Printable Tractor Bill of Sale Form for the State of California

Guide to Writing California Tractor Bill of Sale

After obtaining the California Tractor Bill of Sale form, you will need to provide specific information to ensure a smooth transaction. This document serves as a record of the sale and includes essential details about the buyer, seller, and the tractor being sold. Follow the steps below to complete the form accurately.

- Enter the date: Write the date of the sale at the top of the form.

- Provide seller information: Fill in the seller's full name, address, and contact information.

- Provide buyer information: Fill in the buyer's full name, address, and contact information.

- Describe the tractor: Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price: Write the agreed-upon sale price for the tractor.

- Signatures: Both the seller and buyer must sign and date the form to validate the transaction.

Once you have filled out the form completely, ensure that both parties retain a copy for their records. This document will be crucial for future reference, especially for registration and ownership verification.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale form serves as a legal document to transfer ownership of a tractor from one party to another. |

| Governing Law | The sale of tractors in California is governed by the California Vehicle Code. |

| Required Information | The form must include details such as the buyer's and seller's names, addresses, and signatures. |

| Vehicle Identification | It is essential to provide the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Sales Price | The sales price of the tractor must be clearly stated in the document. |

| Notarization | While notarization is not mandatory, it can add an extra layer of authenticity to the transaction. |

| Use for Registration | The completed bill of sale can be used for registering the tractor with the California Department of Motor Vehicles (DMV). |

| Retention | Both the buyer and seller should keep a copy of the bill of sale for their records. |

FAQ

What is a California Tractor Bill of Sale?

A California Tractor Bill of Sale is a legal document that records the sale of a tractor between a buyer and a seller. This form serves as proof of the transaction and outlines essential details such as the purchase price, vehicle identification number (VIN), and the names and addresses of both parties involved. It is important for both the buyer and seller to retain a copy of this document for their records.

Is a Tractor Bill of Sale required in California?

While a Tractor Bill of Sale is not legally required in California, it is highly recommended. This document provides evidence of the transaction and can be useful for tax purposes, registration, and any future disputes. Having a signed bill of sale can protect both parties by clearly outlining the terms of the sale.

What information should be included in the Tractor Bill of Sale?

A comprehensive Tractor Bill of Sale should include the following information:

- Full names and addresses of the buyer and seller

- Date of the transaction

- Description of the tractor, including make, model, year, and VIN

- Purchase price

- Odometer reading at the time of sale (if applicable)

- Signatures of both the buyer and seller

Can I create my own Tractor Bill of Sale?

Yes, you can create your own Tractor Bill of Sale. It is important to ensure that all required information is included to make the document valid. Templates are available online, but customizing the document to fit your specific transaction is advisable. This customization can help avoid any misunderstandings later on.

How does a Tractor Bill of Sale affect registration?

The Tractor Bill of Sale is an important document for registering the tractor with the California Department of Motor Vehicles (DMV). When registering the vehicle, the buyer will typically need to provide the bill of sale along with other documents, such as proof of ownership and identification. This helps the DMV verify the transaction and update their records accordingly.

What if there are issues after the sale?

If issues arise after the sale, the Tractor Bill of Sale can serve as a key piece of evidence. It outlines the agreed-upon terms and conditions of the sale. If disputes occur regarding the condition of the tractor or payment terms, having a signed bill of sale can facilitate resolution. It is recommended to keep all related documents organized for reference.

Are there any fees associated with the Tractor Bill of Sale?

There are generally no fees specifically associated with creating a Tractor Bill of Sale. However, fees may apply when registering the tractor with the DMV. These fees can vary based on the vehicle's value and other factors. It is advisable to check with the DMV for the most accurate information regarding registration fees.

Can the Tractor Bill of Sale be used for other types of vehicles?

While the Tractor Bill of Sale is specifically designed for tractors, similar forms can be used for other types of vehicles. The essential elements remain the same, including the identification of the buyer and seller, vehicle details, and purchase price. However, it is recommended to use the appropriate form for different vehicle types to ensure compliance with state regulations.

How can I ensure the Tractor Bill of Sale is valid?

To ensure the Tractor Bill of Sale is valid, both parties should sign the document, and it is advisable to have it notarized. Notarization adds an extra layer of authenticity and can help prevent disputes regarding the validity of the signatures. Additionally, retaining copies of the bill of sale is essential for both parties.

Consider Popular Tractor Bill of Sale Forms for Specific States

Farm Tractor Bill of Sale - Encourages proper documentation in agricultural business practices.

In order to simplify your financial tracking, utilizing resources like the Blank Check Template can enhance your ability to maintain an organized Check Register form, ultimately leading to more effective management of your checking account transactions.

Bill of Sale Tractor - Can aid in due diligence for buyers assessing tractor condition.

California Tractor Bill of Sale Example

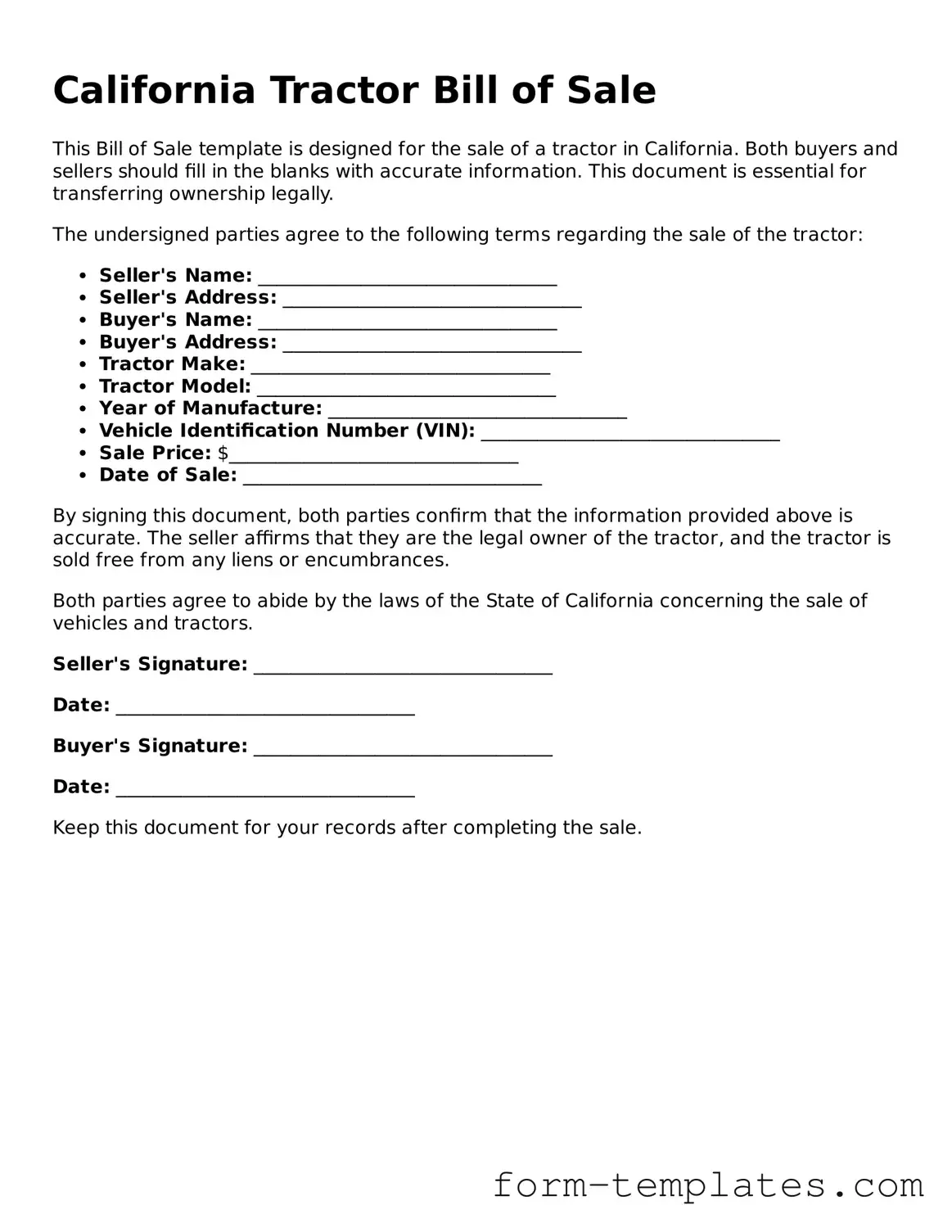

California Tractor Bill of Sale

This Bill of Sale template is designed for the sale of a tractor in California. Both buyers and sellers should fill in the blanks with accurate information. This document is essential for transferring ownership legally.

The undersigned parties agree to the following terms regarding the sale of the tractor:

- Seller's Name: ________________________________

- Seller's Address: ________________________________

- Buyer's Name: ________________________________

- Buyer's Address: ________________________________

- Tractor Make: ________________________________

- Tractor Model: ________________________________

- Year of Manufacture: ________________________________

- Vehicle Identification Number (VIN): ________________________________

- Sale Price: $_______________________________

- Date of Sale: ________________________________

By signing this document, both parties confirm that the information provided above is accurate. The seller affirms that they are the legal owner of the tractor, and the tractor is sold free from any liens or encumbrances.

Both parties agree to abide by the laws of the State of California concerning the sale of vehicles and tractors.

Seller's Signature: ________________________________

Date: ________________________________

Buyer's Signature: ________________________________

Date: ________________________________

Keep this document for your records after completing the sale.