Attorney-Approved Business Bill of Sale Document

Guide to Writing Business Bill of Sale

After obtaining the Business Bill of Sale form, you will need to fill it out accurately to ensure a smooth transfer of ownership. This form is essential for documenting the sale of a business and protecting both the buyer and the seller. Follow these steps to complete the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full legal name of the seller. This should match the name on any official business documents.

- Next, enter the seller's business address. Include the street address, city, state, and zip code.

- Fill in the buyer's full legal name, ensuring it is accurate and complete.

- Include the buyer's business address, following the same format as the seller's address.

- Describe the business being sold. This should include the name of the business, its location, and any relevant details that define the business.

- List the purchase price. Clearly state the total amount agreed upon for the sale.

- Specify the payment method. Indicate whether the payment will be made in cash, check, or another form.

- Include any terms and conditions that apply to the sale. This could involve payment schedules or other agreements.

- Both the seller and buyer must sign and date the form at the bottom. Ensure that all signatures are legible.

Once the form is completed, both parties should retain a copy for their records. This documentation can be crucial for future reference and legal purposes.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Business Bill of Sale form serves as a legal document that transfers ownership of a business from one party to another. |

| Components | This form typically includes details about the seller, buyer, business assets, and purchase price. |

| Governing Law | Each state has its own laws governing the sale of businesses. For example, California's Business and Professions Code applies. |

| Signatures | Both the buyer and seller must sign the form to validate the transfer of ownership. |

| Notarization | In some states, notarization may be required to ensure the authenticity of the signatures. |

| Record Keeping | It is essential for both parties to keep a copy of the signed Bill of Sale for their records and future reference. |

FAQ

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that serves as a record of the transfer of ownership of a business or its assets from one party to another. This document outlines the terms of the sale, including the purchase price and any conditions that apply. It is important for both the buyer and seller, as it provides proof of the transaction and helps protect both parties in case of disputes.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale is crucial for several reasons:

- It acts as a formal record of the transaction, which can be useful for tax purposes.

- The document can help clarify the terms of the sale, reducing the potential for misunderstandings.

- It provides legal protection for both the buyer and seller, establishing the rights and responsibilities of each party.

- In the event of a dispute, this document serves as evidence of the agreement.

What information should be included in a Business Bill of Sale?

A comprehensive Business Bill of Sale should include the following details:

- Identification of the Parties: Clearly state the names and addresses of both the buyer and the seller.

- Description of the Business or Assets: Provide a detailed description of what is being sold, including any tangible and intangible assets.

- Purchase Price: Specify the total amount to be paid for the business or assets.

- Payment Terms: Outline how and when the payment will be made.

- Representations and Warranties: Include any guarantees made by the seller regarding the condition of the business or assets.

- Signatures: Both parties must sign the document to make it legally binding.

Is a Business Bill of Sale required by law?

While a Business Bill of Sale is not always legally required, it is highly recommended. Certain states may have specific regulations regarding the sale of businesses or assets, and having this document can ensure compliance with those laws. Additionally, it provides a layer of protection for both parties involved in the transaction.

Can I create a Business Bill of Sale myself?

Yes, you can create a Business Bill of Sale on your own. Many templates are available online that can guide you through the process. However, it is advisable to consult with a legal professional to ensure that your document meets all legal requirements and adequately protects your interests. A well-drafted Bill of Sale can prevent potential issues down the line.

What should I do after completing the Business Bill of Sale?

Once you have completed the Business Bill of Sale, follow these steps:

- Both parties should sign the document to make it legally binding.

- Make copies of the signed document for both the buyer and seller.

- If applicable, file any necessary paperwork with local or state authorities to officially transfer ownership.

- Keep the original document in a safe place for future reference.

Other Business Bill of Sale Templates:

Faa Aircraft Bill of Sale - Completing the AC 8050-2 properly is key to a successful sale.

Before finalizing any transaction involving personal property, it is advisable to understand the utility of a General Bill of Sale, such as this essential documentation for clarity, accountability, and legal safety. For more information, visit the necessary guidelines of the General Bill of Sale.

Bill of Sale for Horse Trailer - The Trailer Bill of Sale may detail payment terms agreed upon by both parties.

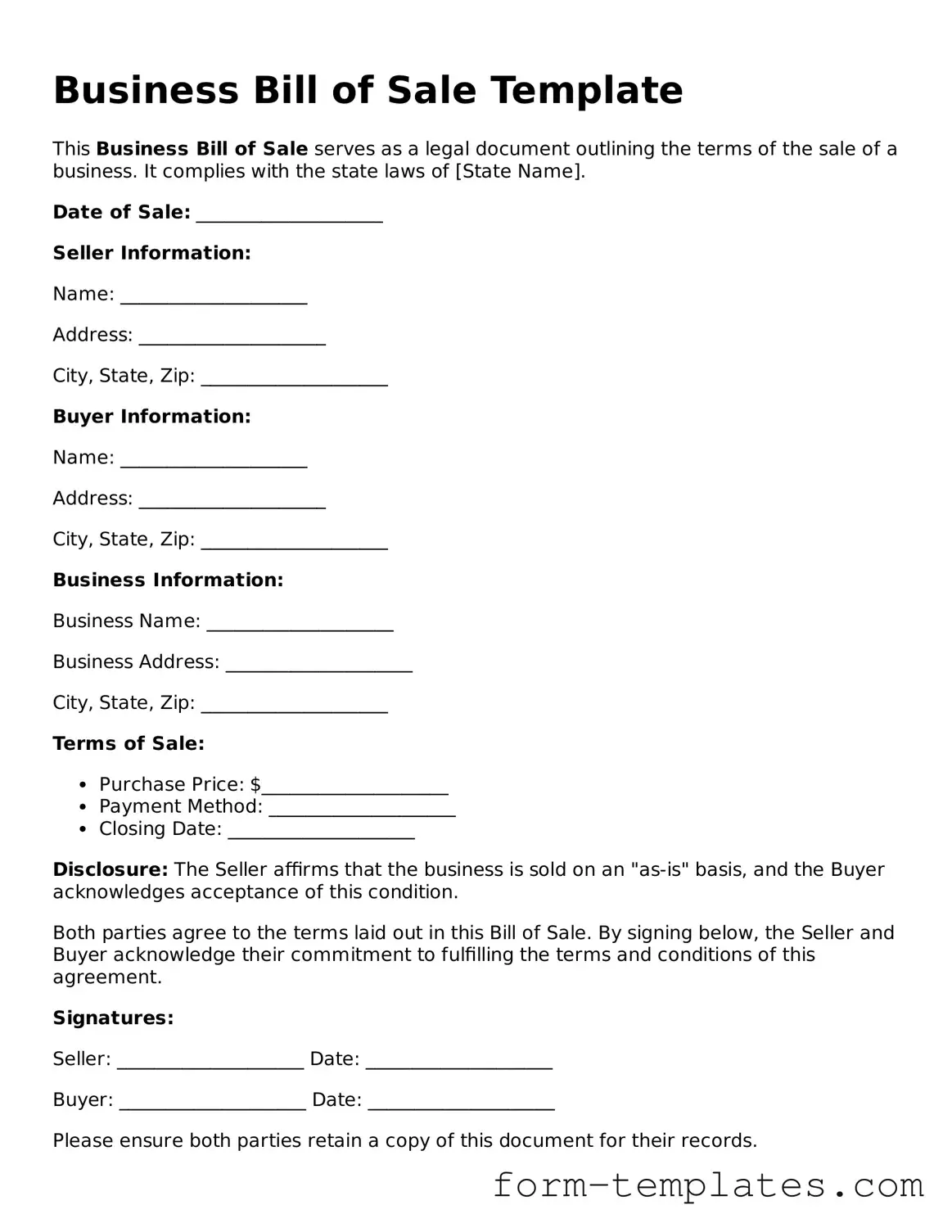

Business Bill of Sale Example

Business Bill of Sale Template

This Business Bill of Sale serves as a legal document outlining the terms of the sale of a business. It complies with the state laws of [State Name].

Date of Sale: ____________________

Seller Information:

Name: ____________________

Address: ____________________

City, State, Zip: ____________________

Buyer Information:

Name: ____________________

Address: ____________________

City, State, Zip: ____________________

Business Information:

Business Name: ____________________

Business Address: ____________________

City, State, Zip: ____________________

Terms of Sale:

- Purchase Price: $____________________

- Payment Method: ____________________

- Closing Date: ____________________

Disclosure: The Seller affirms that the business is sold on an "as-is" basis, and the Buyer acknowledges acceptance of this condition.

Both parties agree to the terms laid out in this Bill of Sale. By signing below, the Seller and Buyer acknowledge their commitment to fulfilling the terms and conditions of this agreement.

Signatures:

Seller: ____________________ Date: ____________________

Buyer: ____________________ Date: ____________________

Please ensure both parties retain a copy of this document for their records.