Attorney-Approved Employee Loan Agreement Document

Guide to Writing Employee Loan Agreement

Completing the Employee Loan Agreement form is a crucial step in securing the necessary funds while ensuring that both parties understand their responsibilities. Take your time to fill out the form accurately, as it will set the stage for a smooth transaction.

- Begin by entering the date at the top of the form. This helps establish the timeline of the agreement.

- Next, fill in the employee’s full name. Make sure to double-check the spelling for accuracy.

- Provide the employee's job title and department. This information is essential for identifying the borrower.

- Input the total loan amount being requested. Be clear and precise about the figures.

- Specify the purpose of the loan. A brief description will suffice, but ensure it is clear.

- Indicate the repayment terms, including the duration and frequency of payments. This section is vital for outlining the expectations.

- Both the employee and the employer must sign the agreement. Make sure that signatures are dated to validate the agreement.

- Lastly, keep a copy of the signed agreement for both parties. This ensures that everyone has access to the terms agreed upon.

By following these steps, you will create a clear and effective Employee Loan Agreement. Ensuring all details are filled out accurately will help prevent misunderstandings in the future.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | An Employee Loan Agreement is a formal document outlining the terms of a loan provided by an employer to an employee. |

| Purpose | This agreement helps clarify the responsibilities of both parties, including repayment terms and interest rates. |

| Repayment Terms | It specifies how and when the employee will repay the loan, often through payroll deductions. |

| Interest Rates | The agreement may include interest rates, which can vary based on company policy and state laws. |

| Governing Law | Each state may have specific laws governing employee loans, such as California's Labor Code or New York's General Obligations Law. |

| Confidentiality | Typically, these agreements include a confidentiality clause to protect both the employer's and employee's information. |

| Default Consequences | It outlines what happens if the employee fails to repay the loan, which could include wage garnishment. |

| Modification Clause | The agreement often contains a clause that allows for modifications, provided both parties agree. |

| Legal Review | It is advisable for both parties to have the agreement reviewed by legal counsel before signing. |

FAQ

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement serves to protect both parties by clearly stating the loan amount, repayment schedule, interest rates, and any other relevant terms.

Why would an employee need a loan from their employer?

Employees may seek loans from their employer for various reasons, such as unexpected medical expenses, home repairs, or educational costs. These loans can be a convenient option, especially if the employee has limited access to traditional lending sources.

What should be included in the Employee Loan Agreement?

An effective Employee Loan Agreement should include the following key components:

- Loan Amount: Specify the total amount being loaned.

- Interest Rate: Clearly state any interest that will be charged on the loan.

- Repayment Schedule: Outline when payments are due and how they will be made.

- Default Terms: Describe what happens if the employee fails to repay the loan.

- Purpose of the Loan: Optionally, include the reason for the loan, if applicable.

How is the repayment process structured?

The repayment process is typically structured to be manageable for the employee. Payments may be deducted directly from the employee's paycheck, or they may make payments through other agreed-upon methods. The agreement should clearly outline the frequency of payments, such as weekly, bi-weekly, or monthly.

Are there any tax implications for the employee?

Yes, there can be tax implications for both the employee and the employer. If the loan is considered a "below-market" loan, the IRS may require the employer to report imputed interest as income. Employees should consult a tax professional to understand their specific situation and any potential tax liabilities.

What happens if the employee leaves the company before repaying the loan?

If an employee leaves the company before fully repaying the loan, the agreement should specify the terms of repayment. Typically, the remaining balance may be due immediately, or the employee may be allowed to continue making payments under a modified schedule. It's essential to address this scenario in the agreement to avoid confusion later.

Can an Employee Loan Agreement be modified?

Yes, an Employee Loan Agreement can be modified if both parties agree to the changes. Any modifications should be documented in writing and signed by both the employer and the employee to ensure clarity and enforceability.

What should an employee do if they cannot make a payment?

If an employee anticipates difficulty in making a payment, it's crucial to communicate with the employer as soon as possible. Many employers are willing to work with employees to adjust the payment schedule or find a temporary solution. Open communication can help prevent misunderstandings and potential default.

Employee Loan Agreement Example

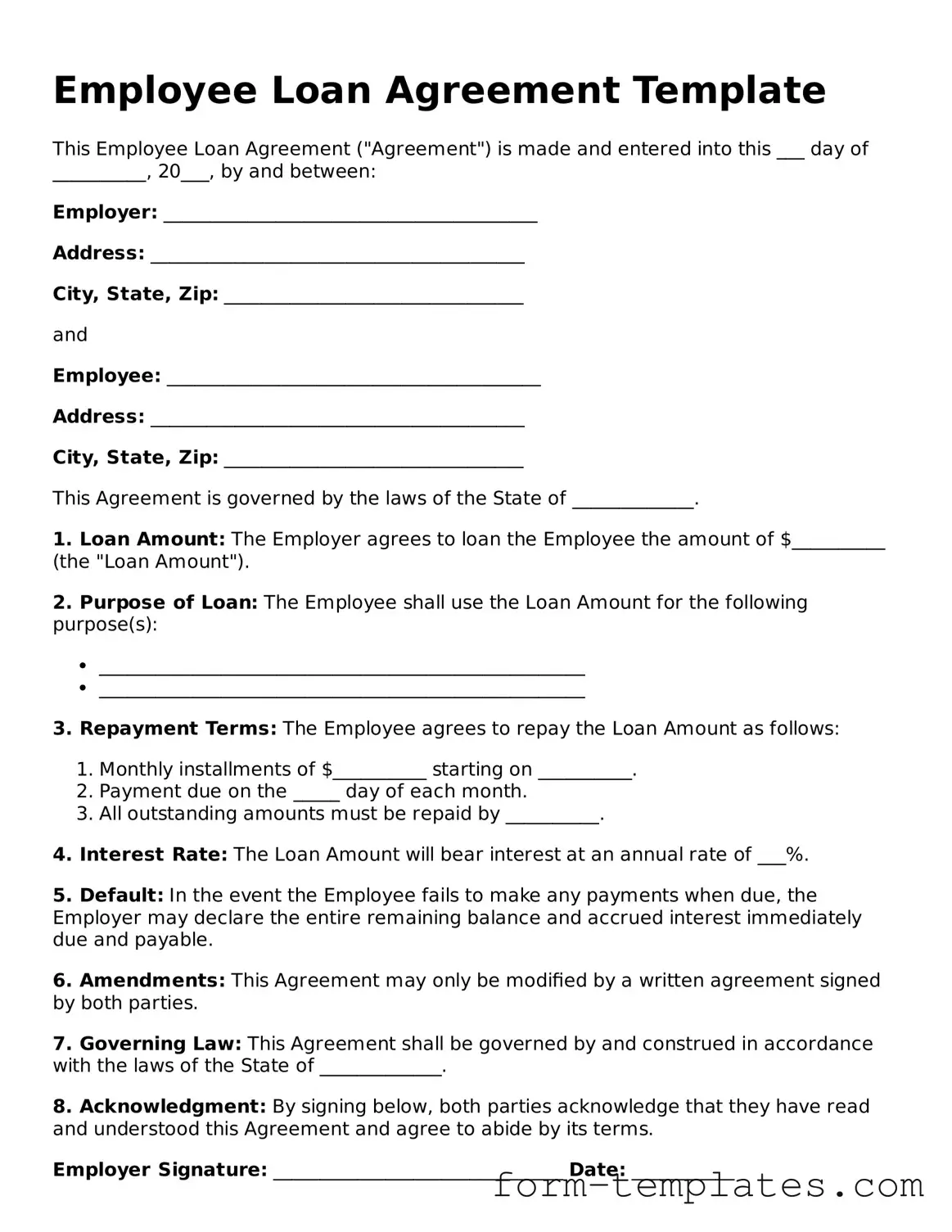

Employee Loan Agreement Template

This Employee Loan Agreement ("Agreement") is made and entered into this ___ day of __________, 20___, by and between:

Employer: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

and

Employee: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

This Agreement is governed by the laws of the State of _____________.

1. Loan Amount: The Employer agrees to loan the Employee the amount of $__________ (the "Loan Amount").

2. Purpose of Loan: The Employee shall use the Loan Amount for the following purpose(s):

- ____________________________________________________

- ____________________________________________________

3. Repayment Terms: The Employee agrees to repay the Loan Amount as follows:

- Monthly installments of $__________ starting on __________.

- Payment due on the _____ day of each month.

- All outstanding amounts must be repaid by __________.

4. Interest Rate: The Loan Amount will bear interest at an annual rate of ___%.

5. Default: In the event the Employee fails to make any payments when due, the Employer may declare the entire remaining balance and accrued interest immediately due and payable.

6. Amendments: This Agreement may only be modified by a written agreement signed by both parties.

7. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of _____________.

8. Acknowledgment: By signing below, both parties acknowledge that they have read and understood this Agreement and agree to abide by its terms.

Employer Signature: _______________________________ Date: ___________

Employee Signature: ______________________________ Date: ___________

This Loan Agreement constitutes the entire agreement between the parties regarding the subject matter herein and supersedes any prior agreements, understandings, or negotiations.