Fill Out a Valid Broker Price Opinion Template

Guide to Writing Broker Price Opinion

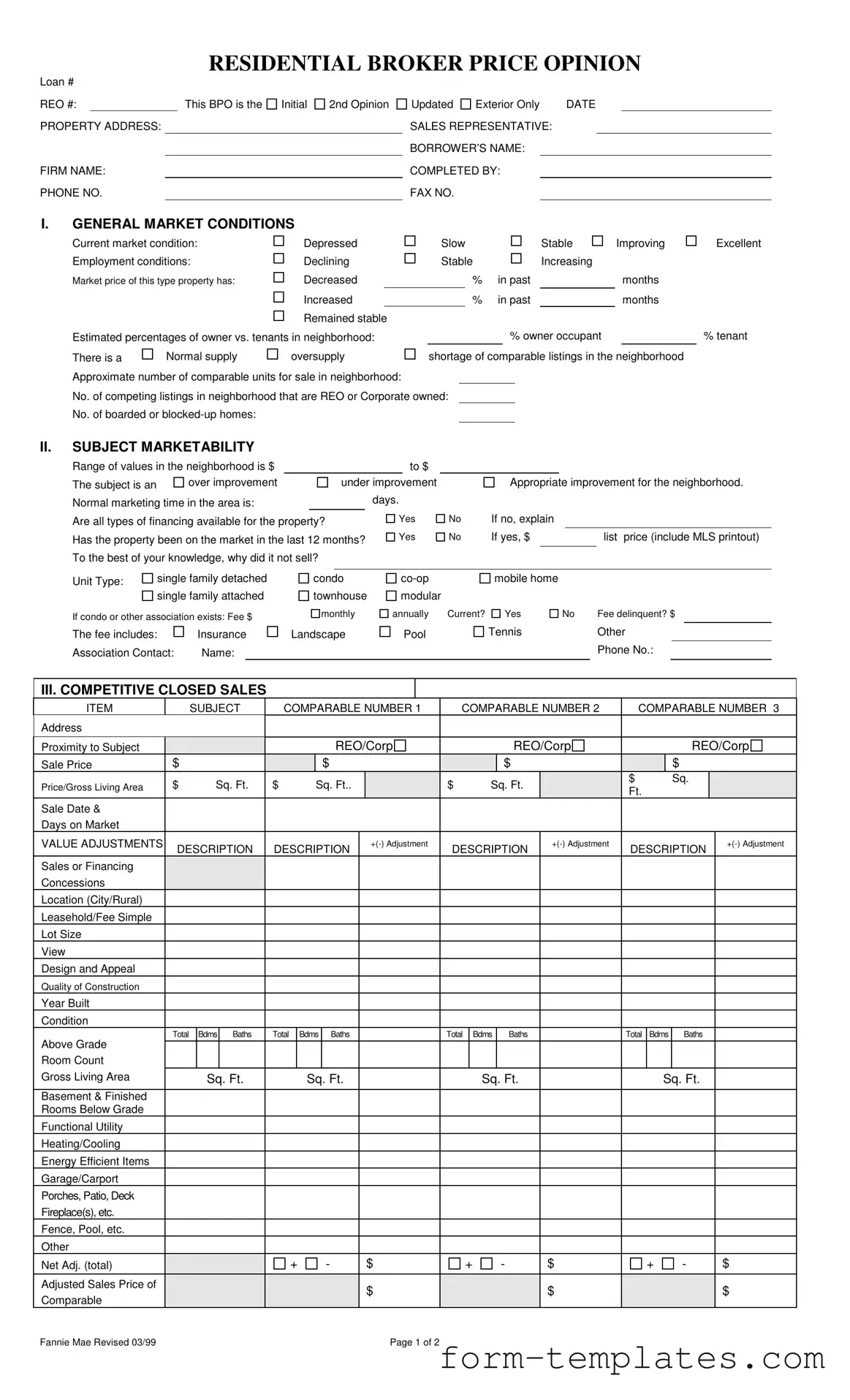

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. Each section gathers important information about the property and its market conditions. Completing this form accurately will help in evaluating the property effectively.

- Start with the top section. Fill in the Loan # and REO # if applicable.

- Provide the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Indicate whether this is an Initial, 2nd Opinion, or Updated report, and if it is for Exterior Only.

- Fill in the DATE, SALES REPRESENTATIVE, BORROWER’S NAME, and COMPLETED BY sections.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition. Choose from Depressed, Slow, Stable, or Improving.

- Evaluate employment conditions as Declining, Stable, or Increasing.

- Indicate if the market price of this type of property has Decreased, Increased, or Remained stable.

- Estimate the percentage of owner occupants in the neighborhood.

- Determine if there is a normal supply, oversupply, or shortage of comparable listings in the neighborhood.

- Provide the approximate number of comparable units for sale and the number of competing listings that are REO or Corporate owned.

- Count the number of boarded or blocked-up homes in the area.

- In the SUBJECT MARKETABILITY section, list the range of values in the neighborhood.

- Assess if the subject property is an over improvement, under improvement, or appropriate improvement for the neighborhood.

- Estimate the normal marketing time in days.

- Indicate if all types of financing are available for the property.

- If the property was on the market in the last 12 months, fill in the list price and explain why it did not sell.

- Specify the Unit Type and provide details if a condo or other association exists.

- In the COMPETITIVE CLOSED SALES section, fill in the details for comparable properties, including address, sale price, and adjustments.

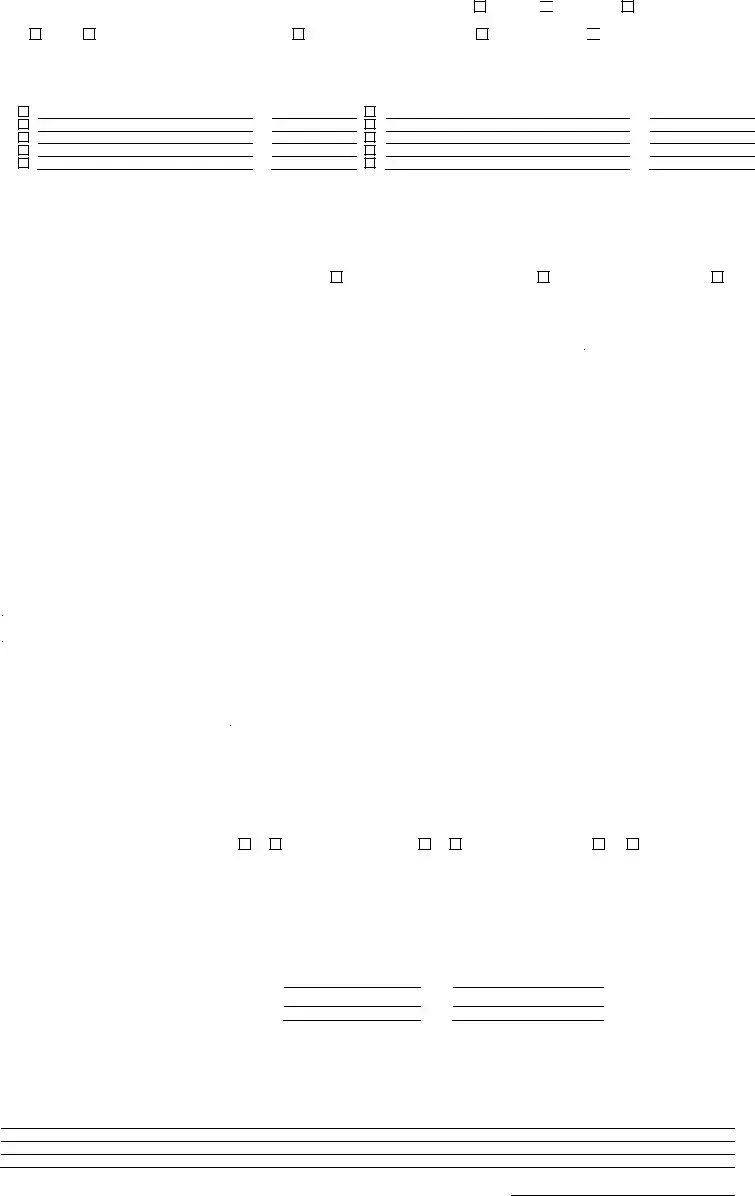

- Document any repairs needed to bring the property to average marketable condition.

- In the COMPETITIVE LISTINGS section, provide information on comparable listings, including list price and adjustments.

- Determine the MARKET VALUE based on competitive closed sales and provide a suggested list price.

- Finally, add any comments regarding the property, including specific concerns and special features.

- Sign and date the form.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | A Broker Price Opinion (BPO) provides an estimated value of a property, often used by lenders and real estate professionals. |

| Components | The BPO form includes sections for market conditions, property details, competitive sales, and marketing strategies. |

| Market Conditions | It assesses current market conditions, including employment rates and the supply of comparable properties. |

| Subject Property | The form requires detailed information about the subject property, including its condition and any necessary repairs. |

| Comparative Analysis | It includes a comparative analysis of similar properties, which helps in determining the market value. |

| State-Specific Forms | Some states may have specific requirements for BPOs, governed by local real estate laws. |

| Usage | BPOs are commonly used for short sales, foreclosures, and in situations where a full appraisal is not necessary. |

FAQ

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is an estimate of the value of a property, provided by a licensed real estate broker or agent. It is often used by lenders and financial institutions to assess the value of a property, especially in situations involving foreclosures or short sales. A BPO considers various factors, including market conditions, comparable sales, and the property's condition.

What information is required to complete a BPO form?

To complete a BPO form, the following information is typically required:

- Property address and loan number.

- Details about the current market conditions, including employment rates and property pricing trends.

- Information about the subject property's marketability and financing options.

- Comparative data from similar properties in the area.

- A description of any necessary repairs and their estimated costs.

How is the value of a property determined in a BPO?

The value of a property in a BPO is determined by analyzing various factors. These include:

- Comparative sales data from similar properties (comps) in the area.

- Current market conditions and trends.

- The property's condition and any necessary repairs.

- Location and neighborhood characteristics.

By evaluating these elements, the broker provides an estimated market value for the property.

What are the differences between a BPO and an appraisal?

A BPO and an appraisal both assess property value, but they differ in several key ways. An appraisal is typically more detailed and conducted by a licensed appraiser, while a BPO is usually less formal and can be completed by a real estate agent. Additionally, appraisals are often required for mortgage lending, whereas BPOs are commonly used for internal assessments by lenders.

How long does it take to complete a BPO?

The time required to complete a BPO can vary based on several factors, including the complexity of the property and the availability of comparable data. Generally, a BPO can be completed within a few days to a week. However, if the property requires extensive research or if there are many comps to analyze, it may take longer.

Who typically requests a Broker Price Opinion?

Broker Price Opinions are commonly requested by banks, mortgage companies, and other financial institutions. They may need a BPO for various reasons, such as evaluating a property for foreclosure, determining a listing price for a short sale, or assessing the value of an asset in their portfolio.

What should I do if I disagree with the BPO value?

If you disagree with the value provided in a BPO, you can take several steps. First, review the data and assumptions used in the BPO. If you believe there are inaccuracies or missing information, gather supporting evidence, such as recent sales data or property condition reports. You may then present this information to the requesting party, such as the lender or financial institution, to request a reevaluation.

Fill out Other Forms

Pest Control Service Agreement Template - Clarity in terms reduces ambiguity, paving the way for a smooth customer service experience.

For employers looking to streamline their payment process, utilizing a proper Payroll Check form is crucial, and resources like the Blank Check Template can simplify this task by providing a well-structured format for issuing payments accurately and efficiently.

Unconditional Waiver and Release on Final Payment Texas - It applies to residential and commercial properties alike.

Youth Baseball Player Evaluation Form - This form is designed to assess baseball skills in a structured manner.

Broker Price Opinion Example

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REO# |

Loan # |

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |