Printable Transfer-on-Death Deed Form for the State of California

Guide to Writing California Transfer-on-Death Deed

Filling out the California Transfer-on-Death Deed form requires careful attention to detail. Once completed, this form will allow you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Here are the steps to fill out the form correctly.

- Obtain the Form: Download the California Transfer-on-Death Deed form from the official state website or obtain a hard copy from a legal stationery store.

- Property Description: Clearly describe the property you wish to transfer. Include the address and any legal descriptions, such as parcel numbers, if applicable.

- Owner Information: Fill in your full name as the current owner of the property. If there are multiple owners, include all names.

- Beneficiary Information: Provide the full name of the beneficiary who will receive the property. Include their address and relationship to you.

- Sign the Form: Sign and date the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the form notarized. The notary will verify your identity and witness your signature.

- Record the Deed: Submit the completed and notarized form to the county recorder's office where the property is located. There may be a recording fee.

After recording the deed, it is advisable to keep a copy for your records. Ensure that your beneficiary is aware of the transfer and has access to the necessary documents when the time comes.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Section 5600-5694. |

| Revocation | Property owners can revoke the deed at any time before their death by recording a revocation form with the county recorder. |

| Beneficiary Requirements | Beneficiaries must be individuals or entities, and they must be clearly identified in the deed to ensure the transfer occurs as intended. |

FAQ

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TODD) allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. This deed is a simple way to ensure that your property passes directly to your chosen heirs, streamlining the transfer process and potentially saving time and costs associated with probate proceedings.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in California can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, it is important that the property owner is of sound mind and acts voluntarily when executing the deed. Additionally, the deed must be properly recorded to be effective.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these steps:

- Obtain the appropriate form, which is available through legal websites or local government offices.

- Complete the form by providing details such as the property description and the names of the beneficiaries.

- Sign the deed in the presence of a notary public.

- Record the deed with the county recorder’s office where the property is located.

It is advisable to consult with an attorney to ensure that the deed meets all legal requirements and accurately reflects your intentions.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. To revoke the deed, the owner must execute a new deed that explicitly states the revocation or record a formal revocation document with the county recorder’s office. Properly documenting the revocation is crucial to avoid confusion about the intended beneficiaries.

What happens if I do not name a beneficiary?

If a Transfer-on-Death Deed does not name a beneficiary, the property will not transfer as intended. Instead, it will become part of the property owner's estate and will be subject to probate. To prevent this outcome, ensure that beneficiaries are clearly named in the deed and that the document is properly executed and recorded.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, property transferred through a Transfer-on-Death Deed does not trigger immediate tax consequences for the beneficiaries. However, the property will receive a step-up in basis, meaning that its value will be adjusted to the fair market value at the time of the owner's death. This can reduce capital gains taxes if the beneficiaries decide to sell the property later. It is recommended to consult a tax professional for personalized advice regarding your situation.

Is a Transfer-on-Death Deed the right choice for everyone?

While a Transfer-on-Death Deed offers many benefits, it may not be suitable for everyone. Individuals with complex estates, multiple properties, or specific wishes regarding property distribution may find other estate planning tools, such as trusts, more appropriate. Each situation is unique, so it is wise to evaluate personal circumstances and consult with an estate planning attorney to determine the best approach.

Consider Popular Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Florida Form - Every state has its own rules regarding how these deeds must be formatted.

How to Avoid Probate in Pa - A Transfer-on-Death Deed allows property owners to designate a beneficiary to receive their property upon death.

To successfully create a corporation, it is important to complete the Florida Articles of Incorporation form, which is a legal document that outlines vital information such as the corporation's name, purpose, and initial directors. For more information, you can access the fillable form at https://floridadocuments.net/fillable-articles-of-incorporation-form, making the process simpler for those looking to establish a business entity in Florida.

Where Can I Get a Tod Form - Provides a designated process for property transfer, reducing uncertainty.

Texas Lady Bird Deed Form - This deed simplifies the inheritance process, enabling a smoother transition of property ownership without court involvement.

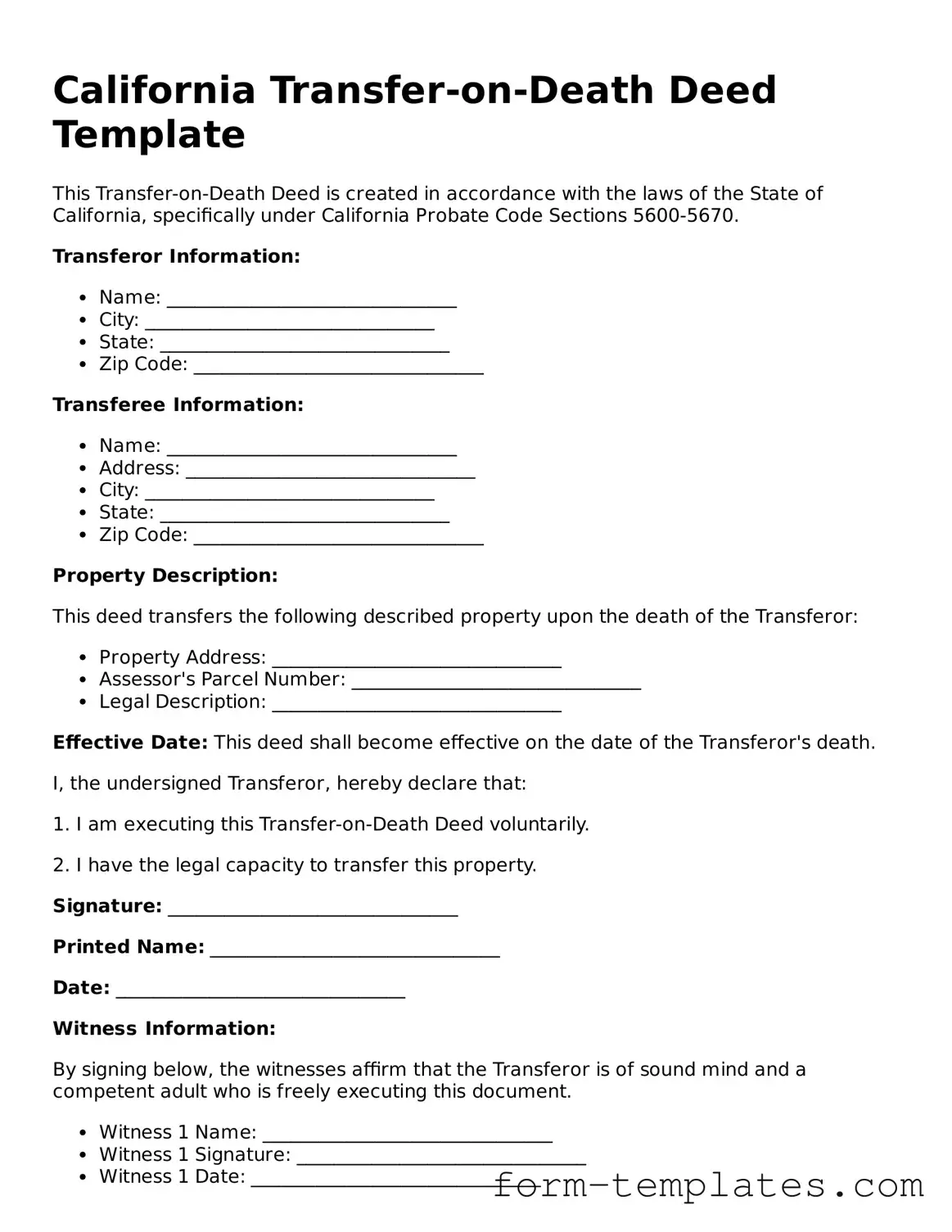

California Transfer-on-Death Deed Example

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the laws of the State of California, specifically under California Probate Code Sections 5600-5670.

Transferor Information:

- Name: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: _______________________________

Transferee Information:

- Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: _______________________________

- Zip Code: _______________________________

Property Description:

This deed transfers the following described property upon the death of the Transferor:

- Property Address: _______________________________

- Assessor's Parcel Number: _______________________________

- Legal Description: _______________________________

Effective Date: This deed shall become effective on the date of the Transferor's death.

I, the undersigned Transferor, hereby declare that:

1. I am executing this Transfer-on-Death Deed voluntarily.

2. I have the legal capacity to transfer this property.

Signature: _______________________________

Printed Name: _______________________________

Date: _______________________________

Witness Information:

By signing below, the witnesses affirm that the Transferor is of sound mind and a competent adult who is freely executing this document.

- Witness 1 Name: _______________________________

- Witness 1 Signature: _______________________________

- Witness 1 Date: _______________________________

- Witness 2 Name: _______________________________

- Witness 2 Signature: _______________________________

- Witness 2 Date: _______________________________

After execution, please file this deed with the county recorder where the property is located to ensure the transfer is recognized upon the death of the Transferor.