Attorney-Approved Business Purchase and Sale Agreement Document

Guide to Writing Business Purchase and Sale Agreement

Completing the Business Purchase and Sale Agreement form is an important step in the process of transferring ownership of a business. Accurate and thorough completion of this form helps ensure that both parties understand their rights and obligations. Following the steps outlined below will guide you through filling out the form effectively.

- Begin by entering the date of the agreement at the top of the form.

- Provide the full legal names of both the buyer and the seller in the designated sections.

- Clearly describe the business being sold, including its name, address, and any relevant identification numbers.

- Detail the purchase price and any terms related to payment, such as deposits or financing arrangements.

- Outline any assets included in the sale, such as equipment, inventory, or intellectual property.

- Include any liabilities that the buyer will assume as part of the sale.

- Specify the closing date and any conditions that must be met before the sale can be finalized.

- Both parties should review the agreement carefully before signing. Ensure all necessary signatures are obtained.

- Make copies of the signed agreement for both the buyer and the seller for their records.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legally binding contract outlining the terms and conditions under which a business is sold. |

| Parties Involved | The agreement typically involves a seller, who is transferring ownership, and a buyer, who is acquiring the business. |

| Governing Law | The governing law may vary by state; for example, in California, the agreement is governed by the California Commercial Code. |

| Key Components | Important elements include purchase price, payment terms, and representations and warranties from both parties. |

| Due Diligence | Buyers are encouraged to conduct due diligence to assess the business's financial health and legal standing before finalizing the agreement. |

| Contingencies | Common contingencies might include financing approval, satisfactory inspections, or regulatory approvals. |

| Closing Process | The closing process involves the finalization of the sale, during which ownership is officially transferred and funds are exchanged. |

FAQ

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. This agreement serves as a roadmap for the transaction, detailing the responsibilities of both the buyer and the seller, and ensuring that all parties understand their rights and obligations.

Why is a Business Purchase and Sale Agreement important?

This agreement is crucial for several reasons:

- It protects the interests of both the buyer and the seller.

- It clarifies the terms of the sale, reducing the risk of misunderstandings.

- It provides a legal framework for the transaction, which can be referenced if disputes arise.

What key elements should be included in the agreement?

A comprehensive Business Purchase and Sale Agreement typically includes the following key elements:

- Identification of the parties involved.

- Description of the business being sold.

- Purchase price and payment terms.

- Representations and warranties of both parties.

- Conditions precedent to closing the sale.

- Indemnification provisions.

- Confidentiality clauses.

- Governing law.

How is the purchase price determined?

The purchase price is typically determined through negotiation between the buyer and seller. Factors such as the business's current revenue, assets, liabilities, market conditions, and future growth potential can all influence the final price. Often, buyers may conduct a valuation or due diligence to ensure they are making a fair offer.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to any changes. It’s essential to document any modifications in writing to maintain clarity and avoid future disputes. A signed amendment to the original agreement can serve as proof of the new terms.

What happens if one party breaches the agreement?

If one party breaches the agreement, the other party may have several options, including:

- Seeking damages for any losses incurred.

- Requesting specific performance, which means asking the court to enforce the agreement.

- Terminating the agreement if the breach is significant.

Legal advice may be necessary to navigate these options effectively.

Is it necessary to have a lawyer review the agreement?

While it is not legally required to have a lawyer review the agreement, it is highly advisable. A legal professional can help identify potential issues, ensure that the agreement complies with state laws, and provide guidance on negotiating terms. Their expertise can ultimately save both parties time and money in the long run.

What should I do if I have questions about the agreement?

If you have questions about the Business Purchase and Sale Agreement, consider reaching out to a legal professional who specializes in business transactions. They can provide clarity on specific terms and help you understand your rights and obligations within the agreement.

Fill out Popular Documents

Application Form Template - The form includes sections for work experience and education history.

The Vehicle Release of Liability form is essential for vehicle owners who wish to safeguard themselves against potential claims. By utilizing the Vehicle Release of Liability form, vehicle owners ensure that all parties understand the risks involved and agree to release the owner from future liabilities. This clarity is vital for both users and owners, as it establishes important legal protections in the event of accidents or damages.

Reiwa Rental Application Form - If you pay an Option Fee, it may be refunded if your application is unsuccessful.

Business Purchase and Sale Agreement Example

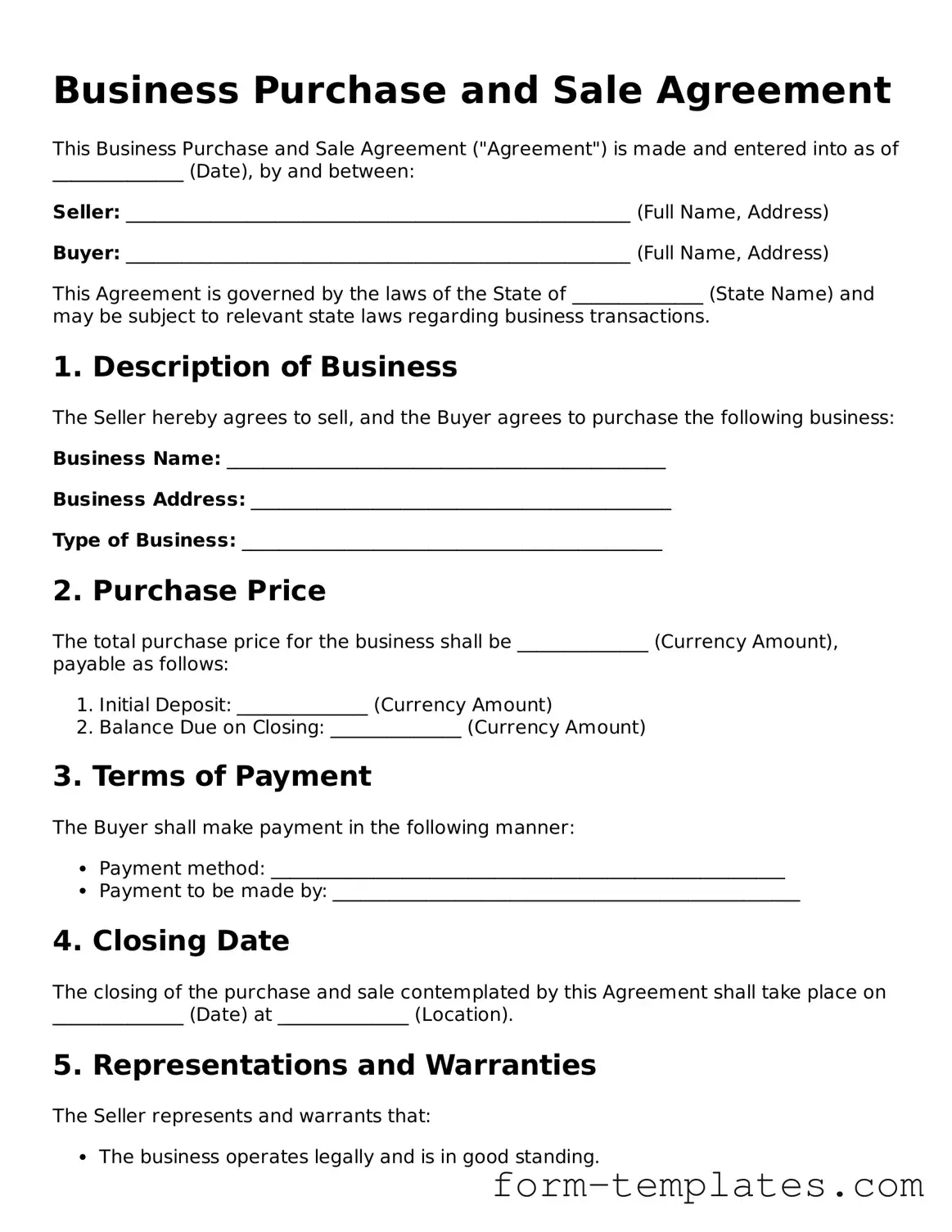

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made and entered into as of ______________ (Date), by and between:

Seller: ______________________________________________________ (Full Name, Address)

Buyer: ______________________________________________________ (Full Name, Address)

This Agreement is governed by the laws of the State of ______________ (State Name) and may be subject to relevant state laws regarding business transactions.

1. Description of Business

The Seller hereby agrees to sell, and the Buyer agrees to purchase the following business:

Business Name: _______________________________________________

Business Address: _____________________________________________

Type of Business: _____________________________________________

2. Purchase Price

The total purchase price for the business shall be ______________ (Currency Amount), payable as follows:

- Initial Deposit: ______________ (Currency Amount)

- Balance Due on Closing: ______________ (Currency Amount)

3. Terms of Payment

The Buyer shall make payment in the following manner:

- Payment method: _______________________________________________________

- Payment to be made by: __________________________________________________

4. Closing Date

The closing of the purchase and sale contemplated by this Agreement shall take place on ______________ (Date) at ______________ (Location).

5. Representations and Warranties

The Seller represents and warrants that:

- The business operates legally and is in good standing.

- There are no pending disputes or claims against the business.

6. Indemnification

The Seller agrees to indemnify and hold harmless the Buyer from any claims arising before the closing date.

7. Governing Law

This Agreement shall be governed by and interpreted in accordance with the laws of the State of ______________ (State Name).

8. Miscellaneous

- This Agreement constitutes the entire understanding between the parties.

- This Agreement may be amended only in writing, signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller Signature: ____________________________ Date: ______________

Buyer Signature: ____________________________ Date: ______________