Attorney-Approved Affidavit of Gift Document

Guide to Writing Affidavit of Gift

Once you have the Affidavit of Gift form in hand, you are ready to begin the process of completing it. This form is essential for documenting a gift transfer and ensures that all necessary information is accurately recorded. Follow the steps below to fill it out correctly.

- Begin by entering the date at the top of the form. This should be the date you are completing the affidavit.

- Next, provide your full name in the designated area. Ensure that you include your middle name if you have one.

- Fill in your address, including the street address, city, state, and ZIP code. Make sure this information is current and accurate.

- Identify the recipient of the gift by writing their full name in the appropriate section. Again, include any middle names.

- Provide the recipient's address, just as you did for your own. This ensures that the recipient's information is complete.

- In the section that describes the gift, clearly state what is being given. This could be cash, property, or another type of asset. Be specific about the item or amount.

- Indicate the value of the gift. If it is a tangible item, provide a reasonable estimate of its worth.

- Sign the form in the designated area. Your signature confirms that the information provided is true and accurate to the best of your knowledge.

- Finally, have the affidavit notarized. This step is crucial, as it adds a layer of authenticity to the document. A notary public will verify your identity and witness your signature.

After completing the form, ensure that you keep a copy for your records. It may also be wise to provide a copy to the recipient. This ensures that both parties have documentation of the gift for future reference.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Affidavit of Gift is a legal document that confirms the transfer of property or assets as a gift from one person to another. |

| Purpose | This form serves to provide proof of the gift for tax purposes and to clarify ownership. |

| Signature Requirement | The giver (donor) must sign the affidavit in the presence of a notary public to validate the document. |

| State-Specific Forms | Some states may have specific versions of the affidavit; for example, California requires adherence to the California Probate Code. |

| Tax Implications | Gifts may have tax consequences; thus, the donor should consult with a tax professional regarding potential gift tax liabilities. |

| Revocation | Once the affidavit is signed and notarized, it generally cannot be revoked unless specific conditions are met. |

| Record Keeping | It is advisable to keep a copy of the affidavit for personal records and future reference. |

FAQ

What is an Affidavit of Gift?

An Affidavit of Gift is a legal document that confirms the transfer of ownership of property or assets from one person to another without any exchange of money. This form is often used for gifts of personal property, real estate, or financial assets. It serves to establish the intent of the giver and to document the transaction for tax purposes.

When should I use an Affidavit of Gift?

You should use an Affidavit of Gift when you are transferring ownership of property or assets as a gift. This could include situations such as:

- Giving a car to a family member or friend.

- Transferring real estate to a child or relative.

- Donating valuable items to a charity.

Using this affidavit helps clarify the nature of the transaction and can be useful for tax reporting.

What information is required on the Affidavit of Gift form?

The Affidavit of Gift typically requires the following information:

- The names and addresses of both the giver (donor) and the recipient (donee).

- A description of the property or assets being gifted.

- The date of the gift.

- A statement confirming that the gift is made voluntarily and without any expectation of payment.

Providing accurate and complete information is crucial for the document to be valid.

Do I need to have the Affidavit of Gift notarized?

While notarization is not always required, it is highly recommended. Having the affidavit notarized adds an extra layer of authenticity and can help prevent disputes in the future. Some institutions, such as banks or title companies, may require notarization before accepting the document.

Are there tax implications associated with gifting property?

Yes, there can be tax implications when gifting property. The IRS allows individuals to gift up to a certain amount each year without incurring gift taxes. For 2023, this amount is $17,000 per recipient. If the value of the gift exceeds this threshold, the giver may need to file a gift tax return. It’s advisable to consult with a tax professional to understand the specific implications based on your situation.

Can an Affidavit of Gift be revoked?

Once the gift has been made and the Affidavit of Gift is executed, it generally cannot be revoked. The giver must clearly express their intent to gift the property, and once that intent is established, the recipient becomes the legal owner. However, if there was fraud or coercion involved in the process, it may be possible to challenge the validity of the affidavit.

Where can I obtain an Affidavit of Gift form?

You can obtain an Affidavit of Gift form from various sources, including:

- Online legal document providers.

- Local government offices, such as the county clerk's office.

- Legal stationery stores.

Make sure to choose a form that complies with your state’s laws and requirements.

Other Affidavit of Gift Templates:

Palm Beach County Declaration of Domicile - This form can assist in determining tax obligations related to residency.

Creating a thorough Last Will and Testament is vital for anyone wishing to outline their estate management. By ensuring your final wishes are documented, you not only provide clarity but also peace of mind for your loved ones. To start this important process, you can find the necessary materials by visiting the complete guide to Last Will and Testament forms.

Affidavit of Gift Example

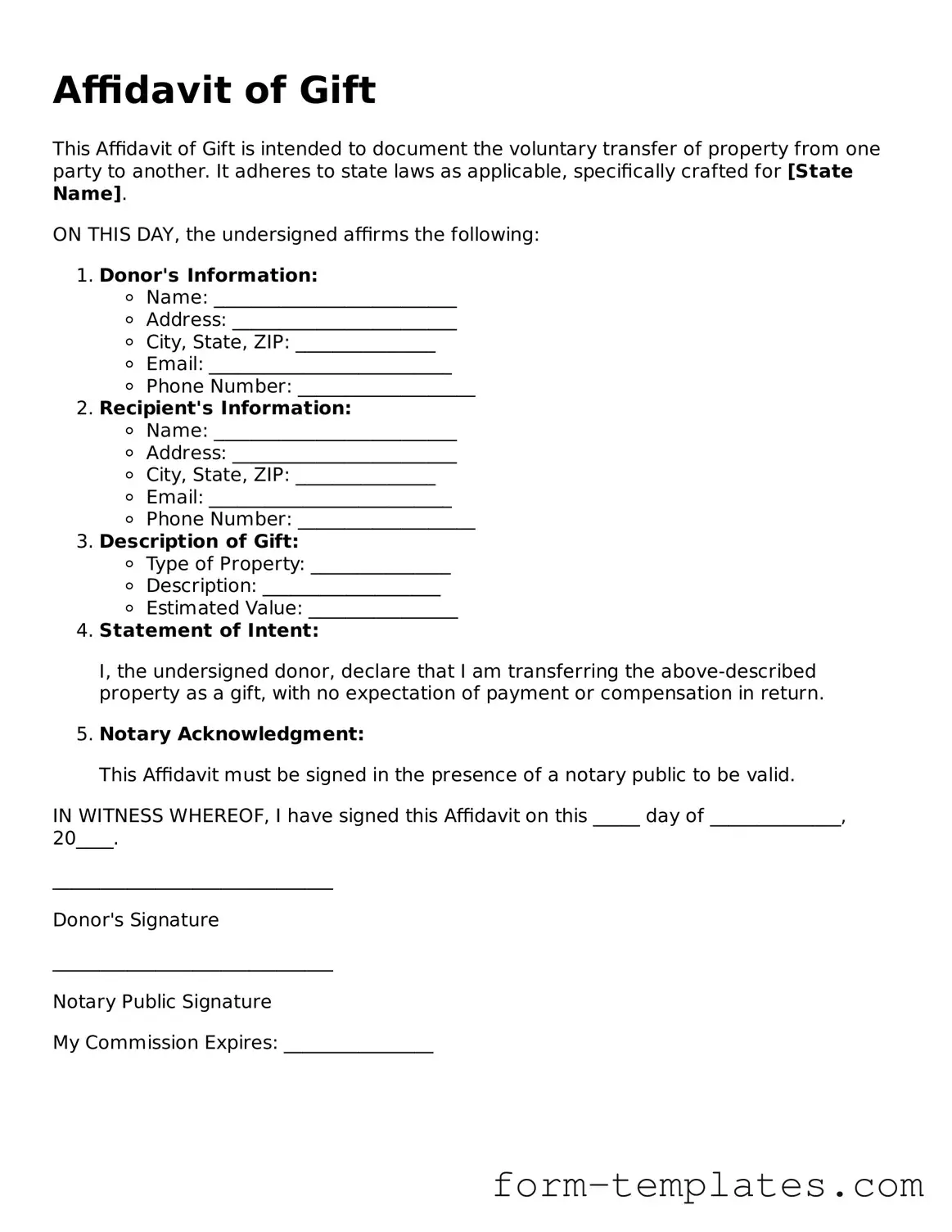

Affidavit of Gift

This Affidavit of Gift is intended to document the voluntary transfer of property from one party to another. It adheres to state laws as applicable, specifically crafted for [State Name].

ON THIS DAY, the undersigned affirms the following:

- Donor's Information:

- Name: __________________________

- Address: ________________________

- City, State, ZIP: _______________

- Email: __________________________

- Phone Number: ___________________

- Recipient's Information:

- Name: __________________________

- Address: ________________________

- City, State, ZIP: _______________

- Email: __________________________

- Phone Number: ___________________

- Description of Gift:

- Type of Property: _______________

- Description: ___________________

- Estimated Value: ________________

- Statement of Intent:

- Notary Acknowledgment:

I, the undersigned donor, declare that I am transferring the above-described property as a gift, with no expectation of payment or compensation in return.

This Affidavit must be signed in the presence of a notary public to be valid.

IN WITNESS WHEREOF, I have signed this Affidavit on this _____ day of ______________, 20____.

______________________________

Donor's Signature

______________________________

Notary Public Signature

My Commission Expires: ________________