Fill Out a Valid Cash Receipt Template

Guide to Writing Cash Receipt

After gathering all necessary information, you are ready to complete the Cash Receipt form. This form is essential for documenting cash transactions accurately. Follow the steps below to ensure that all required information is filled out correctly.

- Start with the date. Write the current date in the designated space at the top of the form.

- Enter the name of the person or organization making the payment. This should be clearly stated in the "Payee" section.

- In the "Amount Received" section, write the total cash amount received. Be sure to include both dollars and cents.

- Specify the method of payment. Indicate whether it was cash, check, or another form of payment in the provided area.

- If applicable, write the check number in the designated field. This is important for tracking purposes.

- Provide a brief description of the purpose of the payment. This helps clarify the transaction for future reference.

- Sign the form in the "Received By" section. This confirms that you have received the payment.

- Finally, make a copy of the completed form for your records before submitting it.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments, ensuring accurate record-keeping for financial transactions. |

| Components | This form typically includes details such as the date of the transaction, amount received, payer's name, and purpose of payment. |

| Importance | It serves as proof of payment for both the payer and the recipient, which can be crucial for audits and financial reviews. |

| Governing Laws | In many states, cash receipt documentation is governed by the Uniform Commercial Code (UCC) and state-specific financial regulations. |

| Retention Period | Organizations are typically advised to retain cash receipt forms for a minimum of seven years for tax and audit purposes. |

FAQ

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. This form helps businesses keep track of money received from customers or clients. It typically includes important details such as the date of the transaction, the amount received, the purpose of the payment, and the name of the payer. By maintaining accurate records, businesses can ensure proper accounting and financial management.

When should I use a Cash Receipt form?

A Cash Receipt form should be used whenever cash is received for goods or services. This can include payments made in person, by mail, or electronically. It is important to document these transactions to maintain accurate financial records. Some common scenarios for using this form include:

- Payments made by customers for products sold.

- Deposits received for services rendered.

- Cash donations or contributions to an organization.

What information is typically included on a Cash Receipt form?

A Cash Receipt form generally contains several key pieces of information to ensure clarity and accuracy. The following details are often included:

- Date of the transaction.

- Name of the payer.

- Amount of cash received.

- Purpose of the payment.

- Signature of the person receiving the cash.

This information helps both the payer and the recipient maintain clear records of the transaction.

How should I store completed Cash Receipt forms?

Completed Cash Receipt forms should be stored securely to protect sensitive financial information. It is advisable to keep both physical and electronic copies. For physical forms, consider using a locked filing cabinet. For electronic forms, ensure they are saved in a secure location with restricted access. Regularly back up electronic files to prevent loss of important data.

Can a Cash Receipt form be used for electronic payments?

Yes, a Cash Receipt form can also be adapted for electronic payments. While cash payments are straightforward, electronic payments such as credit card transactions or bank transfers can be documented using the same form. In these cases, it is important to note the payment method clearly and include any transaction reference numbers for tracking purposes.

What should I do if I make a mistake on a Cash Receipt form?

If a mistake is made on a Cash Receipt form, it is important to correct it promptly. The best practice is to draw a single line through the error, write the correct information next to it, and initial the correction. This ensures that the original entry is still visible, which can be important for record-keeping. In some cases, it may be necessary to issue a new form altogether, especially if the error is significant.

Fill out Other Forms

S Corp Stands for - File this form to avoid double taxation on corporate earnings.

Medicare and Social Security - The CMS-1763 can lead to a more tailored health insurance experience.

For individuals navigating the process of buying or selling a mobile home, our resource can guide you through the essential Mobile Home Bill of Sale documentation you need. This ensures that all key information is properly captured and recorded for your protection during the transaction. To access the form, visit the Arizona Mobile Home Bill of Sale resource.

Tb Clearance Form California - Using the right format supports clear communication.

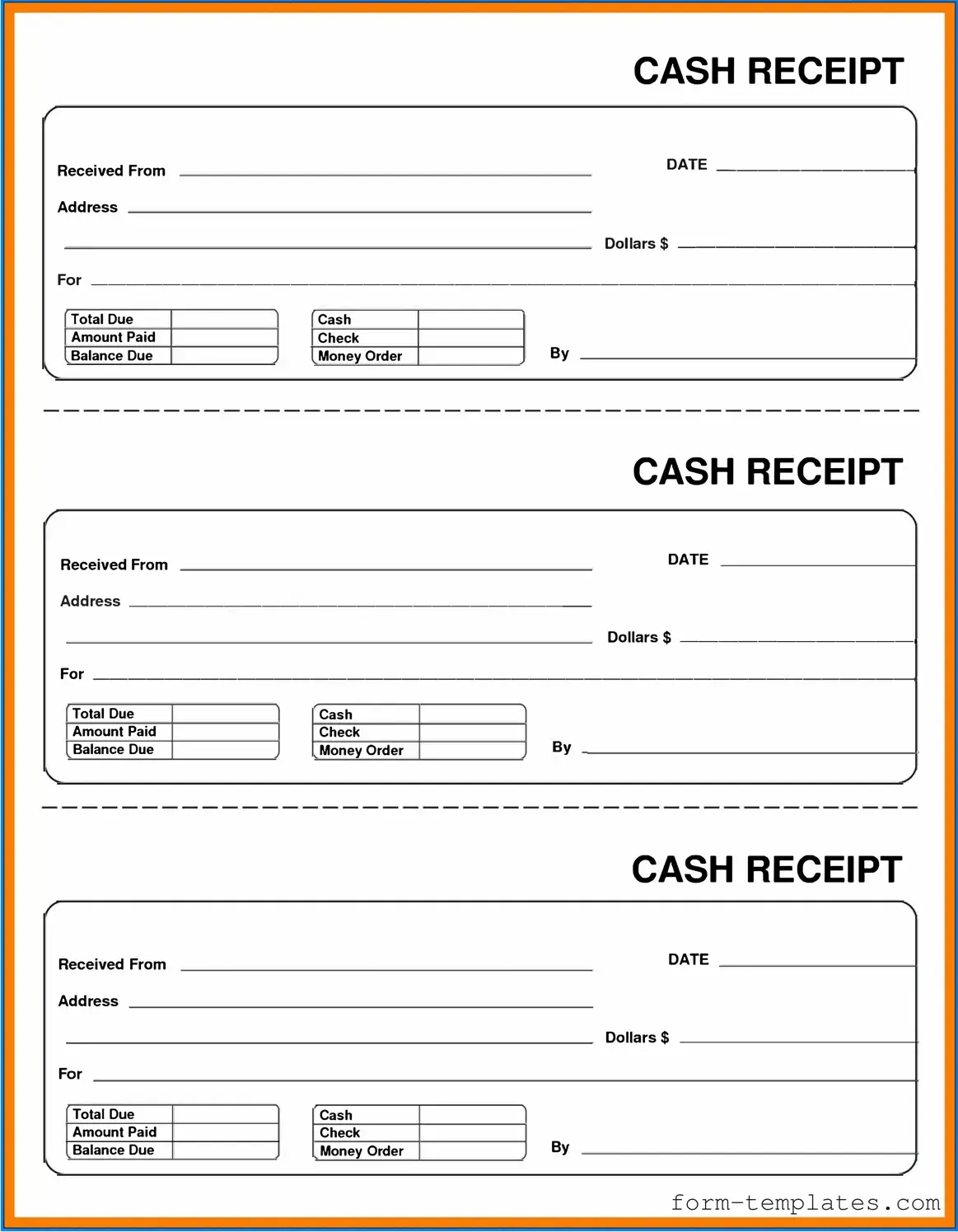

Cash Receipt Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By