Printable Loan Agreement Form for the State of California

Guide to Writing California Loan Agreement

Filling out a California Loan Agreement form is an essential step in formalizing a loan between parties. This document lays out the terms and conditions of the loan, ensuring that both the lender and the borrower are on the same page. Below are the steps to complete the form accurately.

- Gather Necessary Information: Before you start, collect all relevant details about the loan, including the names of the parties involved, the loan amount, interest rate, and repayment terms.

- Start with Borrower Information: In the designated section, enter the full name and address of the borrower. Make sure to double-check for accuracy.

- Provide Lender Information: Next, fill in the lender's name and address. This could be an individual or an institution, so clarity is key.

- Specify Loan Amount: Clearly state the total amount of the loan in the appropriate field. Be precise to avoid any misunderstandings.

- Detail Interest Rate: Enter the agreed-upon interest rate. If it’s a fixed or variable rate, make sure to indicate that as well.

- Outline Repayment Terms: Describe how and when the borrower will repay the loan. Include the payment schedule, due dates, and any late fees that may apply.

- Include Collateral Information: If the loan is secured, specify the collateral that will back the loan. This provides security for the lender.

- Signatures: Finally, both parties must sign the agreement. Make sure to date the document as well. This step is crucial for the agreement to be legally binding.

Once the form is filled out, review it carefully to ensure all information is accurate. Each party should keep a copy for their records. This ensures clarity and helps prevent any disputes in the future.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower within the state. |

| Governing Law | This agreement is governed by California state laws, specifically the California Civil Code sections relevant to contracts and loans. |

| Essential Elements | Key components include the loan amount, interest rate, repayment schedule, and any collateral involved in the agreement. |

| Legal Validity | To ensure enforceability, both parties must sign the agreement, and it may require notarization depending on the loan amount. |

FAQ

What is a California Loan Agreement form?

A California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral that may be required. By signing this document, both parties agree to the outlined terms, creating a binding contract.

Who can use a California Loan Agreement form?

Any individual or entity involved in a lending transaction can utilize a California Loan Agreement form. This includes personal loans between friends or family, business loans, or loans issued by financial institutions. Regardless of the type of loan, having a written agreement helps protect the interests of both the lender and the borrower.

What are the key components of a California Loan Agreement?

A comprehensive California Loan Agreement typically includes the following key components:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Schedule: The timeline for repayment, including due dates and payment frequency.

- Collateral: Any assets pledged to secure the loan, if applicable.

- Default Terms: Conditions under which the borrower may be considered in default.

- Governing Law: A statement indicating that California law will govern the agreement.

Is a California Loan Agreement form legally binding?

Yes, a properly executed California Loan Agreement form is legally binding. For the agreement to hold up in court, it must meet certain legal requirements, such as mutual consent, lawful purpose, and consideration (something of value exchanged between the parties). It is advisable for both parties to read the agreement thoroughly before signing.

Do I need a lawyer to create a California Loan Agreement?

While it is not mandatory to hire a lawyer to draft a California Loan Agreement, doing so can be beneficial, especially for complex loans or significant amounts. A legal professional can ensure that the agreement complies with California law and adequately protects your interests. However, many templates are available for those who prefer to create a simple agreement on their own.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. The specific actions available will depend on the terms outlined in the Loan Agreement. Common remedies include:

- Demanding immediate repayment of the outstanding balance.

- Taking possession of any collateral pledged in the agreement.

- Filing a lawsuit to recover the owed amount.

It is crucial for both parties to understand the default terms to avoid misunderstandings.

Can the terms of a California Loan Agreement be modified?

Yes, the terms of a California Loan Agreement can be modified, but any changes must be agreed upon by both parties. It is advisable to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and legal enforceability.

How can disputes regarding a California Loan Agreement be resolved?

Disputes arising from a California Loan Agreement can be resolved through various means, including:

- Negotiation: The parties may discuss the issue and come to a mutual agreement.

- Mediation: A neutral third party can facilitate discussions between the parties.

- Arbitration: An arbitrator can make a binding decision based on the agreement.

- Lawsuit: If necessary, the dispute can be taken to court.

Choosing the appropriate method depends on the nature of the dispute and the relationship between the parties.

Consider Popular Loan Agreement Forms for Specific States

New York Promissory Note - Establishes the obligations of the borrower and lender.

To assist in keeping track of your financial transactions effectively, you may consider using a Blank Check Template, which can provide a convenient format for recording all activities related to your checking account.

Promissory Note Texas - Outlines confidentiality clauses regarding information shared.

Printable Promissory Note Template - It can clarify any fees associated with the loan process.

California Loan Agreement Example

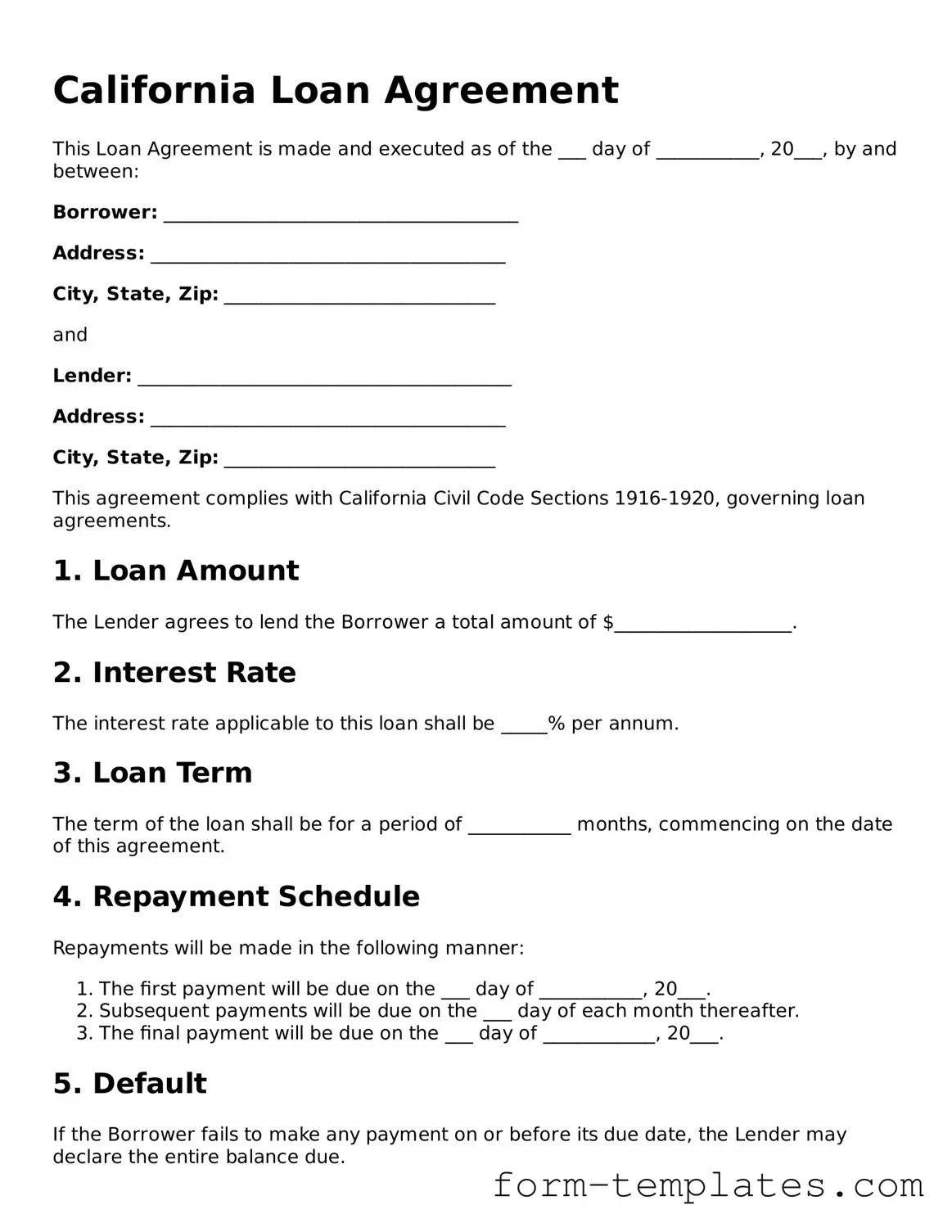

California Loan Agreement

This Loan Agreement is made and executed as of the ___ day of ___________, 20___, by and between:

Borrower: ______________________________________

Address: ______________________________________

City, State, Zip: _____________________________

and

Lender: ________________________________________

Address: ______________________________________

City, State, Zip: _____________________________

This agreement complies with California Civil Code Sections 1916-1920, governing loan agreements.

1. Loan Amount

The Lender agrees to lend the Borrower a total amount of $___________________.

2. Interest Rate

The interest rate applicable to this loan shall be _____% per annum.

3. Loan Term

The term of the loan shall be for a period of ___________ months, commencing on the date of this agreement.

4. Repayment Schedule

Repayments will be made in the following manner:

- The first payment will be due on the ___ day of ___________, 20___.

- Subsequent payments will be due on the ___ day of each month thereafter.

- The final payment will be due on the ___ day of ____________, 20___.

5. Default

If the Borrower fails to make any payment on or before its due date, the Lender may declare the entire balance due.

6. Governing Law

This agreement shall be governed by and construed in accordance with the laws of the State of California.

7. Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Borrower's Signature: ________________________________

Date: _____________

Lender's Signature: __________________________________

Date: _____________