Fill Out a Valid Employee Advance Template

Guide to Writing Employee Advance

Filling out the Employee Advance form is a straightforward process that ensures your request is processed smoothly. By following these steps, you can provide all necessary information clearly and accurately, which will help in getting your advance approved without any delays.

- Begin by entering your full name in the designated space at the top of the form.

- Next, fill in your employee ID number. This is usually provided by your HR department.

- In the following section, indicate the date you are submitting the request.

- Specify the amount you are requesting for the advance. Ensure this amount is within the allowed limits set by your company.

- Provide a brief description of the purpose for the advance. Be clear and concise to help the approver understand your needs.

- If applicable, include any supporting documents that may help justify your request. This could be receipts or quotes.

- Finally, sign and date the form at the bottom to confirm that all information is accurate and that you understand the terms of the advance.

Once you have completed the form, submit it to your supervisor or the designated department for processing. Be sure to keep a copy for your records. This will help you track the request and follow up if necessary.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request funds from an employer to cover expenses incurred during work-related activities. |

| Eligibility | Typically, only employees who have been with the company for a certain period can request an advance. |

| Repayment Terms | Advances are usually deducted from future paychecks, with specific terms outlined in the form. |

| State-Specific Laws | In California, for example, the governing law is the California Labor Code, which outlines the requirements for wage advances. |

| Approval Process | The form must be approved by a supervisor or manager before any funds are disbursed. |

FAQ

What is the Employee Advance form?

The Employee Advance form is a document that employees use to request an advance on their salary or wages. This advance can help cover unexpected expenses or emergencies before the regular payday. The form typically requires details about the amount requested and the reason for the advance.

Who is eligible to request an advance?

Generally, all employees who have been with the company for a specific period may be eligible to request an advance. However, eligibility criteria can vary by organization. It's important to check your company’s policy regarding employee advances to ensure you meet the requirements.

How do I fill out the Employee Advance form?

To complete the Employee Advance form, follow these steps:

- Provide your personal information, including your name, employee ID, and department.

- Specify the amount of the advance you are requesting.

- Explain the reason for your request clearly and concisely.

- Sign and date the form to certify that the information is accurate.

Make sure to review your submission for any errors before handing it in.

What happens after I submit the form?

Once you submit the Employee Advance form, it typically goes through an approval process. Your supervisor or HR department will review your request. You may receive a response within a few days, depending on your company's procedures.

How will I receive the advance amount?

The advance amount is usually provided through your next paycheck or as a separate payment, depending on company policy. Be sure to clarify this with your HR department when you submit your request.

Are there any repayment terms for the advance?

Yes, most companies require employees to repay the advance through deductions from future paychecks. The repayment terms, including the schedule and amount deducted, should be outlined in your company’s policy. It’s essential to understand these terms before accepting the advance.

Can I request an advance more than once?

Many organizations allow multiple requests for advances, but this often depends on the specific policies in place. Frequent requests may raise concerns, so it’s advisable to discuss your situation with HR if you find yourself needing advances regularly.

What if my advance request is denied?

If your advance request is denied, you should receive an explanation as to why. Common reasons include insufficient eligibility or lack of funds. If you believe your request was unjustly denied, consider discussing it with your supervisor or HR department for further clarification or to explore alternative options.

Fill out Other Forms

What Is an Nda Used for - The NCND form safeguards the introduction process, vital in the competitive landscape of business transactions.

Power of Attorney Fl - This form can help avoid complications if you’re unable to be physically present for a vehicle-related transaction.

For those navigating the complexities of workplace policies, the Arizona Employee Handbook form provides invaluable insights and guidelines. To gain a deeper understanding, consider exploring how this critical Employee Handbook document can assist in establishing clear expectations within your organization.

S Corp Stands for - Form 2553 may help in attracting investors interested in S Corporations.

Employee Advance Example

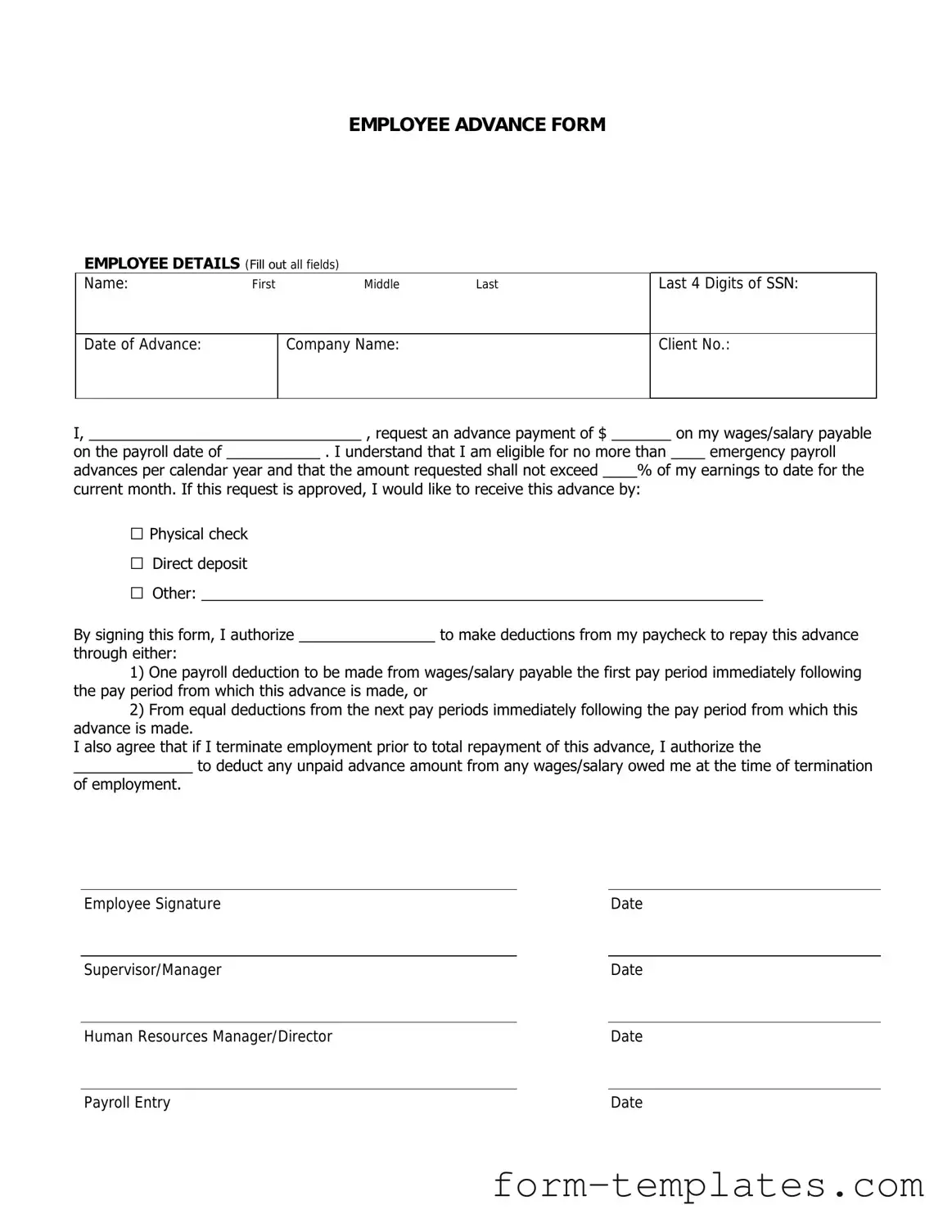

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |