Attorney-Approved Deed in Lieu of Foreclosure Document

Guide to Writing Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. This step is crucial, as it initiates the process of transferring the property back to the lender in exchange for the cancellation of your mortgage debt. Ensure that you keep copies of all documents for your records.

- Begin by obtaining the Deed in Lieu of Foreclosure form from your lender or a legal resource.

- Fill in the property address. This should be the exact location of the property involved in the foreclosure.

- Provide your name and any co-owners' names as they appear on the mortgage documents.

- Include the lender's name and contact information. This is typically found on your mortgage statement.

- State the date of the transfer. This should be the date you are signing the document.

- Clearly describe the property. Include details such as the legal description and any identifying information like parcel numbers.

- Sign the form in the designated area. If there are co-owners, they should also sign.

- Have the form notarized. This adds an extra layer of authenticity to the document.

- Make copies of the signed and notarized form for your records.

- Submit the completed form to your lender. Ensure you follow any specific submission guidelines they may have.

Deed in Lieu of ForeclosureDocuments for Specific US States

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Process | The borrower must negotiate with the lender to agree on the terms, including any potential forgiveness of remaining debt. |

| Benefits | This option can be less damaging to a borrower's credit score compared to a foreclosure and may allow for a quicker resolution. |

| State-Specific Laws | In California, for example, the governing law is found in the California Civil Code, Sections 2924-2924k. |

| Potential Drawbacks | Borrowers may still be responsible for any deficiency balance unless explicitly forgiven by the lender. |

FAQ

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement in which a homeowner voluntarily transfers the ownership of their property to the lender to avoid the foreclosure process. This option can be beneficial for both parties, as it allows the homeowner to avoid the negative consequences of foreclosure while providing the lender with a quicker resolution to recover their investment.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility can vary by lender, but generally, homeowners facing financial difficulties that make it hard to keep up with mortgage payments may qualify. Typically, lenders look for the following:

- The homeowner must be in default or at risk of defaulting on their mortgage.

- The property must be in good condition and free of significant liens.

- The homeowner should have attempted other alternatives, such as loan modification or short sale.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to this option:

- It can help the homeowner avoid the lengthy and stressful foreclosure process.

- The homeowner may be able to negotiate a more favorable outcome, such as debt forgiveness.

- It can have a less severe impact on the homeowner's credit score compared to foreclosure.

- The lender can quickly take possession of the property and resell it, which can minimize their losses.

What are the potential downsides of a Deed in Lieu of Foreclosure?

While there are benefits, there are also some drawbacks to consider:

- The homeowner may still be liable for any remaining mortgage balance if the property sells for less than the owed amount.

- There may be tax implications, as forgiven debt can sometimes be considered taxable income.

- The homeowner will lose their home and any equity they may have built up.

How does the process work?

The process typically involves several steps:

- The homeowner contacts their lender to express interest in a Deed in Lieu of Foreclosure.

- The lender reviews the homeowner's financial situation and property condition.

- If approved, the homeowner signs the deed, transferring ownership to the lender.

- Finally, the lender records the deed, and the homeowner vacates the property.

Can I still get a mortgage after a Deed in Lieu of Foreclosure?

Yes, it is possible to obtain a mortgage after a Deed in Lieu of Foreclosure, but it may take some time. Lenders typically view this option more favorably than foreclosure, but it can still impact your credit score. Generally, waiting periods can range from two to four years before qualifying for a new mortgage, depending on the lender and specific circumstances.

Will I need legal assistance to complete a Deed in Lieu of Foreclosure?

While it is not mandatory to have legal assistance, it is highly recommended. An attorney can help navigate the complexities of the process, ensure that all paperwork is correctly filled out, and protect your interests throughout the transaction.

How can I find out if a Deed in Lieu of Foreclosure is right for me?

To determine if this option is suitable, consider your financial situation, the condition of your property, and your long-term goals. Speaking with a financial advisor or a housing counselor can provide valuable insights. They can help you weigh the pros and cons and explore other alternatives that may be available to you.

Other Deed in Lieu of Foreclosure Templates:

Quick Title Deed - Both parties should seek confirmation of property value before signing.

Lady Bird Johnson Deed - This deed encourages proactive planning, helping families avoid unnecessary legal complications later.

The CID Name Check Request form is a document used to request a background check on an individual by law enforcement officials. It facilitates the accurate identification of individuals through their personal information, including social security numbers. This form is essential for commanders and law enforcement to ensure thorough investigations and maintain security within military operations. For a useful resource, you can refer to the Blank Check Template to assist with the process.

Property Gift Deed Rules - Utilizing a Gift Deed can simplify the gifting process by clearly documenting the property transfer.

Deed in Lieu of Foreclosure Example

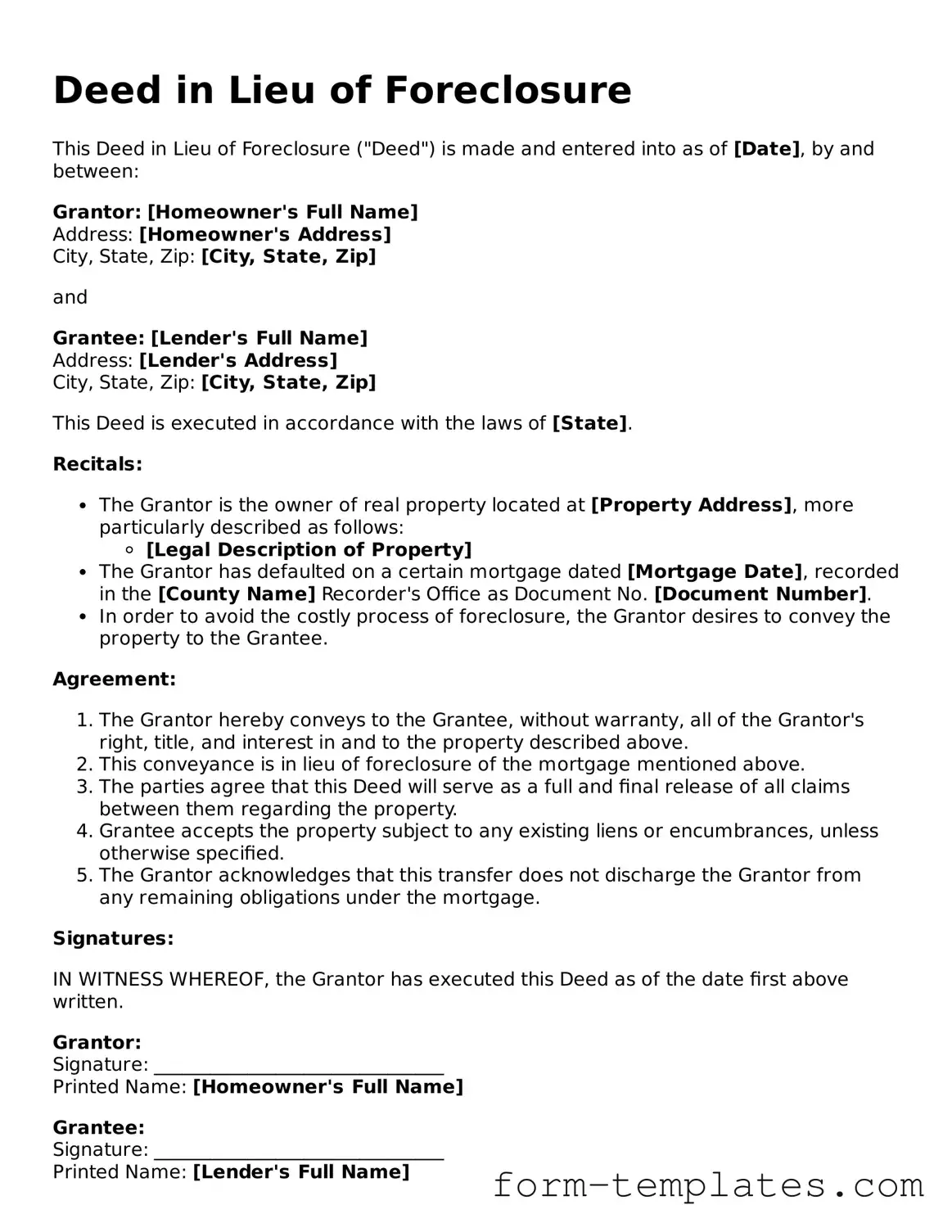

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure ("Deed") is made and entered into as of [Date], by and between:

Grantor: [Homeowner's Full Name]

Address: [Homeowner's Address]

City, State, Zip: [City, State, Zip]

and

Grantee: [Lender's Full Name]

Address: [Lender's Address]

City, State, Zip: [City, State, Zip]

This Deed is executed in accordance with the laws of [State].

Recitals:

- The Grantor is the owner of real property located at [Property Address], more particularly described as follows:

- [Legal Description of Property]

- The Grantor has defaulted on a certain mortgage dated [Mortgage Date], recorded in the [County Name] Recorder's Office as Document No. [Document Number].

- In order to avoid the costly process of foreclosure, the Grantor desires to convey the property to the Grantee.

Agreement:

- The Grantor hereby conveys to the Grantee, without warranty, all of the Grantor's right, title, and interest in and to the property described above.

- This conveyance is in lieu of foreclosure of the mortgage mentioned above.

- The parties agree that this Deed will serve as a full and final release of all claims between them regarding the property.

- Grantee accepts the property subject to any existing liens or encumbrances, unless otherwise specified.

- The Grantor acknowledges that this transfer does not discharge the Grantor from any remaining obligations under the mortgage.

Signatures:

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the date first above written.

Grantor:

Signature: _______________________________

Printed Name: [Homeowner's Full Name]

Grantee:

Signature: _______________________________

Printed Name: [Lender's Full Name]

This document may need to be notarized, depending on state requirements.