Attorney-Approved Deed of Trust Document

Guide to Writing Deed of Trust

After you have gathered all necessary information, you are ready to complete the Deed of Trust form. This document will require specific details about the parties involved and the property in question. Take your time to ensure accuracy, as this will help avoid complications later on.

- Begin by entering the date at the top of the form.

- Identify the borrower. Write the full legal name of the borrower in the designated space.

- Next, provide the lender's information. Include the full legal name of the lender as it appears on their official documents.

- Fill in the property details. This includes the address of the property being secured by the Deed of Trust.

- Specify the loan amount. Write the total amount of the loan that the borrower is taking out.

- List any additional terms. If there are specific conditions or agreements related to the loan, include them in this section.

- Sign the form. The borrower must sign and date the document to make it valid.

- Have the form notarized. A notary public must witness the signature and provide their seal.

- Submit the completed form. File it with the appropriate local government office to ensure it is recorded properly.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of the property to a trustee until the loan is repaid. |

| Parties Involved | It typically involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Purpose | The primary purpose is to protect the lender's interest in the property until the borrower fulfills their loan obligations. |

| State Variations | Each state may have specific requirements and forms for Deeds of Trust, governed by state law. |

| Foreclosure Process | In most states, a Deed of Trust allows for a non-judicial foreclosure process, which can be quicker than judicial foreclosure. |

| Power of Sale Clause | This clause in a Deed of Trust allows the trustee to sell the property to satisfy the debt if the borrower defaults. |

| Recording Requirement | To be enforceable against third parties, a Deed of Trust must be recorded in the county where the property is located. |

| Differences from Mortgages | Unlike a mortgage, a Deed of Trust involves a third party (the trustee) and often provides a simpler foreclosure process. |

| Governing Law | The governing laws for Deeds of Trust vary by state, with each having its own statutes that outline the process and requirements. |

FAQ

- The names of the parties involved (borrower, lender, and trustee)

- A description of the property being secured

- The amount of the loan

- The terms of repayment

- Conditions under which the lender can initiate foreclosure

- Streamlined foreclosure process compared to a mortgage

- Clear assignment of rights and responsibilities among parties

- Potentially lower interest rates due to reduced risk for lenders

What is a Deed of Trust?

A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee. This document is commonly used in real estate transactions to ensure that the lender has a claim to the property if the borrower defaults on the loan.

How does a Deed of Trust work?

When a borrower takes out a loan to purchase a property, they sign a Deed of Trust. This document involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. The borrower transfers the property title to the trustee, who holds it until the loan is paid off. If the borrower defaults, the trustee has the authority to sell the property to repay the lender.

What are the key components of a Deed of Trust?

A Deed of Trust typically includes the following components:

Is a Deed of Trust the same as a mortgage?

No, a Deed of Trust and a mortgage serve similar purposes but are not the same. A mortgage involves only two parties: the borrower and the lender. In contrast, a Deed of Trust involves three parties, which allows for a more streamlined foreclosure process. This difference can affect how quickly and efficiently a lender can reclaim the property in case of default.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender can initiate a foreclosure process. The trustee will then sell the property, usually at a public auction, to recover the outstanding loan amount. The specific procedures and timelines for foreclosure vary by state, so it's important to understand the laws in your jurisdiction.

Can a Deed of Trust be refinanced?

Yes, a Deed of Trust can be refinanced. When refinancing, a new loan replaces the existing one, and a new Deed of Trust is executed. The borrower must go through the refinancing process, which may include credit checks and appraisals, just as they did with the original loan.

How is a Deed of Trust recorded?

A Deed of Trust is recorded with the county recorder’s office where the property is located. Recording the document provides public notice of the lender's interest in the property. This step is crucial for protecting the lender's rights and establishing priority over other potential claims against the property.

What are the benefits of using a Deed of Trust?

Using a Deed of Trust offers several benefits, including:

Can a borrower challenge a Deed of Trust?

Yes, a borrower can challenge a Deed of Trust under certain circumstances. Common reasons for challenges include fraud, misrepresentation, or failure to comply with state laws. If a borrower believes they have a valid claim, it is advisable to consult with a legal professional for guidance.

What should I do if I have questions about my Deed of Trust?

If you have questions about your Deed of Trust, it is best to consult with a qualified attorney who specializes in real estate law. They can provide personalized advice based on your specific situation and help you understand your rights and obligations.

Other Deed of Trust Templates:

Correction Deed Form California - In situations of mistaken identity or attribution, this form is essential.

For those considering a property transfer in Texas, understanding the Quitclaim Deed is essential, as it is a legal document that allows a property owner to transfer their ownership interest in a property to another party, as explained in greater detail at https://topformsonline.com/texas-quitclaim-deed. This form does not guarantee that the property title is free of liens or other claims; instead, it conveys whatever interest the grantor has at the time of the transfer. Often used among family members or in situations where a full title search is not required, it is a straightforward way to change property ownership.

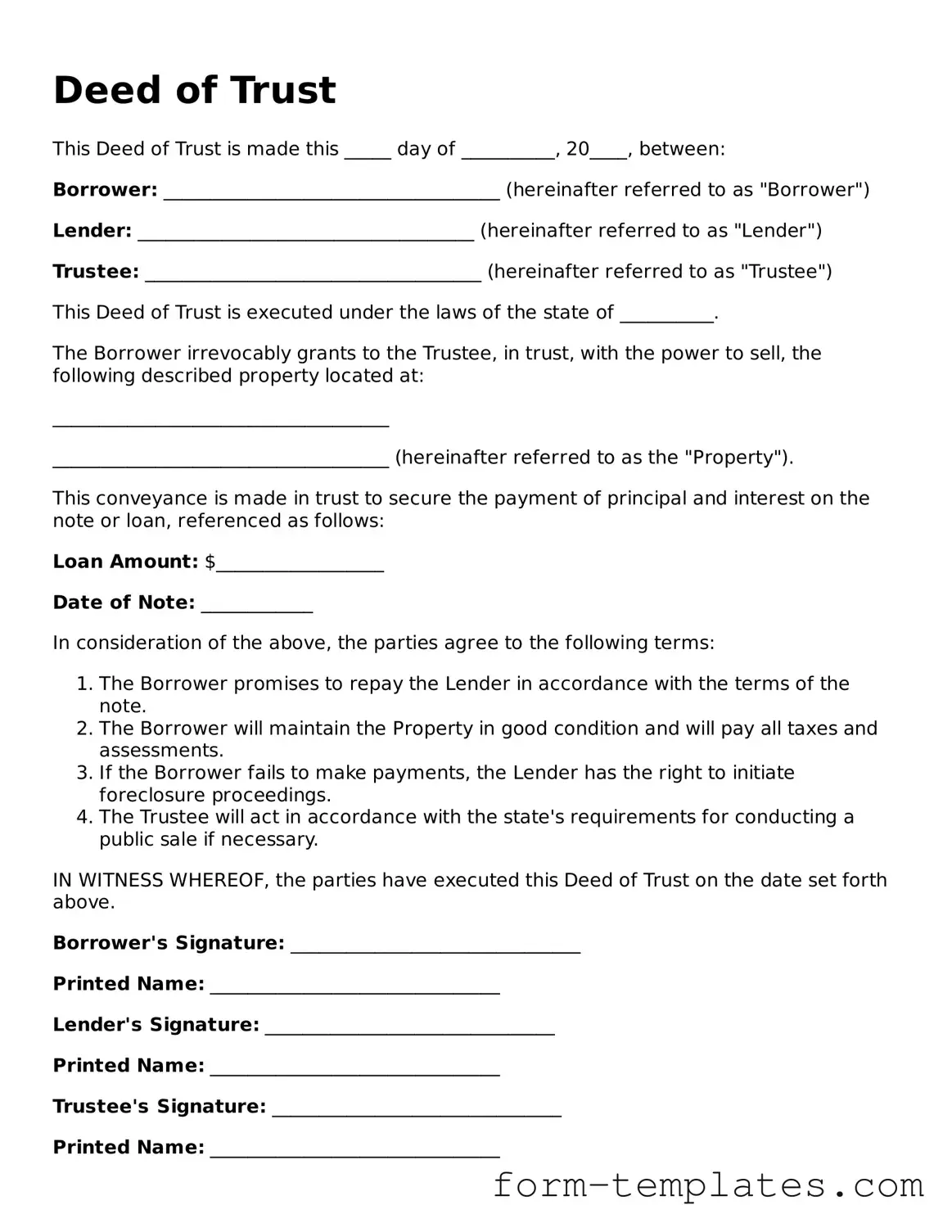

Deed of Trust Example

Deed of Trust

This Deed of Trust is made this _____ day of __________, 20____, between:

Borrower: ____________________________________ (hereinafter referred to as "Borrower")

Lender: ____________________________________ (hereinafter referred to as "Lender")

Trustee: ____________________________________ (hereinafter referred to as "Trustee")

This Deed of Trust is executed under the laws of the state of __________.

The Borrower irrevocably grants to the Trustee, in trust, with the power to sell, the following described property located at:

____________________________________

____________________________________ (hereinafter referred to as the "Property").

This conveyance is made in trust to secure the payment of principal and interest on the note or loan, referenced as follows:

Loan Amount: $__________________

Date of Note: ____________

In consideration of the above, the parties agree to the following terms:

- The Borrower promises to repay the Lender in accordance with the terms of the note.

- The Borrower will maintain the Property in good condition and will pay all taxes and assessments.

- If the Borrower fails to make payments, the Lender has the right to initiate foreclosure proceedings.

- The Trustee will act in accordance with the state's requirements for conducting a public sale if necessary.

IN WITNESS WHEREOF, the parties have executed this Deed of Trust on the date set forth above.

Borrower's Signature: _______________________________

Printed Name: _______________________________

Lender's Signature: _______________________________

Printed Name: _______________________________

Trustee's Signature: _______________________________

Printed Name: _______________________________

STATE OF __________

COUNTY OF ______________

Subscribed and sworn to before me this _____ day of __________, 20____.

Notary Public: _______________________________

My Commission Expires: ______________________