Printable Gift Deed Form for the State of California

Guide to Writing California Gift Deed

After gathering the necessary information, you are ready to fill out the California Gift Deed form. This process involves providing details about the property and the parties involved in the gift. Ensure that all information is accurate and complete to avoid any issues later on.

- Obtain the California Gift Deed form. This can be downloaded from the California government website or obtained from a local office.

- Enter the date at the top of the form. This should be the date you are completing the deed.

- Fill in the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift). Ensure that you spell all names correctly.

- Provide the address of the property being gifted. Include the complete street address, city, and zip code.

- Describe the property in detail. Include the legal description, which can typically be found on the property’s title deed or tax assessment documents.

- Indicate whether the gift is made with or without any conditions. This is important for clarifying the nature of the gift.

- Sign the form in the designated area. The grantor must sign the deed for it to be valid.

- Have the signature notarized. A notary public must witness the signing of the deed to ensure its authenticity.

- Submit the completed Gift Deed form to the appropriate county recorder's office. Check for any local filing fees that may apply.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | A California Gift Deed form is used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Civil Code, specifically sections 11911-11932, governs the use of gift deeds. |

| Parties Involved | The deed typically involves a donor (the giver) and a donee (the recipient). |

| Requirements | The deed must be in writing, signed by the donor, and notarized to be legally valid. |

| Tax Implications | Gifts may have tax consequences; consult a tax advisor for details on potential gift tax liabilities. |

| Revocation | A gift deed is generally irrevocable once executed, meaning the donor cannot take it back. |

| Recording | To protect the interests of the donee, it is advisable to record the gift deed with the county recorder's office. |

| Legal Description | The deed must include a clear legal description of the property being transferred. |

| Witnesses | While not required, having witnesses sign the deed can provide additional legal protection. |

| Use Cases | Commonly used among family members, friends, or to transfer property into a trust. |

FAQ

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property as a gift, without any exchange of money. This form allows the donor (the person giving the gift) to convey their property to the recipient (the person receiving the gift) while avoiding the complexities of a sale. It’s a straightforward way to make a gift of real estate, ensuring that the transfer is legally recognized.

What are the requirements for a valid Gift Deed in California?

To create a valid Gift Deed in California, the following requirements must be met:

- The deed must be in writing.

- It must clearly identify the donor and the recipient.

- The property being gifted must be described accurately.

- The donor must sign the deed.

- The deed must be notarized and recorded with the county recorder's office.

Meeting these requirements ensures that the gift is legally binding and protects both parties involved.

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications when using a Gift Deed. In California, the donor may be subject to federal gift tax if the value of the gift exceeds the annual exclusion limit set by the IRS. As of 2023, this limit is $17,000 per recipient. If the gift exceeds this amount, the donor may need to file a gift tax return. However, gifts between spouses and certain educational or medical expenses may be exempt from these taxes.

It's wise to consult a tax professional to understand your specific situation and any potential tax obligations.

Can a Gift Deed be revoked after it has been executed?

Once a Gift Deed is executed and recorded, it is generally considered irrevocable. This means that the donor cannot take back the gift unless specific conditions are met, such as proving undue influence or lack of capacity at the time of signing. If the donor wishes to retain some control over the property, they may want to consider alternatives, such as a trust. Legal advice is recommended if there are concerns about revocation or control over the property.

Consider Popular Gift Deed Forms for Specific States

What Is a Gift Deed in Texas - A Gift Deed solidifies the relationship between donor and donee.

In order to streamline the payment process, employers can utilize a variety of resources, such as the Blank Check Template, which simplifies the creation of Payroll Check forms, ensuring all necessary information is included to facilitate accurate compensation for employees' work.

California Gift Deed Example

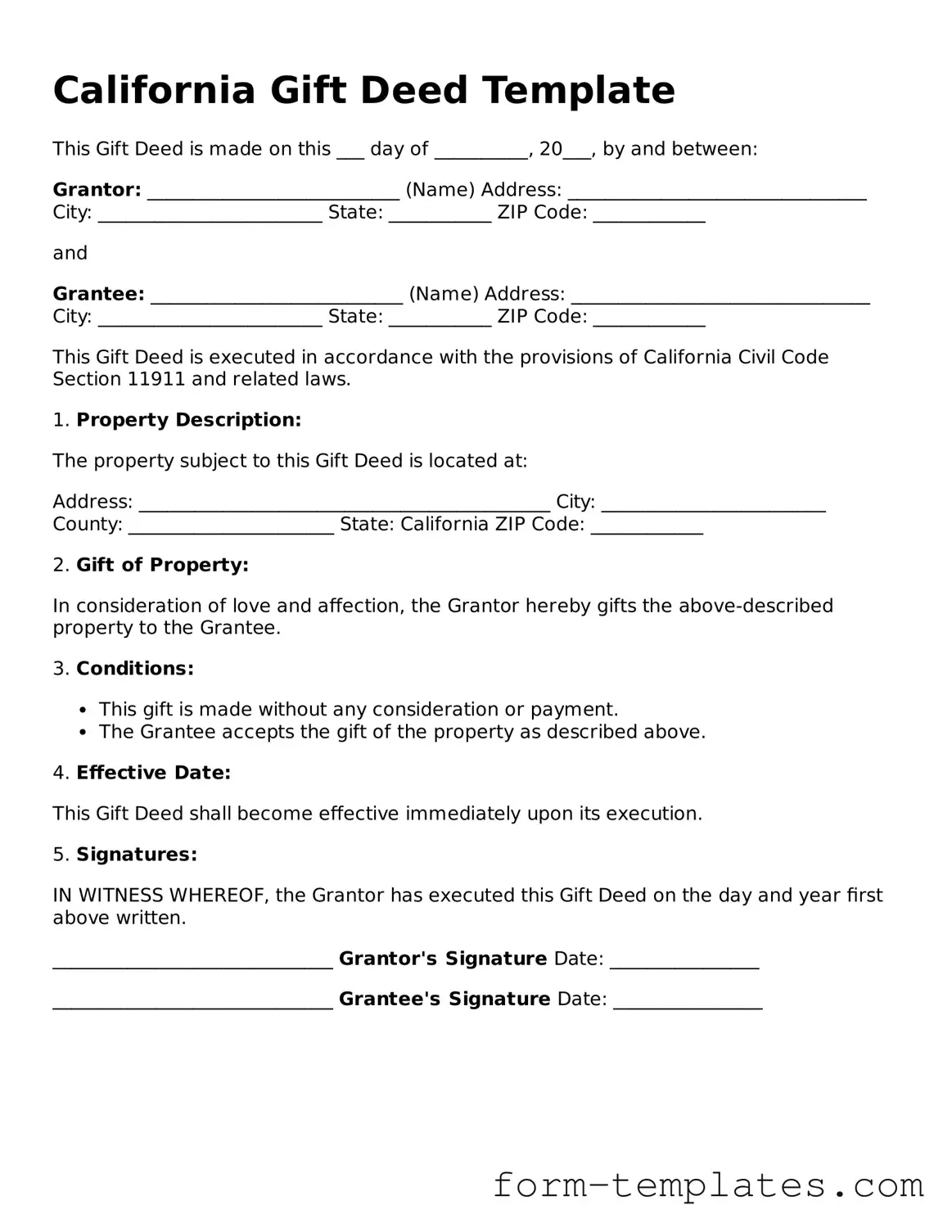

California Gift Deed Template

This Gift Deed is made on this ___ day of __________, 20___, by and between:

Grantor: ___________________________ (Name) Address: ________________________________ City: ________________________ State: ___________ ZIP Code: ____________

and

Grantee: ___________________________ (Name) Address: ________________________________ City: ________________________ State: ___________ ZIP Code: ____________

This Gift Deed is executed in accordance with the provisions of California Civil Code Section 11911 and related laws.

1. Property Description:

The property subject to this Gift Deed is located at:

Address: ____________________________________________ City: ________________________ County: ______________________ State: California ZIP Code: ____________

2. Gift of Property:

In consideration of love and affection, the Grantor hereby gifts the above-described property to the Grantee.

3. Conditions:

- This gift is made without any consideration or payment.

- The Grantee accepts the gift of the property as described above.

4. Effective Date:

This Gift Deed shall become effective immediately upon its execution.

5. Signatures:

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed on the day and year first above written.

______________________________ Grantor's Signature Date: ________________

______________________________ Grantee's Signature Date: ________________