Fill Out a Valid Adp Pay Stub Template

Guide to Writing Adp Pay Stub

Filling out the ADP Pay Stub form is an important step in ensuring accurate record-keeping for your earnings and deductions. This process allows you to keep track of your financial information and helps you understand your paycheck better. Follow these steps carefully to complete the form correctly.

- Gather Necessary Information: Before you start, collect all relevant documents, including your previous pay stubs and personal identification details.

- Fill in Your Personal Information: Enter your full name, address, and Social Security number in the designated fields.

- Input Employment Details: Provide your employer’s name, address, and your job title. Make sure this information is accurate.

- Record Pay Period: Indicate the start and end dates of the pay period for which you are reporting earnings.

- Enter Earnings: List your gross pay, which is the total amount earned before any deductions. Include regular hours worked and any overtime.

- Detail Deductions: Specify all deductions from your pay, such as taxes, insurance, and retirement contributions. Ensure these figures are correct.

- Calculate Net Pay: Subtract total deductions from gross pay to find your net pay, the amount you take home.

- Review Your Entries: Double-check all the information you’ve entered for accuracy. Mistakes can lead to issues down the line.

- Submit the Form: Once everything is filled out and reviewed, submit the form according to your employer's instructions, whether electronically or in hard copy.

Document Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Components | Each pay stub typically includes the employee's gross pay, taxes withheld, retirement contributions, and any other deductions. |

| Frequency | Pay stubs are issued regularly, often bi-weekly or monthly, depending on the employer's payroll schedule. |

| State Variations | Some states have specific requirements regarding the information that must be included on pay stubs. For example, California law mandates that pay stubs must show the total hours worked for non-exempt employees. |

| Access | Employees can typically access their pay stubs electronically through the ADP portal or receive them in paper form, depending on company policy. |

| Importance | Pay stubs are essential for personal financial management, tax preparation, and verifying employment and income for loans or other applications. |

FAQ

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that details an employee's earnings for a specific pay period. It includes essential information such as gross pay, deductions, and net pay. This document serves as a record of compensation and can be used for personal finance management, tax preparation, and loan applications.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP employee portal. Here’s how:

- Visit the ADP website and click on the "Login" button.

- Enter your user ID and password. If you don’t have an account, you may need to register first.

- Once logged in, navigate to the "Pay" section to view and download your pay stubs.

For those who prefer paper copies, some employers may still provide physical pay stubs. Check with your HR department if you need assistance.

What information is included on the ADP Pay Stub?

An ADP Pay Stub typically includes the following details:

- Employee name and identification number

- Pay period dates

- Gross earnings

- Deductions (taxes, retirement contributions, etc.)

- Net pay (the amount you take home)

- Year-to-date totals for earnings and deductions

This comprehensive breakdown helps employees understand their compensation and the deductions taken from their pay.

What should I do if I notice an error on my pay stub?

If you find an error on your ADP Pay Stub, it’s crucial to act promptly. First, verify the information against your records. If the discrepancy persists, contact your employer’s payroll department or HR representative immediately. They can investigate the issue and make necessary corrections. Document your communication for reference.

Can I receive my ADP Pay Stub electronically?

Yes, you can receive your ADP Pay Stub electronically. Most companies that use ADP for payroll offer electronic pay stubs as part of their services. This option allows you to view and download your pay stubs online. Ensure that your employer has enrolled you in this service to take advantage of it.

How long should I keep my ADP Pay Stubs?

It is advisable to keep your ADP Pay Stubs for at least one year. These documents are essential for tracking your income and can be useful for tax purposes. If you are self-employed or have complex financial situations, consider retaining them for several years. Always check with a tax professional for personalized advice.

Who can I contact for support regarding my ADP Pay Stub?

If you need assistance with your ADP Pay Stub, your first point of contact should be your employer’s HR or payroll department. They can provide specific information related to your employment and pay. For technical issues with the ADP portal, you can reach out to ADP’s customer support directly for help.

Fill out Other Forms

How to Fill Out Passport Application - Updated instructions for the DS-11 can usually be found on the Travel.state.gov website.

Fake Goodwill Receipt - Your contribution is a step towards building a stronger, more skilled workforce.

The FedEx Bill of Lading is a crucial document that outlines the details of your shipment. It serves as a receipt for the goods transported and establishes the terms of the transport contract between the shipper and the carrier. To make your shipping process smoother, consider using the resources available at Top Document Templates to fill out the form efficiently.

Free Doctors Note - Offers a respectful tone for addressing absences due to illness.

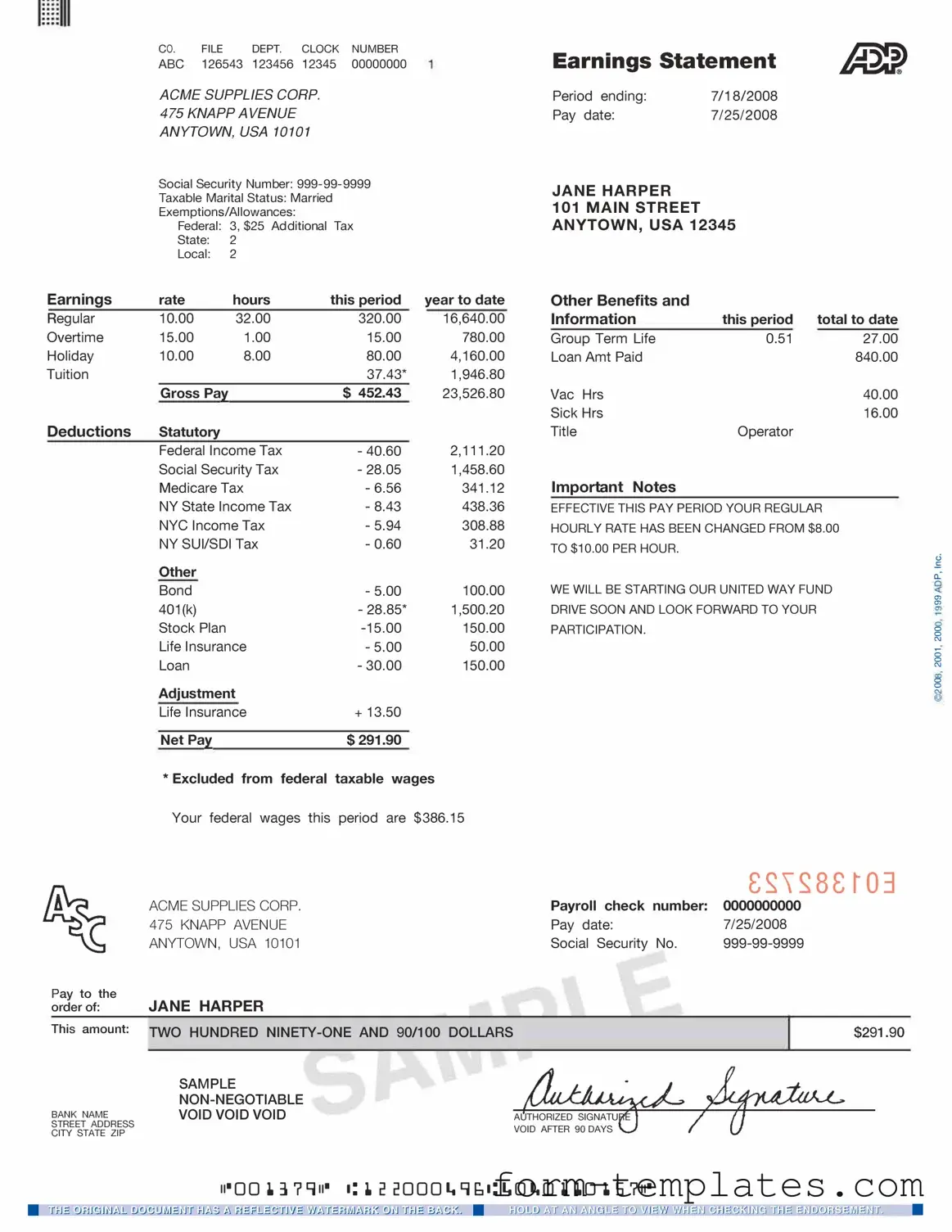

Adp Pay Stub Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90