Printable Promissory Note Form for the State of California

Guide to Writing California Promissory Note

Once you have the California Promissory Note form in hand, you'll need to complete it carefully. This form requires specific information about the loan agreement between the lender and the borrower. Follow the steps below to ensure all necessary details are filled out correctly.

- Begin by entering the date at the top of the form.

- Fill in the name and address of the borrower. Ensure that this information is accurate.

- Next, provide the name and address of the lender.

- Indicate the principal amount of the loan in the designated space.

- Specify the interest rate. Make sure to express it as a percentage.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly) and the total number of payments.

- Outline any late fees that may apply if payments are not made on time.

- Include any prepayment terms, if applicable. This indicates whether the borrower can pay off the loan early without penalties.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are legible.

After completing the form, review all entries for accuracy. Both the borrower and lender should retain a copy for their records. If you have any questions about the terms or need further assistance, consider reaching out to a legal professional.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated party at a certain time or on demand. |

| Governing Laws | This form is governed by the California Civil Code, specifically Sections 3300 to 3302, which outline the requirements for promissory notes. |

| Interest Rates | The note can specify an interest rate, which must comply with California's usury laws to ensure it is not excessively high. |

| Signatures Required | For the note to be legally binding, it must be signed by the borrower, and ideally, a witness or notary public should also sign. |

| Default Terms | The document may include terms outlining what constitutes a default, such as missed payments, and the consequences of defaulting. |

FAQ

What is a California Promissory Note?

A California Promissory Note is a written agreement where one party promises to pay a specific amount of money to another party under agreed-upon terms. This document outlines the amount borrowed, the interest rate, repayment schedule, and any consequences for defaulting on the loan. It serves as a legal record of the transaction and protects both the lender and the borrower.

Who can use a Promissory Note in California?

Any individual or business in California can use a Promissory Note. Whether you are lending money to a friend, family member, or a business, this document helps formalize the loan. It is important to ensure that both parties understand the terms before signing to avoid any misunderstandings later.

What should be included in a California Promissory Note?

A comprehensive Promissory Note should include the following key elements:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan, if applicable.

- Repayment Terms: A detailed schedule outlining when payments are due.

- Default Terms: Consequences if the borrower fails to make payments.

- Signatures: Both parties should sign and date the document.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding in California. This means that if one party does not fulfill their obligations, the other party can take legal action to enforce the terms of the note. However, it is crucial that the note is clear, concise, and signed by both parties to ensure its enforceability.

Can I modify a Promissory Note after it has been signed?

Yes, modifications to a Promissory Note can be made after it has been signed, but both parties must agree to the changes. It is advisable to document any amendments in writing and have both parties sign the updated agreement. This helps maintain clarity and ensures that both parties are on the same page regarding the new terms.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take certain actions as outlined in the Promissory Note. This may include:

- Demanding full repayment of the loan.

- Charging late fees or additional interest.

- Taking legal action to recover the owed amount.

It is important for both parties to understand these consequences before entering into the agreement.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial, especially for larger loans or complex situations. A lawyer can help ensure that the document complies with California laws and adequately protects your interests. For simpler loans, many individuals successfully create their own Promissory Notes using templates or guides.

Consider Popular Promissory Note Forms for Specific States

New York Promissory Note - The legal enforceability of a promissory note helps protect the lender’s interests.

It is important to understand your rights regarding healthcare. By completing the Arizona Living Will form, you can ensure that your medical preferences are documented, providing clarity for your family and healthcare providers when they need it most. Learn more about how this can support your healthcare choices by exploring this valuable Living Will resource.

Promissory Note Florida Pdf - Failure to comply with the terms of a promissory note can harm the borrower's credit score.

California Promissory Note Example

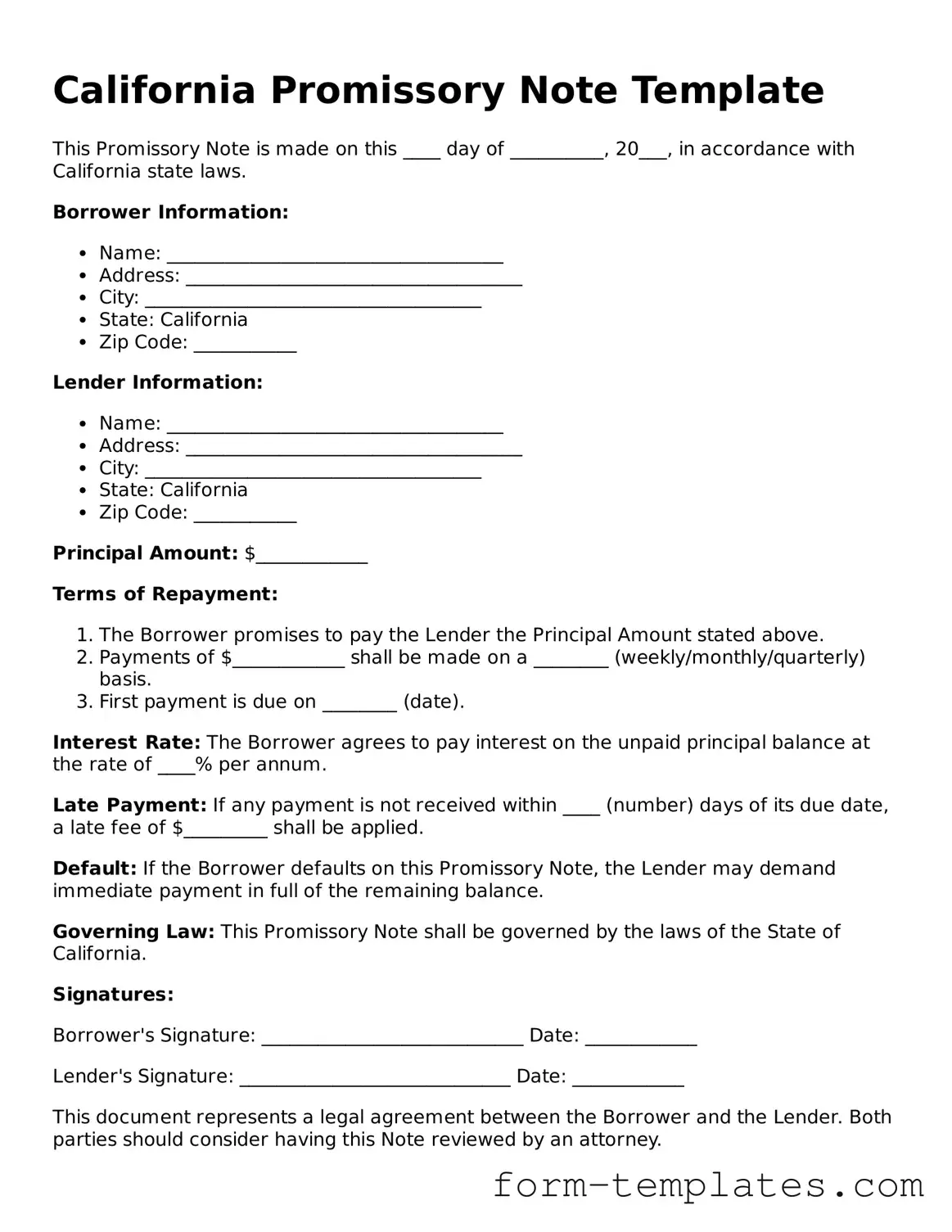

California Promissory Note Template

This Promissory Note is made on this ____ day of __________, 20___, in accordance with California state laws.

Borrower Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: California

- Zip Code: ___________

Lender Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: California

- Zip Code: ___________

Principal Amount: $____________

Terms of Repayment:

- The Borrower promises to pay the Lender the Principal Amount stated above.

- Payments of $____________ shall be made on a ________ (weekly/monthly/quarterly) basis.

- First payment is due on ________ (date).

Interest Rate: The Borrower agrees to pay interest on the unpaid principal balance at the rate of ____% per annum.

Late Payment: If any payment is not received within ____ (number) days of its due date, a late fee of $_________ shall be applied.

Default: If the Borrower defaults on this Promissory Note, the Lender may demand immediate payment in full of the remaining balance.

Governing Law: This Promissory Note shall be governed by the laws of the State of California.

Signatures:

Borrower's Signature: ____________________________ Date: ____________

Lender's Signature: _____________________________ Date: ____________

This document represents a legal agreement between the Borrower and the Lender. Both parties should consider having this Note reviewed by an attorney.