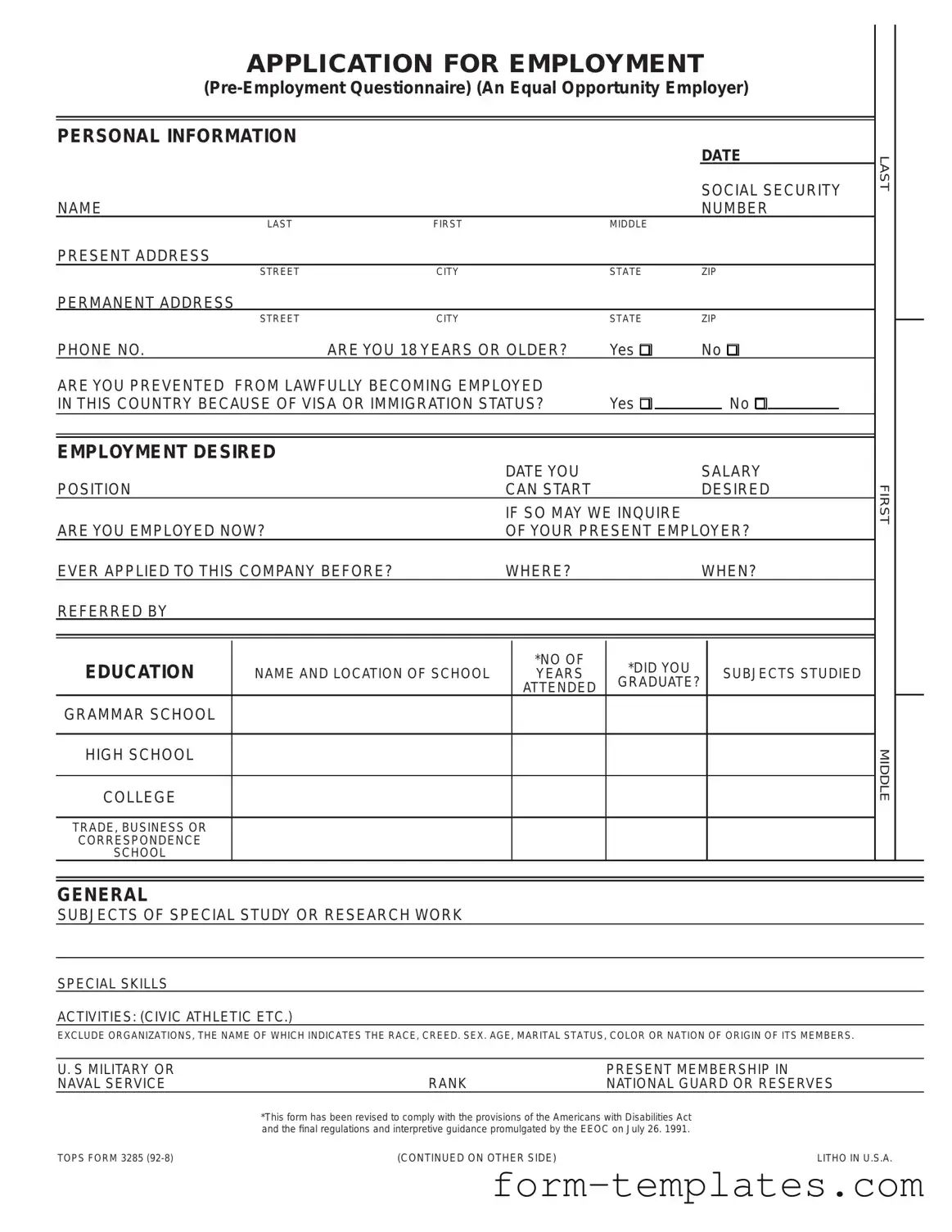

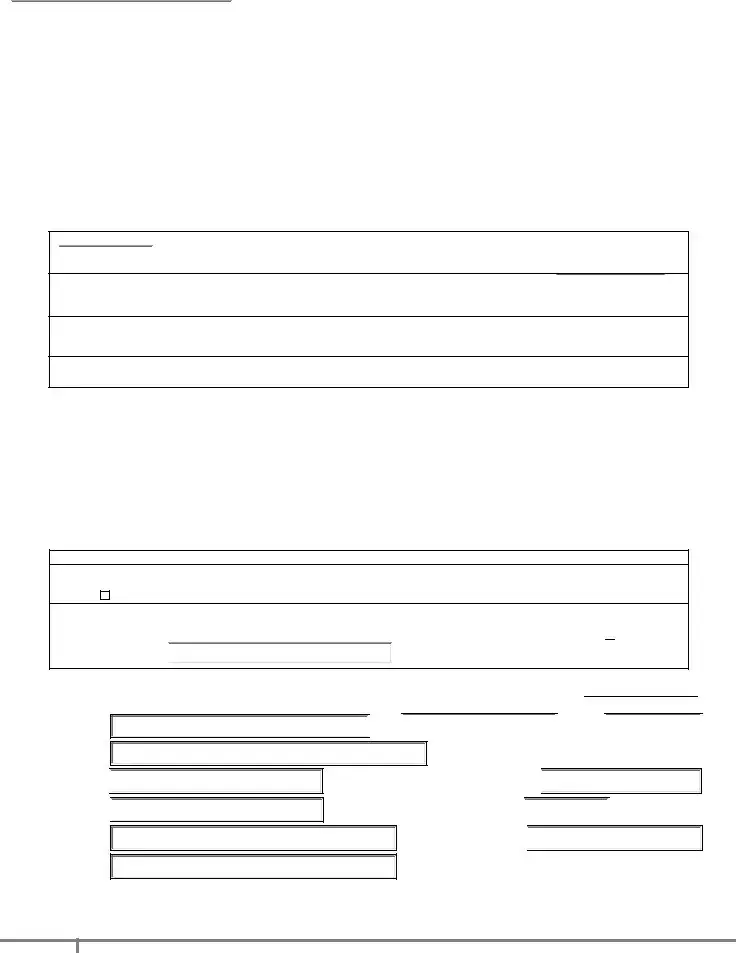

Employment Application Pdf Example

|

|

APPLICATION FOR EMPLOYMENT |

|

|

||||||||||||

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL INFORMATION |

|

|

|

|

|

|

|

DATE |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

LAST |

|

|||||

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NAME |

|

|

|

|

|

|

|

|

NUMBER |

|

|

|||||

|

|

LAST |

FIRST |

|

|

|

MIDDLE |

|

|

|

|

|

|

|

||

PRESENT ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET |

CITY |

|

|

|

STATE |

ZIP |

|

|

||||||

PERMANENT ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET |

CITY |

|

|

|

STATE |

ZIP |

|

|

||||||

|

|

|

|

|

|

|

||||||||||

PHONE NO. |

ARE YOU 18 YEARS OR OLDER? |

|

Yes q |

No q |

|

|

||||||||||

ARE YOU PREVENTED FROM LAWFULLY BECOMING EMPLOYED |

|

|

|

|

|

|

|

|

|

|

|

|||||

IN THIS COUNTRY BECAUSE OF VISA OR IMMIGRATION STATUS? |

|

Yes q |

|

|

|

No q |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYMENT DESIRED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

DATE YOU |

|

|

|

|

SALARY |

|

|

|||||

POSITION |

|

|

CAN START |

|

|

|

|

DESIRED |

FIRST |

|

||||||

|

|

|

|

IF SO MAY WE INQUIRE |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

ARE YOU EMPLOYED NOW? |

|

OF YOUR PRESENT EMPLOYER? |

|

|

||||||||||||

EVER APPLIED TO THIS COMPANY BEFORE? |

|

WHERE? |

|

|

|

|

WHEN? |

|

|

|||||||

REFERRED BY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDUCATION |

|

|

|

|

*NO OF |

|

*DID YOU |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

NAME AND LOCATION OF SCHOOL |

|

YEARS |

|

|

|

SUBJECTS STUDIED |

|

|

|||||||

|

|

|

|

|

ATTENDED |

|

GRADUATE? |

|

|

|

|

|

|

|

||

GRAMMAR SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MIDDLE |

|

HIGH SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLLEGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRADE, BUSINESS OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORRESPONDENCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GENERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBJECTS OF SPECIAL STUDY OR RESEARCH WORK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

SPECIAL SKILLS

ACTlVITIES: (CIVIC ATHLETIC ETC.)

EXCLUDE ORGANIZATIONS, THE NAME OF WHICH INDICATES THE RACE, CREED. SEX. AGE, MARITAL STATUS, COLOR OR NATION OF ORIGIN OF ITS MEMBERS.

U. S MILITARY OR |

|

PRESENT MEMBERSHIP IN |

NAVAL SERVICE |

RANK |

NATIONAL GUARD OR RESERVES |

*This form has been revised to comply with the provisions of the Americans with Disabilities Act and the fnal regulations and interpretive guidance promulgated by the EEOC on July 26. 1991.

TOPS FORM 3285 |

(CONTINUED ON OTHER SIDE) |

LITHO IN U.S.A. |

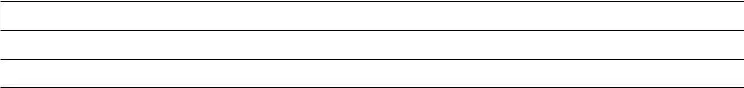

FORMER EMPLOYERS (LIST BELOW LAST THREE EMPLOYERS, STARTING WITH LAST ONE FIRST).

DATE |

NAME AND ADDRESS OF EMPLOYER |

SALARY POSITION REASON FOR LEAVING |

|

MONTH AND YEAR |

|||

|

|

FROM

TO

FROM

TO

FROM

TO

FROM

TO

WHICH OF THESE JOBS DlD YOU LIKE BEST?

WHAT DlD YOU LIKE MOST ABOUT THIS JOB?

REFERENCES: GIVE THE NAMES OF THREE PERSONS NOT RELATED TO YOU, WHOM YOU HAVE KNOWN AT LEAST ONE YEAR.

NAME |

ADDRESS |

BUSINESS |

YEARS |

|

ACQUAINTED |

||||

|

|

|

1

2

3

THE FOLLOWING STATEMENT APPLIES IN: MARYLAND & MASSACHUSETTS. [Fill in name of state.)

IT IS UNLAWFUL IN THE STATE OF ________________________ TO REQUIRE OR ADMINISTER A LIE DETECTOR TEST

AS A CONDITION OF EMPLOYMENT OR CONTINUED EMPLOYMENT. AN EMPLOYER WHO VIOLATES THIS LAW SHALL BE SUBJECT TO CRIMINAL PENALTIES AND CIVIL LIABILITY.

Signature of Applicant

IN CASE OF

EMERGENCY NOTIFY

NAME |

ADDRESS |

PHONE NO. |

"I CERTIFY THAT ALL THE INFORMATION SUBMITTED BY ME ON THIS APPLICATION IS TRUE AND COMPLETE, AND I UNDERSTAND THAT IF ANY FALSE INFORMATION, OMISSIONS, OR MISREPRESENTATIONS ARE DISCOVERED, MY APPLICATION MAY BE REJECTED AND, IF I AM EMPLOYED. MY EMPLOYMENT MAY BE TERMINATED AT ANY TIME.

IN CONSIDERATION OF MY EMPLOYMENT, I AGREE TO CONFORM TO THE COMPANY'S RULES AND REGULATIONS, AND I AGREE THAT MY EMPLOYMENT AND COMPENSATION CAN BE TERMINATED, WITH OR WITHOUT CAUSE. AND WITH OR WITHOUT NOTICE, AT ANY TIME, AT EITHER MY OR THE COMPANY'S OPTION. I ALSO UNDERSTAND AND AGREE THAT THE TERMS AND CONDITIONS OF MY EMPLOYMENT MAY BE CHANGED, WITH OR WITHOUT CAUSE, AND WITH OR WITHOUT NOTICE, AT ANY TIME BY THE COMPANY. I UNDERSTAND THAT NO COMPANY REPRESENTATIVE, OTHER THAN IT'S PRESIDENT, AND THEN ONLY WHEN IN WRONG AND SIGNED BY THE PRESIDENT, HAS ANY AUTHORITY TO ENTER INTO ANY AGREEMENT FOR EMPLOYMENT FOR ANY SPECIFIC PERIOD OF TIME, OR TO MAKE ANY AGREEMENT CONTRARY TO THE FOREGOING.

DATE |

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT WRITE BELOW THIS LINE |

|

INTERVIEWED BY: |

|

DATE: |

|

REMARKS: |

|

|

|

|

|

|

|

NEATNESS |

|

ABILITY |

|

HIRED: q Yes |

q No |

POSITION |

DEPT. |

SALARY/WAGE |

|

DATE REPORTING TO WORK |

|

APPROVED: |

1. |

2. |

3 |

|

EMPLOYMENT MANAGER |

DEPT. HEAD |

GENERAL MANAGER |

This form has been designed to strictly comply with State and Federal fair employment practice laws prohibiting employment discrimination. This Application for Employment Form is sold for general use throughout the United States. TOPS assumes no responsibility for the inclusion in said form of any questions which, when asked by the Employer of the Job Applicant, may violate State and/or Federal Law.

We welcome your application for employment at Southern Platte Fire Protection District (hereinafter referred to as the Company). We are proud that our success is the result of the quality and caliber of our employees. In pursuit of excellence, we require, as a condition of employment, all applicants must consent to and authorize a

The following information is used for identification

purposes in verifying background information.

Printed Name______________________ Date__________

Signature________________________________________

SS#____________________________________________

List any cities and states where you previously resided:

_________________________________________________

_________________________________________________

_________________________________________________

_________________________________________________

DISCLOSURE AND AUTHORIZATION [IMPORTANT

DISCLOSURE REGARDING BACKGROUND INVESTIGATION

(“the Company”) may obtain information about you for employment purposes from a third party consumer reporting agency. Thus, you may be the subject of a “consumer report” and/or an “investigative consumer report” which may include information about your character, general reputation, personal characteristics, and/or mode of living, and which can involve personal interviews with sources such as your neighbors, friends, or associates. These reports may contain information regarding your credit history, criminal history, social security number validation, motor vehicle records (“driving records”), verification of your education or employment history, or other background checks. Credit history will only be requested where such information is substantially related to the duties and responsibilities of the position for which you are applying. You have the right, upon written request made within a reasonable time, to request whether a consumer report has been requested and compiled about you, and disclosure of the nature and scope of any investigative consumer report and to request a copy of your report. Please be advised that the nature and scope of the most common form of investigative consumer report obtained with regard to applicants for employment is an investigation into your education and/or employment history conducted by Validity Screening Solutions, PO Box 860443, Shawnee, KS

(“the Company”) may obtain information about you for employment purposes from a third party consumer reporting agency. Thus, you may be the subject of a “consumer report” and/or an “investigative consumer report” which may include information about your character, general reputation, personal characteristics, and/or mode of living, and which can involve personal interviews with sources such as your neighbors, friends, or associates. These reports may contain information regarding your credit history, criminal history, social security number validation, motor vehicle records (“driving records”), verification of your education or employment history, or other background checks. Credit history will only be requested where such information is substantially related to the duties and responsibilities of the position for which you are applying. You have the right, upon written request made within a reasonable time, to request whether a consumer report has been requested and compiled about you, and disclosure of the nature and scope of any investigative consumer report and to request a copy of your report. Please be advised that the nature and scope of the most common form of investigative consumer report obtained with regard to applicants for employment is an investigation into your education and/or employment history conducted by Validity Screening Solutions, PO Box 860443, Shawnee, KS

New York and Maine applicants or employees only: You have the right to inspect and receive a copy of any investigative consumer report requested by

by contacting the consumer reporting agency identified above directly. You may also contact the Company to request the name, address and telephone number of the nearest unit of the consumer reporting agency designated to handle inquiries, which the Company shall provide within 5 days.

by contacting the consumer reporting agency identified above directly. You may also contact the Company to request the name, address and telephone number of the nearest unit of the consumer reporting agency designated to handle inquiries, which the Company shall provide within 5 days.

New York applicants or employees only: Upon request, you will be informed whether or not a consumer report was requested by  ,

, and if such report was requested, informed of the name and address of the consumer reporting agency that furnished the report. By signing below, you also acknowledge receipt of Article

and if such report was requested, informed of the name and address of the consumer reporting agency that furnished the report. By signing below, you also acknowledge receipt of Article

Oregon applicants or employees only: Information describing your rights under federal and Oregon law regarding consumer identity theft protection, the storage and disposal of your credit information, and remedies available should you suspect or find that the Company has not maintained secured records is available to you upon request.

Washington State applicants or employees only: You also have the right to request from the consumer reporting agency a written summary of your rights and remedies under the Washington Fair Credit Reporting Act.

ACKNOWLEDGMENT AND AUTHORIZATION

I acknowledge receipt of the DISCLOSURE REGARDING BACKGROUND INVESTIGATION and A SUMMARY OF YOUR RIGHTS UNDER THE FAIR CREDIT REPORTING ACT and certify that I have read and understand both of those documents. I hereby authorize the obtaining of “consumer reports” and/or “investigative consumer reports” by the Company at any time after receipt of this authorization and throughout my employment, if applicable. To this end, I hereby authorize, without reservation, any law enforcement agency, administrator, state or federal agency, institution, school or university (public or private), information service bureau, employer, or insurance company to furnish any and all background information requested by Validity Screening Solutions, PO Box 860443, Shawnee, KS

New York applicants or employees only: By signing below, you also acknowledge receipt of Article

Minnesota and Oklahoma applicants or employees only: Please check this box if you would like to receive a copy of a consumer report if one is obtained by the

Company. |

(Must include email address: |

|

) |

|

California applicants or employees only: By signing below, you also acknowledge receipt of the NOTICE REGARDING BACKGROUND INVESTIGATION PURSUANT TO CALIFORNIA LAW. Please check this box if you would like to receive a copy of an investigative consumer report or consumer credit report at no charge if one is obtained by the Company whenever you have a right to receive such a copy under California law. www.validityscreening.com/Site/PrivacyPolicy

(Must include email address:

)

Signature: |

|

Date: |

|

BACKGROUND INFORMATION |

|

Last Name

Other Names/Alias

Social Security # [1][2]

Driver’s License # [2]

Present Address

City/State/Zip

First

First

Middle

Middle

Date of Birth (mm/dd/yyyy) [1][2]

State of Driver’s License [2]

Telephone # (Primary)

[1]This information will be used for background screening purposes only and will not be used as hiring criteria.[2] In Utah, this information may only be collected a) when extending a conditional offer of employment or b) at the time the background report will be run.

3

V 1.0 (Issued: November 2012)

Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la

Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and rental history records). Here is a summary of your major rights under the FCRA. For more information, including information about additional rights, go to www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

•You must be told if information in your file has been used against you. Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment – or to take another adverse action against you – must tell you, and must give you the name, address, and phone number of the agency that provided the information.

•You have the right to know what is in your file. You may request and obtain all the information about you in the files of a consumer reporting agency (your “file disclosure”). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free. You are entitled to a free file disclosure if:

•a person has taken adverse action against you because of information in your credit report;

•you are the victim of identity theft and place a fraud alert in your file;

•your file contains inaccurate information as a result of fraud;

•you are on public assistance;

•you are unemployed but expect to apply for employment within 60 days.

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See www.consumerfinance.gov/learnmore for additional information.

•You have the right to ask for a credit score. Credit scores are numerical summaries of your

•You have the right to dispute incomplete or inaccurate information. If you identify information in your file that is incomplete or inaccurate, and report it to the consumer reporting agency, the agency must investigate unless your dispute is frivolous. See www.consumerfinance.gov/learnmore for an explanation of dispute procedures.

•Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

•Consumer reporting agencies may not report outdated negative information. In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than 10 years old.

•Access to your file is limited. A consumer reporting agency may provide information about you only to people with a valid need – usually to consider an application with a creditor, insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for access.

•You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer. Written consent generally is not required in the trucking industry. For more information, go to www.consumerfinance.gov/learnmore.

•You may limit “prescreened” offers of credit and insurance you get based on information in your credit report. Unsolicited “prescreened” offers for credit and insurance must include a

•You may seek damages from violators. If a consumer reporting agency, or, in some cases, a user of consumer reports or a furnisher of information to a consumer reporting agency violates the FCRA, you may be able to sue in state or federal court.

•Identity theft victims and active duty military personnel have additional rights. For more information, visit www.consumerfinance.gov/learnmore.

States may enforce the FCRA, and many states have their own consumer reporting laws. In some cases, you may have more rights under state law. For more information, contact your state or local consumer protection agency or your state Attorney General. For information about your federal rights, contact:

TYPE OF BUSINESS: |

CONTACT: |

1.a. Banks, savings associations, and credit unions with total assets of |

a. Consumer Financial Protection Bureau |

over $10 billion and their affiliates. |

1700 G Street NW |

|

Washington, DC 20552 |

b. Such affiliates that are not banks, savings associations, or credit |

b. Federal Trade Commission: Consumer Response Center – FCRA |

unions also should list, in addition to the CFPB |

Washington, DC 20580 |

|

(877) |

2. To the extent not included in item 1 above: |

|

a. National banks, federal savings associations, and federal branches |

a. Office of the Comptroller of the Currency |

and federal agencies of foreign banks |

Customer Assistance Group |

|

1301 McKinney Street, Suite 3450 |

|

Houston, TX |

b. State member banks, branches and agencies of foreign banks (other |

b. Federal Reserve Consumer Help Center |

than federal branches, federal agencies, and Insured State Branches of |

P.O. Box 1200 |

Foreign Banks), commercial lending companies owned or controlled |

Minneapolis, MN 55480 |

by foreign banks, and organizations operating under section 25 or 25A |

|

of the Federal Reserve Act |

|

c. Nonmember Insured Banks, Insured State Branches of Foreign |

c. FDIC Consumer Response Center |

Banks, and insured state savings associations |

1100 Walnut Street, Box #11 |

|

Kansas City, MO 64106 |

d. Federal Credit Unions |

d. National Credit Union Administration |

|

Office of Consumer Protection (OCP) |

|

Division of Consumer Compliance and Outreach (DCCO) |

|

1775 Duke Street |

|

Alexandria, VA 22314 |

3. Air carriers |

Asst. General Counsel for Aviation Enforcement & Proceedings |

|

Aviation Consumer Protection Division |

|

Department of Transportation |

|

1200 New Jersey Avenue, S. E. |

|

Washington, DC 20590 |

4. Creditors Subject to Surface Transportation Board |

Office of Proceedings, Surface Transportation Board |

|

Department of Transportation |

|

395 E Street, S.W. |

|

Washington, DC 20423 |

5. Creditors Subject to Packers and Stockyards Act. 1921 |

Nearest Packers and Stockyards Administration area supervisor |

|

|

6. Small Business Investment Companies |

Associate Deputy Administrator for Capital Access |

|

United States Small Business Administration |

|

406 Third Street, SW, 8th Floor |

|

Washington, DC 20416 |

7. Brokers and Dealers |

Securities and Exchange Commission |

|

100 F St, N.E. |

|

Washington, DC 20549 |

8. Federal Land Banks, Federal Land Bank Associations, Federal |

Farm Credit Administration |

Intermediate Credit Banks, and Production Credit Associations |

1501 Farm Credit Drive |

|

McLean, VA |

9. Retailers, Finance Companies, and All Other Creditors Not Listed |

FTC Regional Office for region in which the creditor operates or |

Above |

Federal Trade Commission: Consumer Response Center – FCRA |

|

Washington, DC 20580 |

|

(877) |

(Updated: November 2012)

Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

Remedying the Effects of Identity Theft

You are receiving this information because you have notified a consumer reporting agency that you believe you are a victim of identity theft. Identity theft occurs when someone uses your name, Social Security number, date of birth, or other identifying information, without authority, to commit fraud. For example, someone may have committed identity theft by using your personal information to open a credit card account or get a loan in your name. For more information, visit www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

The Fair Credit Reporting Act (FCRA) gives you specific rights when you are, or believe that you are, the victim of identity theft. Here is a brief summary of the rights designed to help you recover from identity theft.

1.You have the right to ask that nationwide consumer reporting agencies place “fraud alerts” in your file to let potential creditors and others know that you may be a victim of identity theft. A fraud alert can make it more difficult for someone to get credit in your name because it tells creditors to follow certain procedures to protect you. It also may delay your ability to obtain credit. You may place a fraud alert in your file by calling just one of the three nationwide consumer reporting agencies. As soon as that agency processes your fraud alert, it will notify the other two, which then also must place fraud alerts in your file.

•Equifax: 1.888.766.0008; www.equifax.com

•Experian: 1.888.397.3742; www.experian.com

•TransUnion: 1.800.680.7289; www.transunion.com

An initial fraud alert stays in your file for at least 90 days. An extended alert stays in your file for seven years. To place either of these alerts, a consumer reporting agency will require you to provide appropriate proof of your identity, which may include your Social Security number. If you ask for an extended alert, you will have to provide an identity theft report. An identity theft report includes a copy of a report you have filed with a federal, state, or local law enforcement agency, and additional information a consumer reporting agency may require you to submit. For more detailed information about the identify theft report, visit www.consumerfinance.gov/learnmore.

2.You have the right to free copies of the information in your file (your “file disclosure”). An initial fraud alert entitles you to a copy of all the information in your file at each of the three nationwide agencies, and an extended alert entitles you to two free file disclosures in a 12- month period following the placing of the alert. These additional disclosures may help you detect signs of fraud, for example, whether fraudulent accounts have been opened in your name or whether someone has reported a change in your address. Once a year, you also have

the right to a free copy of the information in your file at any consumer reporting agency, if you believe it has inaccurate information due to fraud, such as identity theft. You also have the ability to obtain additional free file disclosures under other provisions of the FCRA. See www.consumerfinance.gov/learnmore.

3.You have the right to obtain documents relating to fraudulent transactions made or accounts opened using your personal information. A creditor or other business must give you copies of applications and other business records relating to transactions and accounts that resulted from the theft of your identity, if you ask for them in writing. A business may ask you for proof of your identity, a police report, and an affidavit before giving you the documents. It may also specify an address for you to send your request. Under certain circumstances, a business can refuse to provide you with these documents. See www.consumerfinance.gov/learnmore.

4.You have the right to obtain information from a debt collector. If you ask, a debt collector must provide you with certain information about the debt you believe was incurred in your name by an identity thief – like the name of the creditor and the amount of the debt.

5.If you believe information in your file results from identity theft, you have the right to ask that a consumer reporting agency block that information from your file. An identity thief may run up bills in your name and not pay them. Information about the unpaid bills may appear on your consumer report. Should you decide to ask a consumer reporting agency to block the reporting of this information, you must identify the information to block, and provide the consumer reporting agency with proof of your identity and a copy of your identity theft report. The consumer reporting agency can refuse or cancel your request for a block if, for example, you don’t provide the necessary documentation, or where the block results from an error or a material misrepresentation of fact made by you. If the agency declines or rescinds the block, it must notify you. Once a debt resulting from identity theft has been blocked, a person or business with notice of the block may not sell, transfer, or place the debt for collection.

6.You also may prevent businesses from reporting information about you to consumer reporting agencies if you believe the information is the result of identity theft. To do so, you must send your request to the address specified by the business that reports the information to the consumer reporting agency. The business will expect you to identify what information you do not want reported and to provide an identity theft report.

To learn more about identity theft and how to deal with its consequences, visit www.consumerfinance.gov/learnmore, or write to the Consumer Financial Protection Bureau. You may have additional rights under state law. For more information, contact your local consumer protection agency or your state Attorney General.

In addition to the new rights and procedures to help consumers deal with the effects of identity theft, the FCRA has many other important consumer protections. They are described in more detail at www.consumerfinance.gov/learnmore.

(Updated: November 2012)