Fill Out a Valid Cash Drawer Count Sheet Template

Guide to Writing Cash Drawer Count Sheet

After gathering your cash drawer and ensuring you have all necessary materials, you are ready to fill out the Cash Drawer Count Sheet. This form will help you accurately record the amount of cash in your drawer, ensuring accountability and accuracy for your financial records.

- Begin by writing the date at the top of the form. This helps keep track of when the count was performed.

- In the designated area, enter your name or the name of the person conducting the count.

- Count all the cash in the drawer. This includes bills and coins. Be thorough to ensure accuracy.

- Record the total amount of cash counted in the appropriate box on the form.

- If there are any discrepancies, note them down in the comments section. This could include reasons for shortfalls or overages.

- Sign the form at the bottom to verify that the count is accurate.

- Submit the completed form to your supervisor or the designated person for review.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the cash on hand in a cash drawer at the end of a business day or shift. |

| Importance | This form helps businesses track cash flow and ensures that the amount of cash in the drawer matches sales records. |

| Frequency of Use | Typically, the Cash Drawer Count Sheet is filled out daily, but it can also be used at the end of shifts or during cash audits. |

| Components | The form generally includes fields for the date, starting cash amount, total sales, cash collected, and cash remaining. |

| Record Keeping | It is essential to keep these sheets for accounting purposes and for reconciling discrepancies that may arise. |

| Governing Laws | While there are no specific federal laws governing cash drawer counts, state regulations may apply to record-keeping practices in businesses. |

FAQ

What is the Cash Drawer Count Sheet form?

The Cash Drawer Count Sheet form is a tool used by businesses to track the cash in their drawers at the end of a shift or business day. It helps ensure that the amount of cash on hand matches the sales recorded during that period.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons:

- It helps identify discrepancies between sales and cash on hand.

- It aids in preventing theft and fraud by providing a clear record of cash transactions.

- It assists in managing cash flow effectively.

How do I fill out the Cash Drawer Count Sheet?

To complete the Cash Drawer Count Sheet, follow these steps:

- Start by entering the date and your name or employee ID.

- Count the cash in the drawer, including bills and coins.

- Record the amounts in the designated fields for each denomination.

- Calculate the total cash and write it in the appropriate section.

- Sign and date the form to confirm accuracy.

Who is responsible for completing the Cash Drawer Count Sheet?

The responsibility typically falls on the employee who is closing out the cash drawer. However, management may also review the form to ensure accuracy and compliance with company policies.

What should I do if I find a discrepancy?

If you discover a discrepancy between the cash on hand and the recorded sales, take the following steps:

- Double-check your count to ensure accuracy.

- Review the sales records for any missed transactions.

- Report the discrepancy to your supervisor immediately for further investigation.

How often should the Cash Drawer Count Sheet be completed?

The Cash Drawer Count Sheet should be completed at the end of each shift or business day. Regular counting helps maintain accurate records and reduces the risk of larger discrepancies over time.

Can the Cash Drawer Count Sheet be used for multiple cash drawers?

Yes, the Cash Drawer Count Sheet can be adapted for multiple cash drawers. Simply create separate sections for each drawer, ensuring that all cash is accounted for and properly recorded.

Where should I store completed Cash Drawer Count Sheets?

Completed Cash Drawer Count Sheets should be stored securely, either in a physical file or digitally. This ensures easy access for audits and helps maintain a clear record of cash handling practices.

Fill out Other Forms

Printable Trucking Company Owner Operator Lease Agreement Form Pdf - Owner Operators must maintain records of deliveries for inspection by the Carrier or associated parties for a minimum of two years.

To navigate the complexities of divorce proceedings, understanding the role of the important Marital Separation Agreement form is crucial. This document ensures that all parties have a clear outline of their responsibilities and entitlements.

USCIS Form I-864 - It must be signed under penalty of perjury by the sponsor.

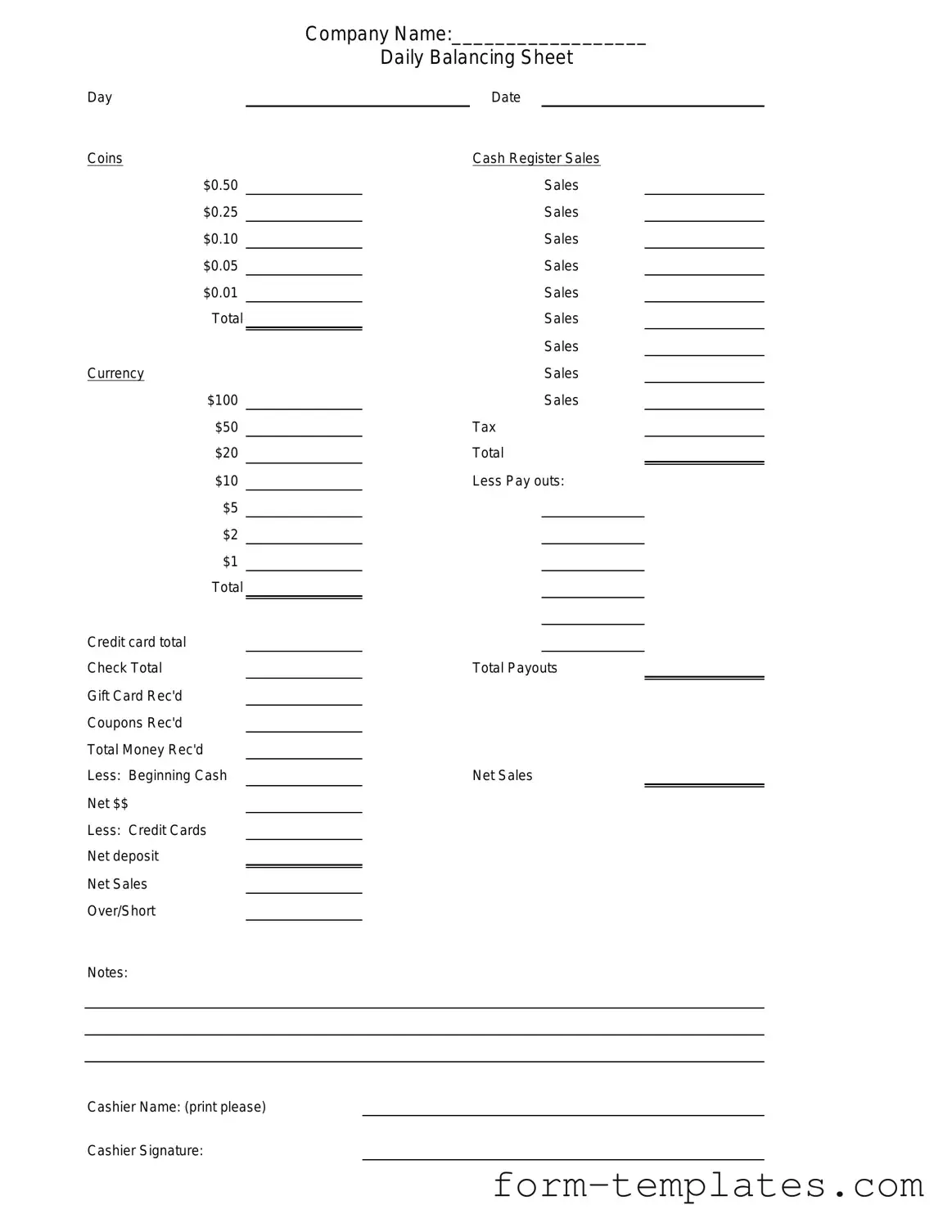

Cash Drawer Count Sheet Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature: