Fill Out a Valid Business Credit Application Template

Guide to Writing Business Credit Application

Completing the Business Credit Application form is an important step in establishing a credit relationship. Once you have gathered the necessary information, follow these steps to ensure the form is filled out accurately and completely.

- Begin by entering your business name in the designated field.

- Provide the business address, including city, state, and zip code.

- Fill in the primary contact person's name and their position in the company.

- Enter a valid phone number and email address for the primary contact.

- Indicate the type of business structure (e.g., sole proprietorship, LLC, corporation).

- Provide the Federal Employer Identification Number (EIN) if applicable.

- List the date the business was established.

- Include the business's annual revenue and number of employees.

- Specify the type of credit being requested and the desired credit limit.

- Complete any additional sections regarding business references or financial information as required.

- Review all entered information for accuracy and completeness.

- Sign and date the form to certify the information provided is true.

After submitting the form, the credit provider will review your application. They may reach out for additional information or clarification. Stay attentive to any communications to expedite the process.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or financial institutions. |

| Required Information | Typically, the form requests details such as business name, address, ownership structure, and financial information. |

| State-Specific Forms | Some states may have specific requirements for the form. For example, California law requires additional disclosures related to business credit. |

| Approval Process | After submission, the application undergoes a review process. Creditworthiness is assessed based on the provided information. |

FAQ

What is the purpose of the Business Credit Application form?

The Business Credit Application form is designed to help businesses apply for credit with a supplier or financial institution. By filling out this form, businesses provide essential information about their financial status, credit history, and operational details. This information allows the creditor to assess the risk involved in extending credit and to make informed decisions regarding credit limits and terms.

What information is typically required on the form?

When completing the Business Credit Application form, you will generally need to provide various types of information, including:

- Business Details: Name, address, and type of business entity (e.g., corporation, LLC).

- Contact Information: Names and contact details of key personnel, such as owners or financial officers.

- Financial Information: Annual revenue, bank references, and possibly recent financial statements.

- Credit History: Information about any existing credit accounts and payment history.

Some forms may ask for additional information, so it’s important to read all instructions carefully.

How long does it take to process the application?

The processing time for a Business Credit Application can vary depending on several factors, including the complexity of the application and the creditor's internal processes. Generally, you can expect a response within a few days to a couple of weeks. If additional information is needed, the creditor may reach out to you, which could extend the processing time.

What should I do if my application is denied?

If your application for business credit is denied, it's important to understand the reasons behind the decision. You can take the following steps:

- Request an Explanation: Contact the creditor to ask for specific reasons for the denial.

- Review Your Credit Report: Check your business credit report for any inaccuracies or negative information that could have influenced the decision.

- Address Issues: If there are legitimate concerns, take steps to improve your creditworthiness before reapplying.

- Consider Alternatives: Look into other financing options or suppliers that may have different criteria.

Understanding the reasons for denial can help you improve your chances in future applications.

Fill out Other Forms

Army Retirement Points - It reflects the soldier’s commitment to continual professional development through training.

A Room Rental Agreement is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a room. This agreement typically covers important details such as rent amount, payment due dates, and responsibilities of both parties. Understanding this form is essential for ensuring a smooth rental experience, and you can find a helpful template at Room Rental Agreement.

Chick Fil a Jobs Near Me - Familiarize yourself with the core values of Chick-fil-A before filling out the form.

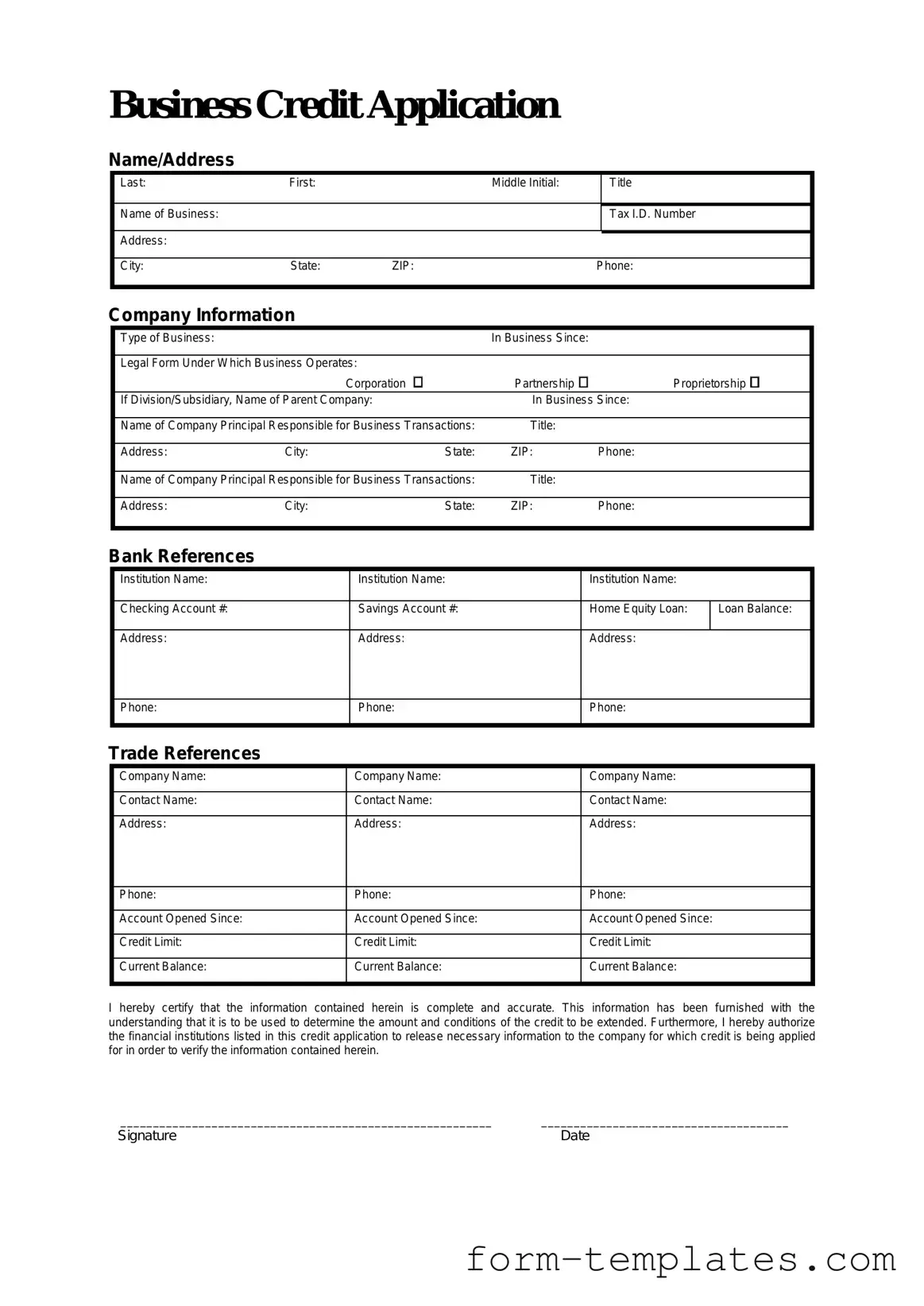

Business Credit Application Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |